KUALA LUMPUR (Feb 27): IJM Corp Bhd, whose net profit was flat at RM93.42 million in the third quarter ended Dec 31, 2018 (3QFY19), said the group would have a “satisfactory performance”.

Its managing director and chief executive officer Datuk Soam Heng Choon noted that its order book, which is at its near-record high, will provide earnings visibility over the next few years.

“Going forward, IJM will be well-poised to meet the new construction landscape as the country is still in need of quality and reputable contractors to execute its infrastructure needs,” Soam said.

The group is also on track to achieve its property sales target of RM1.6 billion for the financial year ending March 31, 2019 (FY19), he added.

The diversified group’s, which has presence in construction, property development and oil palm plantation, earnings were mostly flat in 3QFY19.

Quarterly net profit came in at RM93.42 million, marginally higher compared with RM93.39 million in the previous corresponding quarter.

Quarterly revenue dropped 2.7% at RM1.51 billion against RM1.55 billion a year ago. The slightly lower revenue was attributed to a drop in contributions across the group’s construction, manufacturing and quarrying, as well as plantation divisions.

According to IJM, its construction division was less profitable during the quarter under review due to lower construction margins and as project revenues were not yet reaching optimal construction phase.

Its manufacturing and quarrying division saw lower sales volumes and margins. The combination of lower commodity prices and production cost pressure have weighed on its plantation division.

These were mitigated by its property development division, thanks to a launched Penang condominium project, higher sales achieved from the disposal of completed stocks and commercial land, as well as higher margins derived from its current development projects.

Its infrastructure division, meanwhile, recorded higher contributions from its local tolls and port concessions.

For the cumulative nine-month (9M) period, IJM’s net profit nearly halved to RM178.11 million from RM328.79 million in the same period in FY18; while revenue contracted 7.6% to RM4.26 billion from RM4.61 billion in 9MFY18.

IJM attributed the decrease in its profitability to net unrealised foreign exchange losses amounting to RM59.2 million, and a one-off loss on disposal of its remaining 30% equity interest in Swarna Tollway Private Limited amounting to RM41.4 million.

Shares in IJM closed nine sen or 4.8% higher at RM1.97 yesterday after the selldown yesterday amid concerns that the Government may not be offering fair valuation to take over toll highways. The group’s market capitalisation is RM7.14 billion. — theedgemarkets.com

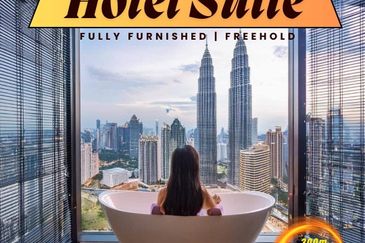

TOP PICKS BY EDGEPROP

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

KL Gateway Premium Residence

Bangsar South, Kuala Lumpur

Impian Bukit Tunku

Kenny Hills (Bukit Tunku), Kuala Lumpur