KLCCP Stapled Group (Nov 14, RM7.66)

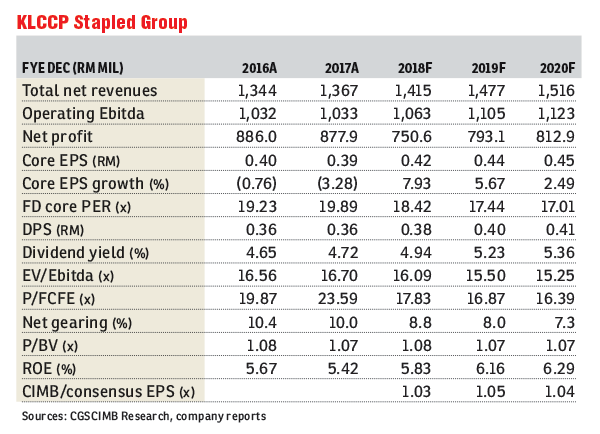

Maintain hold with an unchanged target price of RM7.83: KLCCP Stapled Group’s (KLCCP) core net profit for the nine months ended Sept 30, 2018 (9MFY18) made up 73% of our and 74% of consensus full-year estimates. The results were broadly in line as we expect a stronger retail rental revenue and positive impact from refurbished hotel rooms in the fourth quarter of this year (4Q18).

9MFY18 revenue growth of 2.5% year-on-year (y-o-y) was driven by all segments, particularly hotel as it returned to full room inventory post-refurbishment. Core net profit rose at a slower pace of 1.7% y-o-y, dragged down by depreciation of refurbished hotel rooms at the Mandarin Oriental KL (MOKL) and higher operating expenditure. 9MFY18 distribution per unit of 26.1 sen was in line.

9MFY18 operating numbers across all assets were supported by 100% occupancy rate for offices, sustained lower-single-digit growth in retail rental reversions, new parking and maintenance contracts and higher average occupancy rates. Rental revenue growth of 6% y-o-y for hotels outpaced the 1-4% y-o-y growth for office, retail and management services. This was underpinned by higher rental and average room rates in 3Q18 as the full set of new refurbished rooms came onstream.

The 2.2% y-o-y retail revenue growth at Suria KLCC was driven by improved occupancy and higher rental rates from new and renewed leases. KLCC recorded positive growth in moving average tenant sales across segments, particularly for beauty & skin care and food retail.

In the third quarter ended Sept 30, 2018 (3QFY18), it added new tenants, namely Acme Bar & Coffee, Delirium, Dotty’s, B& by Boost, Cigar Malaysia, Michael Kors, and APM Monaco. All of these stores were opened between Aug 16 and Sep 13.

From our recent site visit to MOKL, we understand that the overall domestic hotel market’s oversupplied state remains a challenge for MOKL. Based on industry data, Kuala Lumpur is set to see a 23% increase in supply in 2018 versus a mere 2% demand growth, suggesting a fairly competitive environment.

We maintain our FY18 to FY20 earnings per share estimates and retain our “hold” call in view of the limited upside to our target price. KLCCP’s prime locations, secured office assets and sustained high occupancy rates are offset by the oversupplied state of the office and hotel segment along with retail competition. However, we expect the share price to be supported by its FY18 to FY20 forecasted dividend yields of 4.9% to 5.4%. Upside risk is higher-than-expected rental reversions; downside risk is tenant non-renewals. — CGSCIMB Research, Nov 13

This article first appeared in The Edge Financial Daily, on Nov 15, 2018.

TOP PICKS BY EDGEPROP

Eco Business Park V

Bandar Puncak Alam, Selangor

Pacific Place @ Ara Damansara

Ara Damansara, Selangor

Pacific Place @ Ara Damansara

Ara Damansara, Selangor

Pacific Place @ Ara Damansara

Ara Damansara, Selangor

Pacific Place @ Ara Damansara

Ara Damansara, Selangor