The value of unclaimed estates left by the deceased since independence in Malaysia is in the region of RM60 billion, according to former Natural Resources and Environment Deputy Minister Datuk Hamim Samuri in a news report two years ago (Feb 3, 2016).

He had said the sum was derived from data provided by the Department of Director General of Lands and Mines (JKPTG) through the Estate Distribution Section or Bahagian Pembahagian Pusaka (BPP). However, when contacted recently, the division told EdgeProp.my that it was in the dark as to how the figure was derived. It has remained a mystery.

“The section does not have such a record. Personal assets are private, so BPP will certainly not have information about who owns what in our database.

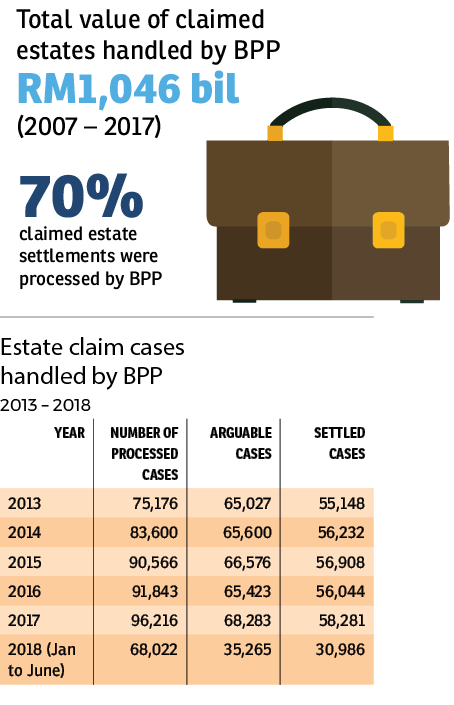

“The function of the BPP is to verify the estate ownership of the deceased when their heirs report to the section, and then assist the rightful heirs to claim the estates. Hence we will only have the statistics of reported cases and the value of claimed estates,” director of BPP Hasiah Kasah tells EdgeProp.my.

Nevertheless, the fact remains that cases of unclaimed assets abound.

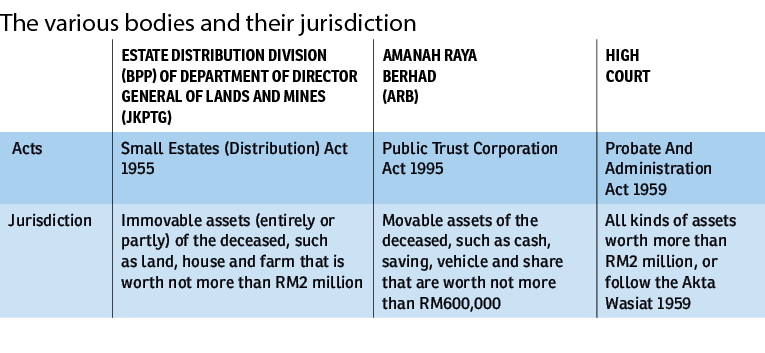

Besides JKPTG, other bodies that manage queries and applications related to estate administration such as the distribution of inheritance in Malaysia are the High Court and Amanah Raya Bhd.

“Under JKPTG, the BPP handles immovable assets, such as land, landed and non-landed properties, farms and estates, worth not more than RM2 million. We are also the agency that processes most of the inheritance distribution cases in the nation, which is about 70%, among the three agencies,” Hasiah shares.

The High Court is responsible for all kinds of asset distribution valued above RM2 million while Amanah Raya distributes movable assets such as money, savings, vehicles, bonds, and shares, worth not more than RM600,000.

“Of course the government will have some unclaimed asset information, such as unclaimed money in banks or EPF (Employees Provident Fund). However, we cannot verify the ones which are somebody’s inheritance. Some people may have just forgotten the bank accounts they had opened a long time before,” BPP’s chief assistant director Noor Rashidah Ramli explains.

Meanwhile, for estate assets, Hasiah says the state government can track the owner of an abandoned house or land when quit rent is not paid but it will not take the initiative to look for the heirs if the owner has passed on.

“There are different laws in every state. Some states will forfeit the land if quit rent has not been paid for five years, some three years,” Hasiah notes.

However, there are cases where an unrelated person pays the quit rent in order to illegally occupy abandoned land.

“Especially in suburbs or rural areas, the deceased’s neighbour or any unacquainted person could continue to pay the quit rent of the land, so that they can purposely continue to use the land for farming or business without buying over the land. In this case, the local government will not know it is an unclaimed property,” Hasiah says.

Potential merger?

Noor Rashidah says the three agencies work independently and do not share information or data with each other.

“The only department to have all claimed asset information is the Central Registry, under the Kuala Lumpur High Court. It serves as the administrator of the three agencies to help verify and cross-check information from each agency, as well as take record of all claimed inheritance in Malaysia,” Noor Rashidah says.

As for unclaimed inheritances, Hasiah reiterates that JKPTG does not have the records of unclaimed properties.

“Countless people have come to the office to check what their late family owns and what is available to claim, but we will not know. If you, as the deceased’s family member, do not know what your family member owns, why would we?” Hasiah points out.

She says the public is confused over where to claim what because all three bodies handle inheritance distribution.

“All three bodies have the same function. The only difference is the kind of assets we are each handling. We cannot merge because all three bodies are guided by different Acts,” she explains.

However, some research has been done by the government to study the possibility of placing all three bodies under the same roof, to avoid confusion, raise efficiency, as well as to comprehend inheritance data.

“Data is required to better manage resources to benefit the public. In order for us to come up with the (unclaimed property of the deceased) data and statistics, we also need to be linked to other ministries and agencies such as JPN (the National Registration Department), but currently we are not linked,” Hasiah notes.

“Centralising the roles of the three bodies will also provide a set of standardised fees. JKPTG is a government department, and our charge is as low as RM30. However, Amanah Raya is a business-driven corporation, so they have their own charge rate. Meanwhile, for high court, one will need to pay the lawyer to claim inheritance.

“The purpose of having the two agencies to handle inheritance distribution other than the court was to avoid burdening the public, because you will need to hire a lawyer if you are going to court. This is why, for assets valued under RM2 million, you go to JKPTG and Amanah Raya. In the early days, Amanah Raya was under the government. It became a corporation later on.

Know your rights

“Maybe it is time to change now because the structure no longer fits into today’s context. The legal department and MAMPU (Transformation Policy Division) have done a research (on merging the three agencies). However, BPP is just a section under JKPTG. We need someone to present the proposal to the cabinet to realise it,” Hasiah explains.

Meanwhile, Noor Rashidah highlights that it is important to know one’s rights to protect one’s assets by having a will.

“Not only will it ensure that your assets go to your chosen beneficiaries but also speeds up the process of claim by your family members,” she says.

Although BPP only handles immovable assets worth less than RM2 million, it provides free consultation services to the public on inheritance claims.

“We have over 30 offices nationwide. If you are not sure where to claim the money or immovable asset, just come to us and we will try our best to guide you. However, the whole process will be different if you come with a valid will that states the assets, executors and beneficiaries,” Noor Rashidah shares, adding that it will take around four months to distribute an estate (without a will).

However, interestingly, only 10% of the adult population in Malaysia has a will, Rockwills International Group managing director Saw Leong Aun tells EdgeProp.my.

“If we zone into city areas, about 60% to 70% of adults do not have a will,” Saw says.

He believes a will is a necessity today. “Even your insurance policy and EPF have a nominee, how can your property or estate, which has a higher value, have no nominee or executor? Do you know, even if you only have half a share in a property, the property will not automatically go to the surviving owner? Unlike Singapore, we do not have a survivorship clause,” he explains

He highlights that a will is not about money, but to protect the survivors and make sure the inheritance will be distributed according to the wish of the deceased, as well as to speed up the entire claiming process.

“You do not need to spend time to find out what assets your deceased family member had left behind,” Saw notes.

He highlights that a real estate property can be forfeited by the local land office if one does not pay the quit rent for a few years, depending on the local land office regulations.

Unaware or unwanted?

According to Rockwills International Group marketing advisor Low Wan Gem, unclaimed property inheritances in Malaysia may not be solely due to the ignorance and apathy of the heirs.

“There are also cases where the heirs do not want to claim the property or land because it is not worth the effort, for instance when the value of the asset cannot cover the quit rent or the debt of the deceased,” Low offers.

He elaborates that when the deceased have debts owed to banks, income tax, or mortgages to clear, the heir needs to clear all such debts before he or she can apply to transfer ownership.

“It is not worth the time and effort when the property may be just an apartment. Do not forget that you may need to spend an additional amount to renovate the house before you can sell it during a slow market like the present one. Eventually, you may find that you get nothing after spending time and effort in claiming the property,” Low adds.

There are also cases where not all the heirs are willing to contribute to claiming the asset.

“For those who do not have a will, spouse and parents, their properties will be equally divided among their children. What if some children do not want to contribute effort and money to clear the debt and claim the property?

“Those who are willing to contribute can carry on (the claiming process), but bear in mind, those who do not contribute anything have the right to get a share of the property because under the law, he or she is also the rightful heir,” Low notes, adding that not being able to agree or see eye to eye on this, is another common reason for heirs to leave the properties unclaimed.

Is a DIY will valid?

Any person can draft his or her own will as long as all the criteria for a valid will is adhered to, says Marcus Hwang & Co partner Normaliza Sulaiman.

Normaliza tells EdgeProp.my that it is advisable to engage a professional to draw up the will to ensure it is valid and enforceable to avoid any dispute upon death.

She explains that a valid will is required in writing by a person who is above 18 years old and of sound mind, signed before two witnesses who shall sign in the presence of each other.

“A will can be challenged based on the grounds that the contents have been altered, signature is forged, the execution is not witnessed by two persons or the testator is of unsound mind. A will is a wish of the testator and hence shall not be written under any undue influence,” Normaliza notes.

Besides that, any exclusion of an immediate or important person in a will with no express justifiable reason can also lead to it being disputed and challenged by the person who feels deprived.

In the case of a person who dies intestate or without a legal will, Normaliza says the assets shall be distributed under the Distribution Act 1958.

“If no one claims the inheritance, unclaimed moneys shall fall under the Unclaimed Moneys Act 1965. As for unclaimed real property, there will be no dealings or transfer unless the inheritance issue has been resolved.

“In the case where the quit rent revenue has been due and outstanding for many years despite notices of demand, the

Land Office can invoke the National Land Code to forfeit the land under Forfeiture.

The land shall be reverted and vested to the State Authority as state land, freed, discharged without any payment of compensation and all due revenue shall be extinguished,” she says.

Hence it certainly pays to not only make a will but make a valid one that leaves little room for dispute.

This story first appeared in the EdgeProp.my pullout on Sept 7, 2018. You can access back issues here.