“Mother, let’s buy a house. You pay half, I pay half.”

When you can’t afford to buy a property on your own, sharing with someone else could be a good idea but do you know the risks involved in joint ownership? Indeed, joint ownerships could lead to nightmares in the unforeseen future, especially when relationships turn sour.

Founder and managing partner of Chur Associates Chris Tan explains that if there is no legal evidence suggesting otherwise, all co-owners are deemed to have the exact same equal share of the property. If there is bank financing for the property, it is very likely that the joint owners shall be jointly liable for the entire loan sum procured and not for each co-owner’s respective share only.

Decision making in a joint ownership of a property is a situation where it is “all or nothing”, where everyone agrees or it’s a no-go. “It’s certainly not a matter of majority rules,” says Tan.

Read also

VPEX is back with great deals!

Confidence returning

Research online, buy offline

Don’t miss the boat: Exciting offerings for homebuyers

One way to prevent unpleasant scenarios among joint owners of a property is to have the parties sign a joint-ownership agreement (JOA).

A JOA is signed between co-buyers who enter into the Sale and Purchase Agreement together. Although there is no guarantee that a JOA could solve all problems, an agreement is better than no agreement, says Tan.

Law firm Marcus Hwang & Co partner Normaliza Sulaiman concurs. “The JOA will assist the co-proprietors to resolve any disputes, differences or disagreements,” she says.

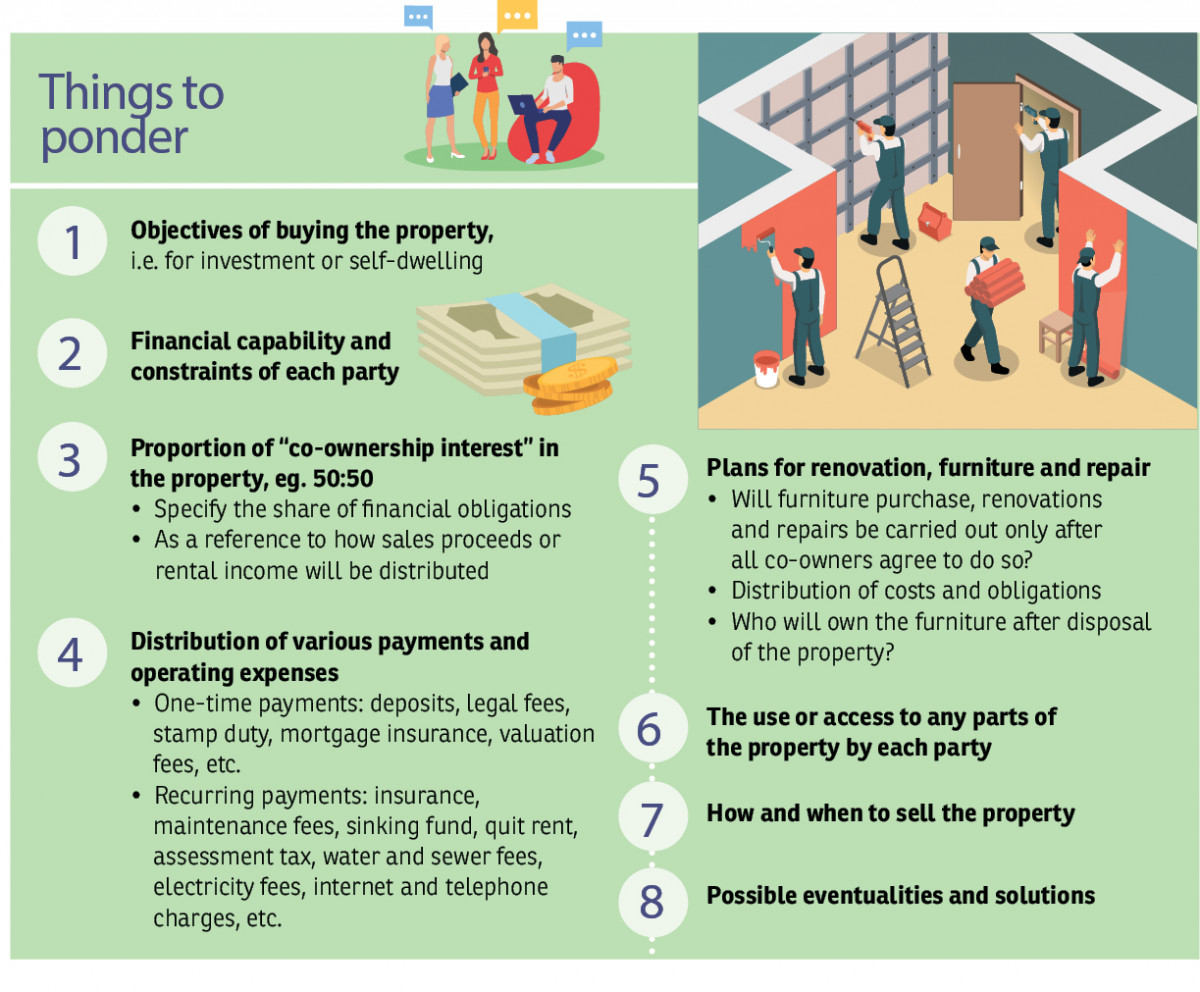

Before meeting a lawyer, the potential joint owners should discuss and agree on major issues such as whether the spread of co-ownership interest should be 20:80 or 40:60 or 50:50 and so on; distribution of utility fees and various expenses; as well as a consensus on maintenance, repair and improvement of the property.

More importantly, the owners need to specify conditions to guide their decision-making regarding the property and the process for selling the property, such as how to determine a minimum selling price and duration for holding the property.

Possible eventualities and solutions also need to be considered. The owners are encouraged to agree on and spell out clear exit strategies if relationships between parties become strained or when one dies or becomes ill.

Clauses on pre-emptive rights (right of first refusal) should also be included to grant a co-owner the first right to buy out the property if the property is to be disposed.

Inheritance of the agreement

If one of the joint-owners dies, the person’s heritage beneficiary or beneficiaries will inherit the deceased’s portion of the property.

Notwithstanding the fact that Malaysia is part of the

Commonwealth and is still operating under the British Common Law today, Tan points out that Malaysia does not adopt the notion of the “law of survivorship”. In other words, if a co-owner passes away, the surviving owner/owners will not inherit the property if he or she is not a heritage beneficiary of the deceased.

The successors of the heritage should be bound by the terms of the JOA, but ultimately it is up to the court to decide whether the agreement could be challenged or not.

The concept of having a JOA is still relatively new in Malaysia. As such, the legality of a JOA has yet to be tested in the local judicial system.

However, the courts are likely to consider the agreement, as long as the agreement does not contradict with the Contract Act 1950 or the National Land Code 1965 (NLC 1965) and there is no duress or fraud.

“All agreements are legally valid and sufficient if they are executed by the relevant parties, attested witnesses and stamped to have the agreement admissible for court proceedings,” Normaliza says.

“It is generally binding and enforceable, unless it is validly challenged in law or even policy reasons like inconsistency with the applicable bumiputera policies,” says Tan, adding that this is normally an extra contractual agreement with mutually agreeable unique terms between the joint owners, in addition to the fact that the joint ownership should have been adequately reflected in the land registry already.

Normaliza adds that the legal fee charged by each solicitor to draw up the JOA differs as the JOA does not fall under the scale or fixed fee under the Solicitors Remuneration Order 2015. Thus, solicitors are free to charge fair and reasonable fees based on the contents, complexity and time taken in the preparation of such an agreement.

So, do you really need a JOA?

Perhaps, because it’s not just about signing an agreement but by doing so, it forces the buyers to sit down and dive deep into the purpose of buying a property together, while getting to know more about each other’s needs and constraints.

Most importantly, sufficient communication is needed to prevent dispute and losses arising from joint ownership property.

Co-owners have to ensure that they share common objectives for buying the property, to avoid conflict and dispute regarding the management of the property.

As each person may have different financial needs at different times, a common financial objective is an important consideration.

Normaliza says it is better for the co-owners to have legal relationship or strong relationship bond, such as spouses or family members, as this could reduce the risk of personal conflicts later on.

“Choose wisely your co-proprietor. If you have a legal relationship with each other, if one dies, the inheritance will remain within the same circle,” she says.

Meanwhile, Tan says it is advisable for owners to have the right expectations of each other.

“As long as there is sufficient consensus among the co-owners, whether there is a need for a proper document will depend on the risk profile of the respective co-owners,” he adds.

Form a company to hold the property

Another way to reduce risk in a joint ownership is to set up a joint-holding company to hold the property. This could potentially eliminate some hurdles at the point of exit from the investment.

Unlike jointly holding a property, the majority rules in decision-making in a company as regulated under the Companies Act, potentially easing the decision-making process.

Apart from that, there is a difference between being a director and a shareholder especially in terms of rights and obligations.

According to Normaliza, the benefit of forming a company to hold a property is that the rights of each co-proprietor will be based on the amount of company shares they hold. Similarly, the liability is limited to the shares held.

A company can also act as an entity for ownership transfer. As a shareholder, one can sell shares in the company that owns the property. A shareholders’ agreement can be drawn up to govern the co-owners’ relationship.

On top of that, she points out that a company that owns a property can have an increase in their limit for capital funding.

However, costs and ongoing obligations for setting up a company should also be mulled over.

Costs to maintain a company include employing a company secretary to keep records and proceedings, as well as the expenses for annual filings, book keeping, mandatory annual audit, tax submission and Annual General Meeting and/or Extraordinary General Meeting and so on. Costs of setting up a company and closing it down should also be considered.

The good part is that all expenses are deductible as company expenses instead of individual expenses.

On the downside, if a company is to acquire a residential property, the margin of finance from the banks is generally lower given that the purchase is for investment purpose, while the applicable interests might differ too.

He adds that the profit from the property disposal and rental could be subject to Real Property Gains Tax or income tax depending on the circumstances. Furthermore, there is also a need to declare dividends before the profit can be distributed to the shareholders.

Whatever you choose to do, it is best to consult a professional, Tan advises.

This story first appeared in the EdgeProp.my pullout on July 19, 2019. You can access back issues here.