S P Setia Bhd (May 10, RM2.08)

Upgrade to buy with unchanged target price (TP) of RM2.53: S P Setia first quarter of financial year 2019 (1QFY19) core net income of RM85 million came in above our expectations, making up 32% of our full-year estimate. The positive deviation is attributable to faster than-expected progress billing in 1QFY19.

However, the core net income figure is slightly below consensus expectations, making up 19% of consensus full-year estimate. 1QFY19 core net income was higher on sequential basis (+46.7% quarter-on-quarter [qoq]) and yearly basis (+94.2% year-on-year [y-o-y]), driven by revenue recognition from strong new property sales registered in 4QFY18 of townships in central and southern regions.

Note that sales from the two regions contributed RM1.63 billion or 32% of total new sales in FY18.

Meanwhile, unbilled sales declined to RM10.95 billion in 1QFY19 from RM12.3 billion in 4QFY18, providing three years earnings visibility.

S P Setia recorded new sales of RM718 million in 1QFY19, lower than new sales of RM1.9 billion in 4QFY18 due to “wait-and-see” attitude of property buyers.

Local projects contributed 94% of the total new sales while international projects contributed the remaining percentage of the total sales. 1QFY19 new sales made up only 13% of management new sales target of RM5.65 billion for FY19. Nevertheless, management is maintaining its new sales target of RM5.65 billion with planned launches with total gross development value of RM6.47 billion for the remaining part of FY19.

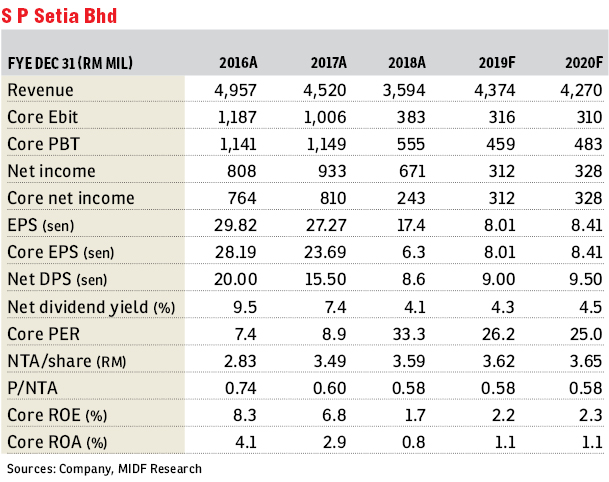

We revise upwards our FY19/FY20 earnings forecasts by 19%/13% respectively, to factor in the faster-than-expected progress billing of local projects.

Our TP if maintained at RM2.53, based on 43% discount to RNAV. We upgrade our call on S P Setia to “buy” as we see value has emerged following the weakness in share price.

S P Setia is trading at 42% discount to its latest net tangible asset per share of RM3.60, making its valuation look appealing.

Completion of sale of Phase 2 of Battersea in March 2019 is also positive to S P Setia. — MIDF Research, May 10

This article first appeared in The Edge Financial Daily, on May 13, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor