KUALA LUMPUR (Feb 27): AME Elite Consortium Bhd posted net profit RM14.83 million in the third quarter ended Dec 31, 2019 (3QFY20) on the back of new construction projects with higher profit margin.

In a bourse filing Feb 26, the integrated industrial space solutions provider said 3QFY20 net profit was flat compared with a year earlier, while revenue for the quarter rose 1.1% to RM106.09 million from RM104.95 million, mainly due to the increase in engineering services revenue and rental income.

Earnings per share was 3.57 sen versus 4.35 sen previously.

AME Elite did not declare any dividends.

For the nine months ended Dec 31, AME’s net profit rose 55% year-on-year to RM48.95 million against RM31.56 million, on the back of higher revenue of RM282.25 million versus RM269.91 million earlier.

Reviewing its performance, AME said it recorded higher net profit mainly due to the higher fair value gains on investment properties and higher share of profit from a joint venture, partially offset by the higher administrative expenses and finance costs.

In a separate statement, AME group managing director Kelvin Lee Chai said the firm hit record new quarterly property development sales of RM73.8 million in the third quarter ended Dec 31 alone, exceeding the RM63.6 million sales attained in the six months ended September 2019.

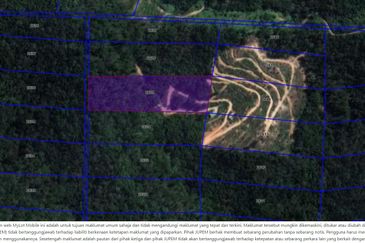

“The strong uptake at i-Park @ Indahpura and i-Park @ Senai Airport City comprises substantial investments from China and Singapore, and sizeable clients from Australia, Hong Kong, Japan, and the US.

“We are optimistic of this continued uptrend, as various corporations accelerate the pace of geographical diversification in this region to strengthen their sustainability and competitiveness,” said Lee.

Lee added that AME is optimistic of delivering healthy performance for the full year ending March 31, 2020, supported by continued development of Phase 1 and 2 of i-Park @ Senai Airport City, in addition to the newly-commenced Phase 3.

“We also expect to achieve higher contributions from all segments of construction and engineering services, rental of workers dormitories and the leasing of industrial properties,” he said.

TOP PICKS BY EDGEPROP

Central Residence, Sungai Besi

Salak Selatan, Kuala Lumpur

Kuala Terengganu Golf Resort

Kuala Terengganu, Terengganu