Glomac Bhd (Sept 18, 36.5 sen)

Maintain sell with an unchanged target price of 37 sen: Glomac Bhd’s first quarter ended July 31, 2019 (1QFY20) net profit of RM3.5 million (+243% year-on-year [y-o-y], -2% quarter-on-quarter [q-o-q]) came within expectations, accounting for 21% of both our and consensus full-year forecasts. Glomac’s 1QFY20 revenue declined 10% y-o-y to RM51.9 million.

The weaker results were attributable to lower progress billing as previous key contributing projects are nearing completion or have completed during the period under review while new projects are still at its initial stage of development.

However, 1QFY20 net profit jumped 243% y-o-y to RM3.5 million, largely due to lower administrative expenses and lower effective tax rate as previous corresponding quarter result was impacted by higher effective tax rate due to non-recognition of deferred tax assets on tax losses.

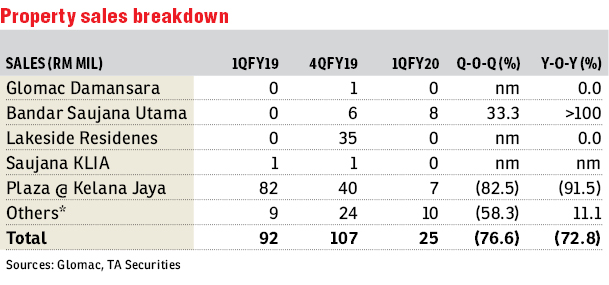

Glomac only secured new sales of RM25 million in 1QFY20 (-73% y-o-y, -77% q-o-q) as no new projects were launched during the quarter under review.

Unbilled sales as at July eased to RM432 million from RM476 million a quarter ago. This provides the group with 12 months’ earnings visibility. No change to our FY20 to FY22 earnings forecasts.

The group plans to roll out RM903 million worth of new launches in FY20. Following the successful launch of Plaza@Kelana Jaya in FY19 (gross development value [GDV]: RM292 million, 71% sold), the group introduced another high-rise project — 121 Residence (GDV: RM321 million).

Soft launched in August, Tower A of 121 Residence was 90% sold (445 serviced apartments and SoHo units, indicative selling price of RM750 per sq ft).

Management is confident about this project given its strategic location with close proximity to the bustling hub of One Utama and competitive pricing of RM300,000 per unit onwards.

Management expects FY20 sales to improve y-o-y in view of sizable pipeline launches worth RM903 million in FY20 (versus RM540 million launched in FY19).

Despite only recorded RM25 million property sales in 1Q, management has maintained its FY20 sales target of RM500 million to RM600 million (+55% to +86% y-o-y), driven by booking conversion from Tower A of 121 Residences as well as pipeline launches in the second half.

We project the group to record property sales of RM537 million in FY20, on the conservative assumptions high-rise project — Lakeside Residence and 121 Residences to record take-up rate of 50%, and 70% take-up of other projects. — TA Securities, Sept 18

This article first appeared in The Edge Financial Daily, on Sept 19, 2019.

Click here for more property stories

TOP PICKS BY EDGEPROP

Taman Tasik Semenyih (Lake Residence)

Semenyih, Selangor

Primaya Bandar Tun Hussein Onn

Cheras, Selangor

Bandar Damai Perdana

Bandar Damai Perdana, Selangor

Megan Phoenix Business Centre

Cheras, Kuala Lumpur

Danau Impian Condominium

Taman Desa, Kuala Lumpur

Megan Phoenix Business Centre

Cheras, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Seksyen 1, Petaling Jaya

Petaling Jaya, Selangor

OUG Parklane

Jalan Klang Lama (Old Klang Road), Kuala Lumpur