Malaysian Resources Corp Bhd (Aug 5, 86 sen)

Maintain buy with an unchanged target price (TP) of RM1.02: Malaysian Resources Corp Bhd’s (MRCB) subsidiary, KD District Cooling System Sdn Bhd (KDDCS), has entered into a chilled water supply agreement with Kwasa Utama Sdn Bhd (KUSB). KUSB is a wholly-owned subsidiary of the Employees Provident Fund. The job awarded entails the supply of chilled water to an office building in Kwasa Damansara. The contract which runs for 25 years is worth RM150 million to MRCB.

MRCB has the expertise in providing chilled water supply since 2013. KDDCS was formerly set up under the group for the proposed provision of chilled water supply. The supply agreement signed with KUSB requires the delivery of chilled water beginning Sept 1, 2020.

We view the impact on MRCB as positive, consequent to the long-term commitment agreed to with KUSB. We understand that the contract value is derived after taking into account proposed revisions of tariffs over the tenure of the term. By extension, revisions over the past 10 years averaged at 6.75% in every three years.

Adding the new job value of RM150 million to the group’s outstanding order book (as of the first quarter of financial year 2019 [1QFY19]), we arrive at a total value of RM21.6 billion. In a broader sense, the group remains on a sound footing given its long-term visibility. The outlook for a shorter term is turning better, whereby the progress of work on projects, namely light rail transit 3 (LRT3), will see earnings recognised in the second half (2H) of FY19 due to retiming issues. Notwithstanding that, we believe a greater emphasis should be put on its long-term prospects moving forward.

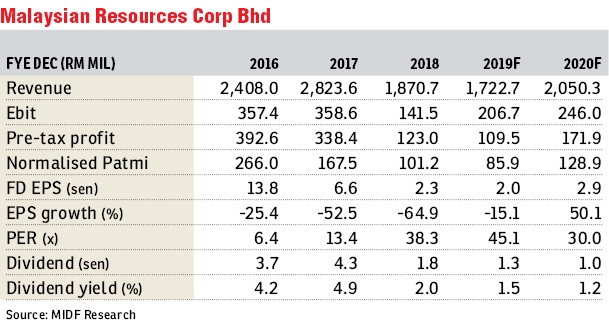

We have not changed our FY19 and FY20 estimates. We believe the earnings impact is only notable beginning from FY21, succeeding the commercial operation date on Sept 1, 2020. Accordingly, contributions from this contract will likely raise its bottom line by a minimal quantum annually.

LRT3’s billing is expected to pick up in 2HFY19. On that account, a bigger income flow from that period would potentially offset the retiming downside in 1HFY19. As of 1QFY19, its gearing stood at 0.23 times versus 0.58 times, leaving the group headroom to leverage a bigger-scale project. Adding into that, the group’s robust order book and healthy balance sheet are expected to firm up support for value accretion prospectively. The return of previously shelved projects, namely Bandar Malaysia and the East Coast Rail Link, is an encouraging development, whereby MRCB could emerge as a potential beneficiary. We maintain our “buy” call with an unchanged TP of RM1.02. — MIDF Research, Aug 5

This article first appeared in The Edge Financial Daily, on Aug 6, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Horizon Hills @ Golf East

Horizon Hills, Johor

Pantai Panorama

Pantai Dalam/Kerinchi, Kuala Lumpur

Taman Perindustrian Maju Jaya

Johor Bahru, Johor

Parkland By The River

Permas Jaya/Senibong, Johor