KUALA LUMPUR (Feb 7): AmBank Research expects the ringgit (MYR) to trade between its support level of 4.0826 and 4.0893 while the resistance is pinned at 4.1008 and 4.1107.

In his AmBankFXDaily note today, AmBank group chief economist and head of research Dr Anthony Dass said the local market was closed for two days (Tuesday and Wednesday) in view of the Lunar New Year Holidays.

Dass, who is also adjunct professor in economics at University of New England, Sydney, Australia, said on Monday, the MYR gained 0.06% to 4.093 against the dollar.

* Australia, S'pore and UK properties most favoured by M'sia's ultra-rich

He said there were strong foreign buying interest on the Malaysian Government Securities (MGS) 7-15 year tenors, with yields down by 1-4 basis points (bps).

He said the 7-year was down 1bps to 3.900% while the 10-year MGS fell 4bps to 4.030% and the 15-year yields down 4.0bps to 4.405%.

“Meanwhile, the 3-& 5 year stayed unchanged at 3.600% and 3.755%, respectively. The KLCI on Monday stayed unchanged at 1,683.6 with a short trading session due to the Lunar New Year Holidays.

“In the commodity space, both Brent and WTI closed higher by 1.15% to US$62.69/bbl and up 0.65% to US$54.01/bbl, respectively driven by signs of stronger US demand.

“However, gains were capped underpinned by the strong dollar while API crude oil recorded higher inventory by 2.5 million barrels as of 1st Feb compared to 2.1mil barrels from the week prior.

“The MYR strengthened against its regional peers as it rose 0.11% to 3.023 against Singapore Dollar, up 0.03% to 12.790 against peso, and closed higher by 0.59% to 3401.0 against rupiah peso. However, MYR weakened against baht by 0.04% to 7.638,” he said. — theedgemarkets.com

TOP PICKS BY EDGEPROP

Suria Residence by Sunsuria

Bukit Jelutong, Selangor

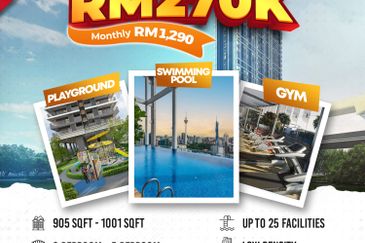

Suria Rafflesia

Setia Alam/Alam Nusantara, Selangor

Taman Perindustrian USJ 1

Subang Jaya, Selangor

Taman Perindustrian USJ 1

Subang Jaya, Selangor