Scientex Bhd (Sept 21, RM8.74)

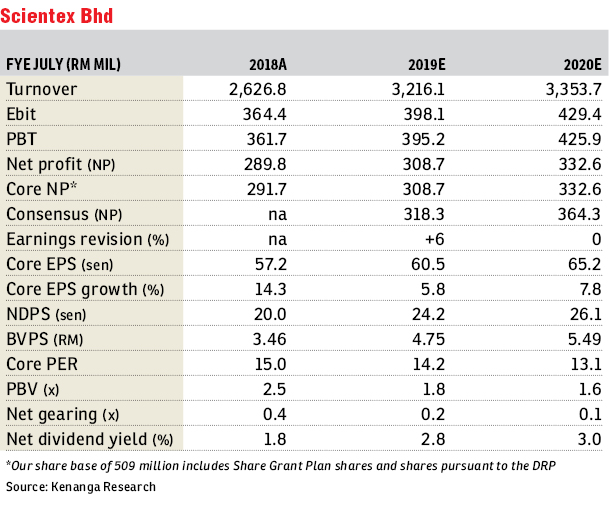

Maintain underperform with a higher target price (TP) of RM7.80: Scientex Bhd’s financial year 2018 (FY18) core net profit (CNP) of RM291.7 million came in above our and consensus estimates at 114% and 107%, respectively. Top line came in within, at 103%, but we believe the deviation from our estimates was due to better-than-expected CNP margins in FY18 of 11.1% (versus our estimate of 10%), mainly because of better-than-expected property margins in the fourth quarter of FY18 (4QFY18) (at a 40% earnings before interest and tax [Ebit] margin versus 30% in 3QFY18) on the back of cost savings from better operational efficiency and improved product mix. A single-tier interim dividend of 10 sen was announced, which brings FY18 dividend to 20 sen, which is also above our estimates (132%).

Quarter-on-quarter (q-o-q), top line increased by 22%, contributed mainly by the property (+39%) as well as the manufacturing (+17%) segments. This was also on the back of a significantly better property Ebit margin of 40% (versus 30%) contributed from projects in Johor, Melaka and Ipoh on better operating efficiency and product mix. This coupled with lower effective tax rates of 16.5% (versus 18.6%), caused CNP to increase by 48%. Year-on-year (y-o-y), year-to-date (YTD) top line was up by 9% mostly on contributions from the manufacturing segment (+14%) on improved sales as well as contributions from Klang Hock Plastic Industries Sdn Bhd (KHPI), while the property segment’s revenue declined marginally by 2%. The Ebit margin improved marginally to 13.9% (from 13.5%) from contributions from both segments. This, coupled with lower financing cost (-23%) caused CNP to increase by 14%.

Scientex is focused on ramping up utilisation, targeting 70% over the next few years (versus around 60% currently), mostly from its biaxially oriented polypropylene plant and Arizona plant in the United States, which will mostly contribute from FY19 onwards. We do not expect additional capacity in FY19 and FY20 for now, but growth is premised on gradual improvements in utilisation rates for the manufacturing segment, and full-year contributions from KHPI in FY19.

We are expecting launches of RM800 million and RM850 million in FY19 and FY20, as we increase our property Ebit margin slightly to 35% (from 32% previously) on the segment’s strong margin improvements this quarter (Ebit margin of 40%), and maintain manufacturing sector utilisation rates of 65% and 70% in FY19 and FY20 on capacity of 450,000 tonnes per annum. All in, we increase FY19 estimate (FY19E) CNP by 6% to RM309 million, and introduce FY20E CNP of RM333 million, with dividend yields of 2.8% and 3% in FY19 and FY20.

Our TP is based on our sum-of-parts FY19E valuations with an unchanged price-earnings ratio (PER) of 10 times for the property segment and an unchanged 14 times applied PER for the manufacturing segment. Results have been weak in the previous two quarters, missing expectations, while earnings improvements this quarter were mostly driven by the property sector of which we are not overly bullish on. As such, we are comfortable with our “underperform” call as our in-house property analyst has reservations on the sustainability of the strong margins and maintains a neutral outlook on the sector in light of macro uncertainties and margin pressures. — Kenanga Research, Sept 21

This article first appeared in The Edge Financial Daily, on Sept 24, 2018.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Premium Height @ Bandar Dato Onn

Johor Bahru, Johor

Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

Biji Living (Seventeen Residences)

Petaling Jaya, Selangor

Kolombong Industrial Centre

Kota Kinabalu, Sabah

Seri Mutiara Apartment, Bandar Baru Seri Alam

Masai, Johor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor