LONDON (Aug 16): Eco World International Bhd (EWI), which has achieved an average take-up rate of 89% for its nine active projects in London, UK, is maintaining its momentum with the launch of the second block of Verdo apartments at its Kew Bridge development in West London.

Undertaken by EWI's 70%-owned subsidiary EcoWorld London, Verdo comprises three blocks housing 253 units with a gross development value (GDV) of more than £100 million. The first block was launched earlier.

The second block launched yesterday comprises 96 units with built-up sizes from 550 to 1,000 sq ft. Priced at around £750 psf on average, the units are targeted to be completed in the first quarter of EWI's financial year ending Oct 31, 2022 (1QFY2022).

"Due to Brexit, the sales of our premium projects priced from £1,000 psf tend to be slower, but the mid-market products priced about £700 psf are doing very well.

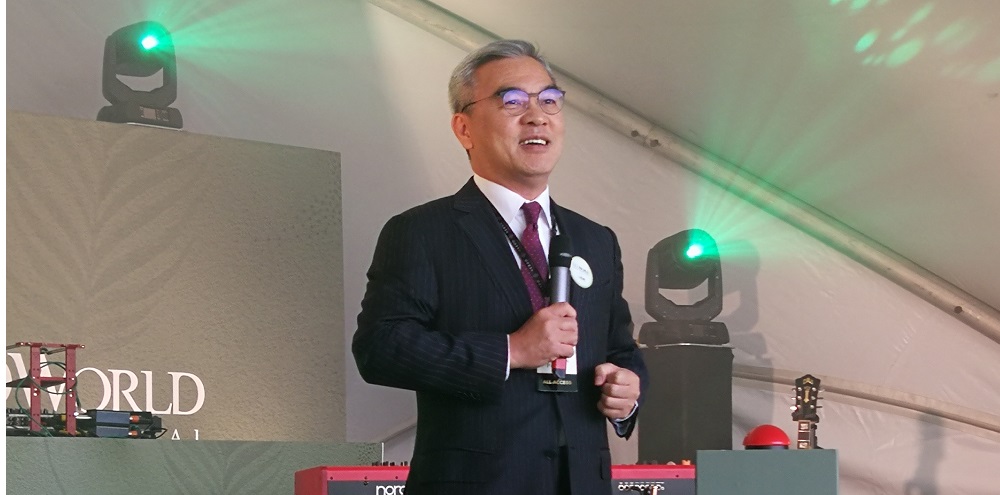

"And the apartment units that we are launching today falls into the latter category," EWI executive vice chairman Tan Sri Liew Kee Sin told EdgeProp.my.

Kew Bridge is one of EWI's nine active projects in UK. With a total GDV of about £593 million, the entire Kew Bridge comprises the redevelopment of the Brentford Football Club Stadium, Verdo apartments and 487 units of build-to-rent (BTR) apartments which have been sold to Invesco Real Estate last December.

Combining the sale of the BTR apartments and the units in the first block of Verdo, the take-up rate for Kew Bridge stood at 91% to date.

The remaining five projects that are being undertaken by EcoWorld London are also enjoying strong take-up rates, namely Millbrook Park (82%), Aberfeldy Village (88%), Kensal Rise (99%), Nantly House (100%) and Barking Phase 1 (100%).

Meanwhile, EWI's 75%-owned subsidiary EcoWorld-Ballymore's developments of Wardian London in London Docklands; London City Island in Leamouth Peninsula; and Embassy Gardens in Nine Elms, have recorded take-up rates of 84%, 85% and 68%, respectively.

A topping out ceremony was held at Wardian London earlier yesterday. The £566 million Wardian London comprises two residential towers of 55 and 50-storeys offering 766 homes including suites, one and two-bedroom apartments (500 to 1,100 sq ft) and penthouses (1,600 to 1,800 sq ft).

Set for handover to owners in 2020, these high-rises are priced at about £1,200 psf on average.

“It has been a great pleasure to see the development take shape and become one of the most highly-anticipated housing developments in London, and I am delighted to be able to celebrate its topping-out today – a momentous occasion for EcoWorld Ballymore," Liew said at the ceremony.

Ballymore Group chairman and group chief executive Sean Mulryan, who was present at the event said the team has worked closely with Glenn Howells Architects to create a building that is beautiful on the inside and out.

“We are incredibly proud of what has been achieved today. Ballymore has owned the site on which Wardian now stands for 25 years so it brings me great joy to see these two beautiful new towers standing on what has been such an underutilised space for so long," he said.

TOP PICKS BY EDGEPROP

Jalan Setia Damai U13/15

Setia Alam/Alam Nusantara, Selangor

Puteri Palma Condominium @ IOI Resort City

Putrajaya, Selangor

The Residence 1 @ Tiara South

Semenyih, Selangor

Residensi Selangorku Akasia Diamond

Semenyih, Selangor

Karisma Apartment @ Eco Majestic

Semenyih, Selangor

Ascotte Boulevard Condominium

Semenyih, Selangor

Mercato 2 @ Bandar Baru Enstek

Labu, Negeri Sembilan

Taman Taming Indah 1

Bandar Sungai Long, Selangor