SINGAPORE (Oct 4): Hong Kong action-hero Donnie Yen (pictured), star of the Ip Man martial arts film series, was in Singapore last week. But it was not his kungfu moves that left realtors swooning: It was the fact that Yen and his wife, Cissy Wang, were in town shopping for a property.

The celebrity couple, who came incognito, were said to be “actively looking for value buys” in the $5 million to $10 million price range, says a property agent. Completed high-end condos that Yen and Wang were said to have visited included The Oliv on Balmoral Road, Bishopsgate Residences at the exclusive Bishopgate neighbourhood, Nouvel 18 on Anderson Road, and South Beach Residences on Beach Road.

Yen and Wang were not the only ones out shopping in Singapore’s high-end real estate market. Visitors from mainland China were in Singapore for the F1 night race on Sept 20-22, and more are said to have arrived during the Golden Week – a seven-day holiday that began on Oct 1, which marks the National Day and the 70th anniversary of the People’s Republic of China.

Getting a headstart

“Some of the Chinese visitors who were here over the past two weeks mentioned that they knew of friends and associates who were planning to come to Singapore during the Golden Week,” says Bruce Lye, managing partner of SRI, a realtor specialising in marketing high-end homes. “It’s one of the reasons they decided to get a headstart by locking in their property purchases.”

While high-end malls and luxury hotels in Hong Kong were bereft of crowds in the weekend before Golden Week, Lye says many of his foreign friends visiting Singapore in the same period have complained that they could not get a room in the mid-range to upscale hotels here as they were fully booked. “There are many Chinese and Hong Kong visitors in Singapore this Golden Week,” he adds. “We have a list of at least 13 high-net-worth individuals, the majority of them mainland Chinese, who are in town. Shopping for a property is on their agenda. It will be interesting to see how much stock gets moved this week.”

On Saturday, Sept 28, a Chinese national purchased a 5,662 sq ft unit at Ritz-Carlton Residences Cairnhill Singapore for $20 million ($3,532 psf) in a deal brokered by an agent from SRI. The mega-unit was an amalgamation and reconfiguration of two separate three-bedroom units on the 15th floor of the 36-storey The Ritz-Carlton Residences by property developer KOP Ltd. The luxury branded residence on Cairnhill Road contains just 58 units and was completed in 2011. The mega-unit was initially launched for sale at $22 million ($3,955 psf) this July.

Earlier that week, SRI also brokered the sale of a 6,232 sq ft, four-bedroom unit on the 11th level of the Signature Tower of The Marq on Paterson Hill for $23 million ($3,691 psf). The buyer was said to be a Chinese national.

A fortnight ago, another SRI agent brokered the sale of a 1,991 sq ft, four-bedroom unit on the 59th floor of Wallich Residence, Singapore’s tallest residential tower at 64 storeys high. The purchase price was $8.35 million ($4,194 psf). The buyer was said to be a Chinese national. The junior penthouse next door, of 3,509 sq ft, fetched $16.5 million ($4,702 psf), according to a caveat lodged on Sept 23. The buyer is believed to be from Taiwan, with the deal brokered by an agent from PropNex Realty.

“Many of the Chinese are buying these luxury homes for their own use – whether as a permanent residence or holiday home,” observes Lye. “So these units are not likely to flood the rental market with more inventory.”

Overseas developers target Hong Kong

In Hong Kong, realtors like Terence Law, senior principal project director of Centaline Property, one of the biggest real estate agencies in Hong Kong with over 5,500 agents, have been equally busy over the past fortnight. “Normally, there are 15 to 20 property shows on an average weekend,” he says. “Over the two weekends of Sept 21-22 and Sept 28-29, there were more than 30 property events each weekend. It means that overseas developers are eyeing Hong Kong as a target market.”

For instance, over the weekend of Sept 28-29, there were three Australian property shows featuring Melbourne and Sydney projects; four others featuring UK properties in London and Manchester, and another four from Singapore.

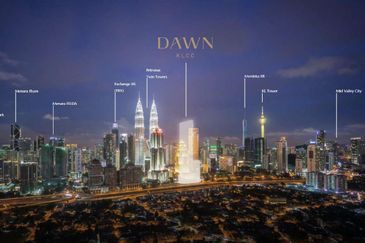

Going on at the same time were 11 shows from Malaysia with seven from Kuala Lumpur and at least two from Penang; four from Bangkok; two from Toronto and Vancouver; three from Osaka and Tokyo; and a couple from Dubai and Vietnam.

In the lead-up to the series of property shows over the weekend, there was a seminar on immigration to Australia on Sept 26, with another one on Malaysia’s My Second Home programme on Sept 27, organised by Centaline Property.

To top it off, there was the inaugural Singapore Property Festival organised by the South China Morning Post (SCMP) in collaboration with EdgeProp Singapore, which featured six property developers – Aurum Land, Bukit Sembawang Estates, CapitaLand, Chip Eng Seng’s CEL Development, Far East Organization and GuocoLand. Many of the projects that were showcased were in the prime districts, although there were some projects in the city fringe as well.

According to SCMP, about 1,000 people had registered their interest to attend the event held on Sept 28. Based on a survey done prior to the event, the majority is male, in the 35-44 age range, with household income of more than HK$200,000 ($36,000) a month. Most are said to be directors or C-suite executives, and living in the more affluent neighbourhoods on Hong Kong island. They were said to be interested in properties in the HK$5 million to HK$10 million price range, which translates to $900,000 to $1.8 million.

One of the attendees was an expatriate banker who has been living in Hong Kong for 12 years. He says: “We’ve been looking at investment opportunities across Asia, and Singapore has not been on our radar because of the high stamp duties. We have been eyeing Australia because it’s one of the places where you can find stability, economic growth and capital appreciation. Right now, Singapore is becoming more worthy of exploration because of what’s happening in Hong Kong.”

‘Singapore – an attractive investment destination’

The investment seminars during the Singapore Property Festival featured presentations by Jo’An Tan, associate director of Redbrick Mortgage Advisory, and Gary Leong, executive director of Singapore-based law firm, Sim Mong Teck & Partners.

“The good turn-out demonstrates that Singapore continues to be an attractive investment destination for foreigners. It is safe, has a stable government, and is seen by many as a link to other countries in the region,” says Dora Chng, general manager (residential) at GuocoLand, one of the property developers who participated in the event.

“Hongkongers are very discerning and experienced property investors who are able to see value in well-designed developments,” adds Chng. “Our projects, including developments like Wallich Residence, Martin Modern and Leedon Residence, have always attracted buyers from an array of nationalities. Some of our foreign buyers are from Hong Kong and China.”

The Singapore Property Festival was “like an expo, ideal for those who are in an exploratory stage”, says Law of Centaline, which represented four of the Singapore developers at the event. Based on his observation of the attendees, about 20% were expatriates and another 80% were local Hong Kong residents, including Chinese and other foreigners. Law reckons that some are either already Singapore permanent residents (SPRs) or are considering applying for residency.

Since July 2018 when the latest round of property cooling measures came into effect, SPRs have to pay 5% additional buyer’s stamp duty (ABSD) on their first residential property purchase, while foreigners have to pay 20% ABSD.

Hongkongers are used to high buyer’s stamp duty (BSD), which is 30% for foreigners and those using a company to buy property; and 15% for local Hongkongers purchasing a second property, notes Law.

ABSD a deterrent?

“While the ABSD in Singapore is a deterrent, some will still go ahead [and buy] as they are SPRs or Singapore citizens working in Hong Kong; while others hold American passports and enjoy the same ABSD structure as a Singapore citizen,” adds Law.

The measures were put in place by the Singapore government to prevent property prices from escalating too quickly and then collapsing, says Alan Cheong, executive director of research & consultancy at Savills Singapore, who participated in the panel discussion at the Singapore Property Festival. “If you’re buying a property and paying 20% ABSD, you’re in effect buying something that has been ‘de-risked’ by the authorities. If there’s a crisis in the world, the government can just release the brakes and offset against negative pressures from around the world. So it’s actually a good thing.”

For foreigners who have purchased units in Singapore, the 20% ABSD is considered “the cost of ownership, an amount they have to factor in as part of the transaction cost”, notes SRI’s Lye. Looks like even “Ip Man” is taking the ABSD in his stride.

This story first appeared in the Oct 4, 2019 issue of EdgeProp Singapore

TOP PICKS BY EDGEPROP

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor

Pusat Bandar Puchong

Bandar Puteri Puchong, Selangor

Sanderling @ Lakefront Cyberjaya

Cyberjaya, Selangor

Freehold Agriculture Land @ Karak, Bentong (Water, Electricity, Tar Road with drainage DONE)

Desa Parkcity, Kuala Lumpur

Pusat Bandar Puchong

Bandar Puteri Puchong, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor