Malaysian house prices are in continuous upward trend since 1990. The steep ascent in house prices, without a structural break, corresponds with the concept of bubble, where a housing bubble happens when exuberant herd instinct of tomorrow making good profit. However, this could also be driven by the demand for housing due to the expansion of young adult population and rapid urbanisation rate. It is, thus, important to examine if there is an existence of housing bubbles, or housing cycles.

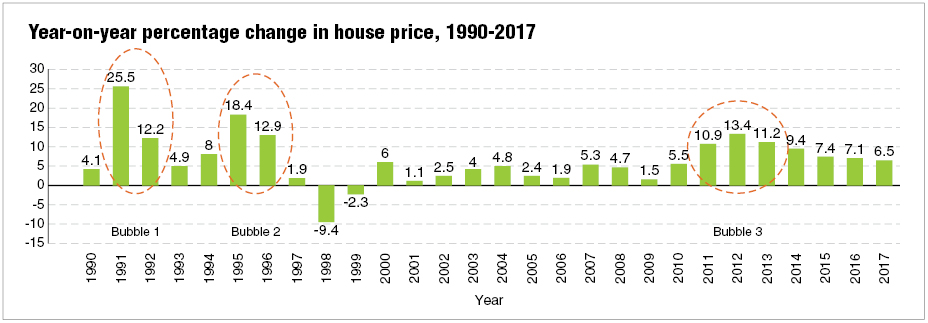

From the perspective of percentage change in house price (See chart), three distinct periods of exponential price growth are observed: 1991-1992; 1995-1996; and 2011-2013. The average price growth during these periods was 18.9% (1991-1992); 15.7% (1995-1996); and 11.8% (2011-2013); where the growths were well above the average yearly increase throughout the period of 1990-2017 (6.5%).

In the case of Bubble 1, it starts to rise rapidly from 4.1% in 1990 to 25.5% in 1991, and then drops drastically to 4.9% in 1993 within a three-year period. This satisfies the bubble characteristics where there is a sharp upsurge and rapid fall of house price within a short period of time. Similar price movement is observed in Bubble 2. In the case of Bubble 3, however, it starts to rise from 1.5% in 2009, reaching a peak of 13.4% in 2012, and then moderately decreases to 6.5% in 2017. The upswing in house price followed by a gradual coming down implies that the country is most likely experiencing a periodic severe form of housing cycle, as a result of the natural inelasticity of the housing supply market.

The moderation of a bubble to a cycle is mainly due to the cooling measures introduced by the government, to curb speculation in the property market: (i) interest rate hikes; (ii) abolishment of Developer Interest Bearing Scheme (DIBS); (iii) raised real property gains tax; (iv) minimum property purchase price for foreign investors; (v) maximum 70% loan-to-value for third residential mortgage loan onwards; (vi) 10-year limit on cash out mortgage refinancing; and (vii) increase in transparency of property sales price.

With these cooling measures in place, Malaysia is expected to be free from any impeding bubble in the immediate future. However, house prices are unlikely to decrease due to the continuous increase in demand from the expanding young adult population, as well as the increase in housing quality, construction costs and land prices.

The recent development of house prices and income indicates that Malaysia is likely to face a housing affordability crisis. Throughout the period of 2011-2017, the rate of house price growth (7.78%) exceeds the growth rate of income (-0.75%), leading to the aggravation of housing affordability conundrum. This is in contrast to the period of 1991-2000 and 2001-2010, where the income moves in tandem with house prices during 1991-2000, or grows in a higher pace than the house prices throughout 2001-2010.

While the government has been actively building affordable housing in the past few years, most of these housing projects are not executed as they are planned initially. They are either priced above the affordable price tag as estimated by Bank Negara Malaysia (RM282,000), or located far away from the urban area that is lacking local amenities, infrastructure network, employment opportunities, educational facilities etc, causing inconveniences to the people. The low take-up rate of these houses, eventually, turns into unsold properties and contribute to the overhang of affordable housing in the country.

This is justified by studying both the absorption and production rate of affordable housing. The newly launched affordable homes, from 2013 to 2017, was increasing with a compound annual growth rate (CAGR) of 52.3%, as compared to the unit sold, with a CAGR of 46.4%, indicating the industry is producing affordable houses faster than the market can absorb, especially during the period of global economic downturn, the domestic market remains flat, access to credit is restricted, and the housing loan rejection is high.

In the near future, one can foresee that the fast-growing pace of affordable housing production will potentially inflate the already crowded affordable housing market segment, leading to the market cannibalisation between new supplies and the existing stocks.

Tan Sri Eddy Chen Lok Loi is group managing director of MKH Bhd

This article first appeared in The Edge Financial Daily, on Aug 29, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Sijangkang @ Industrial

Telok Panglima Garang, Selangor

Section 13 (Seksyen 13)

Petaling Jaya, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

Taman Perindustrian Nusa Cemerlang

Gelang Patah, Johor