The best time to buy your first home

While the property market is expected to remain challenging in 2019, for those looking to buy a home for their own stay, it may be a good time to buy as sellers are more flexible with their asking prices while developers are offering attractive packages with freebies and other incentives.

“The current slowdown in the market is a good opportunity to shop around and buy property, especially for your own stay,” Nawawi Tie Leung managing director Eddy Wong tells EdgeProp.my, adding that developers are now more inclined to offer discounts and incentives in order to move sales.

“This is the best time to pick up bargains as property is a long-term investment and the market will eventually recover. Look for properties which are well connected, and located in a neighbourhood with good access to amenities,” he advises.

Zerin Properties CEO Previndran Singhe concurs, adding that asking prices have dropped in the property market.

“For residential property, transit-oriented developments (TODs) or those located close to public transport are recommended. I do like second-tier developers which are selling at a discount rather than premium developers. Notwithstanding, premium developers are offering good deals now,” he says.

According to Knight Frank’s Global Residential Cities Index for 3Q2018, average residential property prices in Kuala Lumpur has slipped slightly by 0.6% from 3Q17 to 3Q18.

Moreover, the government is providing assistance to first-time homebuyers in the form of incentives and various affordable housing schemes.

According to the Housing and Local Government Ministry (KPKT), these schemes and incentives can be divided into two categories:

1. Homeownership programmes and home purchase subsidies

2. Down payment assistance programmes

Under the first category, the federal government offers three homeownership programmes: the People’s Housing Programme, the Housing Loan Scheme and the Transit Home Programme.

The second category features four schemes — the First Home Deposit Funding Scheme (MyDeposit), the Private Affordable Ownership Housing Scheme (MYHOME), My First Home Scheme and the Youth Housing Scheme.

The government also encourages private sector initiatives to ease first-time homeownership. Launched by the prime minster in November last year was EdgeProp Sdn Bhd’s FundMyHome scheme which enables a person to own a home by only paying 20% of the property price.

Besides the above existing schemes, the government announced more incentives during the tabling of Budget 2019 in

November 2018. These include stamp duty exemptions, mortgage support and low interest rate housing loan schemes.

Malaysian Institute of Professional Estate Agents and Consultants (MIPEAC) deputy president and Metro Homes Sdn Bhd director See Kok Loong says these schemes will benefit first-time homebuyers who find it difficult to afford a home amidst a strict lending environment.

He says young first-time homebuyers can also consider FundMyHome to get a foot on to the housing ladder with financial assistance from their parents to come up with the 20% payment.

“FundMyHome is an innovative approach for first-time homebuyers because it offers an alternative to a housing loan which means one need not go through the rigid bank loan application and approval process where an applicant’s debt service ratio and current income are assessed,” he says, adding that if family members such as parents can come up with the 20% payment, there will be no loan commitment for the buyer in the first five years.

“After the fifth year, the buyer can choose to cash out and purchase another house in a place that they want to settle down in. So I encourage parents to support their kids who are applying for the FundMyHome scheme by helping them with the 20% payment,” he says.

Previndran also agrees that FundMyHome, which puts together buyers, sellers and funders, provides easy entry for first time homebuyers.

It certainly looks like a good time to buy a property, especially for those wanting to buy their first home.

For those who wish to utilise these schemes in order to purchase a home in 2019, See has listed a few basic reminders to consider:

1. Buy from reputable developers

Project delays and abandonments are a homebuyer’s nightmare, so one should always buy from a reputable developer or one that is financially sound.

2. Know what you are buying

Homebuyers should do their research and understand fully what they are potentially buying into — from the overall view of the entire development to the surrounding amenities — to ensure they get a property that they will be happy to stay in or invest in.

3. Be certain that you are able to pay for the mortgage

Homebuyers must be very certain about their ability to make their home loan repayments punctually before they commit to a purchase.

However, if you want to avoid taking a mortgage, you could consider alternative homeownership schemes such as FundMyHome where you do not have worry about repayments.

4. Do not overspend on renovations

According to See, although it may help to value-add a property, renovations do not provide a significant boost to the value of a house. Stretching finances to fund unnecessary renovations is not advisable.

5. Do not overlook the importance of property management

Those who are buying a strata property are advised to look for well-maintained properties. If it is a new property, find out how much it takes to maintain the property in the long run, not just when it is first completed. Good maintenance is the key to the long term sustainability of the property’s value.

HOMEOWNERSHIP PROGRAMMES

1. FundMyHOME

Key features

• Pay only 20% of the price to own a home while the balance 80% will be contributed by participating institutions. There is no mortgage, hence no monthly repayments.

• The holding period is five years which means by the end of the fifth year, a homebuyer will have to choose whether to sell, to own the property (by taking up the remaining 80% share of the house based on market value) through a mortgage or refinance the unit on FundMyHome.

• Currently, nine developers are offering about 1,000 homes priced below RM500,000 to eligible individuals through www.FundMyHome.com.

Eligible applicants

• Malaysian citizens aged 18 and above

• First-time homebuyers, non-bankrupt

2. People’s Housing Programme (PPR)

Key features

• Consists of two categories: PPR for Rent (PPRS) and PPR for Ownership (PPRM)

• Affordable houses built to be sold or rented out to those in the low-income group

• Houses under this scheme have a minimum built-up of 700 sq ft with three bedrooms and two bathrooms each

• Monthly rental rate is as low as RM124 while the selling price is set at RM35,000 for homes in Peninsular Malaysia and RM42,000 for homes in East Malaysia

Eligible applicants

• Malaysian citizens aged 18 and above

• First-time homebuyers with a total household income below RM2,500 per month

3. Housing Loan Scheme (SPP)

Key features

• Housing loans of up to RM60,000 for low-income households to build a house on their own land or on land owned by an immediate family member with an interest rate of only 2%

• Loan tenure is up to 35 years, or when the borrower reaches 70 years of age, whichever is earlier

• The house must be developed according to the provided plan only

Eligible applicants

• Malaysian citizens aged between 21 and 70 years

• Not a government servant or pensioner

• Do not own a house

• Own land

4.Transit Home Programme

Key features

• For newly married couples in urban areas with a household income below RM3,000 to rent a home under the scheme at RM250 per month for two years

• The homes are two- or three-bedroom and two bathroom units with built-ups from 700 to 850 sq ft

Eligible applicants

• Malaysian citizens aged between 18 and 30

• Have monthly household income of below RM3,000

• Do not own a house in the area or state that he/she is applying for

• Work in the area or state that he/she is applying for

• Have no criminal record

HOME PURCHASE SUBSIDY AND DOWN PAYMENT ASSISTANCE

First Home Deposit Funding Scheme (MyDeposit)

Key features

• Assists homebuyers in paying the deposit for a home amounting to 10% of purchase price or a maximum of RM30,000 per unit for private housing and housing projects on the secondary market priced RM500,000 and below

• The house is not allowed to be sold for a period of 10 years

• The owner is not allowed to rent out the house, but use it for own stay only

Eligible applicants

• Malaysian citizens aged 21 and above

• First-time homebuyers

• Have a household income between RM3,000 and RM15,000 per month

Youth Housing Scheme

Key features

• The scheme offers a 100% loan to help single or married youths own their very first home, either completed, under construction or sub-sale properties

• Only eligible for the purchase of properties worth between RM100,000 and RM500,000

• Limited to 20,000 buyers only, on a “first come, first served” basis

• The government will provide monthly financial assistance of RM200 to borrowers for the first two years

• 100% stamp duty exemption on the transfer of ownership and facility documents for properties priced up to RM300,000

• Maximum financing tenure is 35 years provided the borrower’s age does not exceed 65 years at the end of the tenure

Eligible applicants

• Malaysian citizens aged between 25 and 40 years old

• First-time homebuyers

• Single or married with a household income of no more than RM10,000 per month

My First Home Scheme

Key features

• Allows first-time homebuyers to obtain 100% financing from banks and financial institutions, enabling them to own a home without paying a 10% down payment

• Limited to the purchase of residential properties valued between RM100,000 and RM500,000

• Home purchases must be for owner-occupation, not for any other investment purposes

• Financing tenure must not exceed 35 years subject to borrower’s age not exceeding 65 years at the end of the financing tenure

• Amortising facility only (no redraw features)

• Panel banks include Affin Bank, Alliance Bank, AmBank, Bank Islam, Bank Muamalat, CIMB Bank, Hong Leong Bank, Maybank, MBSB Bank, OCBC Bank, Public Bank, RHB Bank, Standard Chartered Bank, United Overseas Bank and more

Eligible applicants

• Malaysian citizen or employee in the private sector

• Individuals of up to 40 years of age

• First-time homebuyers

• Have a monthly gross income not exceeding RM5,000 if single borrower

• Have a monthly gross income not exceeding RM10,000 if joint borrower (family only)

• Repayment of total financing obligation must not be more than 60% of net monthly income or maximum financing limit of participating bank, whichever is lower

NEW INCENTIVES ANNOUNCED IN BUDGET 2019

The government is looking to enable private sector-driven “property crowdfunding” platforms, which will serve as an alternative source of financing for first-time homebuyers. These exchange platforms will be regulated by the Securities Commission Malaysia (SC) under the peer-to-peer financing framework. This will enable more people to own homes without being exposed to heavy mortgage burdens while allowing investors to invest in the property sector in smaller amounts. The framework is expected to come into effect in the first quarter of 2019.

Six-month stamp duty exemption from Jan 1, 2019 for first-time buyers of completed unsold houses priced between RM300,000 and RM1 million. This will be part of a National Home Ownership Campaign, where developers will offer a minimum price discount of 10% for these completed unsold residential properties.

For first-time homebuyers purchasing residential properties priced up to RM500,000, the government will exempt stamp duty up to RM300,000 on sale and purchase agreements as well as loan agreements for a period of two years until December 2020.

Government to spend RM1.5 billion on affordable housing via the People’s Housing Programme (PPR), Malaysia Civil Servants Housing Programme (PPAM), 1Malaysia People’s Housing (PR1MA) and Syarikat Perumahan Nasional Bhd (SPNB).

For those earning no more than RM2,300, a RM1 billion fund will be set up by Bank Negara to help finance purchase of homes priced up to RM150,000 at interest rates of 3.5% through selected banks.

For first-time homebuyers with a household income of up to RM5,000, the government will allocate RM25 million to Cagamas Bhd for mortgage support and to help homebuyers pay the deposit for a home. This will provide an estimated cost savings of between 7% and 11% to homebuyers.

The Real Estate and Housing Developers’ Association Malaysia has agreed to reduce house prices by as much as 10% for houses in new projects which are not subject to price controls. This follows the SST exemption on construction materials.

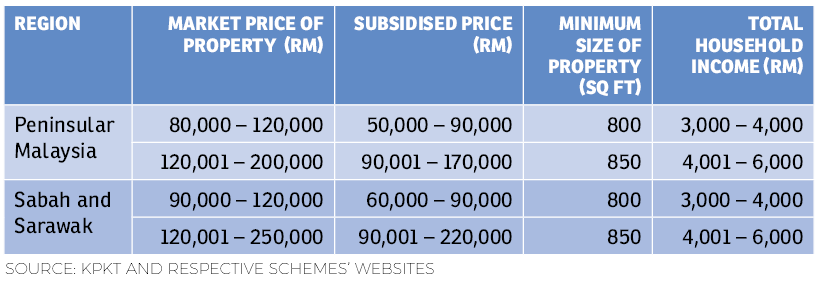

PRIVATE AFFORDABLE HOUSING SCHEME (MYHOME)

Key features

• Aims to encourage the private sector to build more affordable houses,

it offers incentives up to RM30,000 for houses priced below a certain ceiling

• Houses under the scheme are three-bedroom and two-bathroom units

• Owners have to adhere to a 10-year moratorium period

Eligible applicants

• Malaysian citizens aged 18 years and above

• First-time homebuyers

• Have a monthly household income as follows:

This story first appeared in the EdgeProp.my pullout on Jan 4, 2019. You can access back issues here.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.