Sunway Construction Group Bhd (Aug 17, RM1.99)

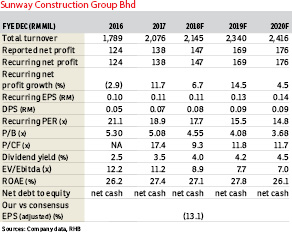

Maintain buy with a lower target price (TP) of RM2.30: We maintain our “buy” call on Sunway Construction Group Bhd (SunCon), with a new TP of RM2.30 from RM2.42, a 14% upside. Its first half of financial year 2018 (1HFY18) core earnings missed expectations, coming in at 42% of FY18 net profit estimates. We trim our FY18 to FY20 earnings forecasts by 10% to 14%, anticipating delays for its light rail transit 3 (LRT3) contract. However, we continue to favour the stock, as it has won the second highest value of new jobs in 2018 at RM854 million. In addition, the company has outstanding tenders in excess of RM4 billion, comprising mainly external building jobs.

The company reported for the second quarter of FY18 core profit after tax of RM35.2 million (-4.3% year-on-year [y-o-y]; +5.3% quarter-on-quarter [q-o-q]) as a marginal RM1.2 million annual increase in construction earnings before interest and tax (Ebit) was insufficient to negate a RM4 million decrease in precast Ebit. For 1HFY18, earnings were down 3.8% y-o-y to RM68.7 million, missing estimates, representing only 42% of our and 41% of the consensus FY18 forecasts. A 3.5 sen dividend was announced, within estimates.

The earnings miss can be attributed to slower-than expected progress of the company’s RM2.2 billion LRT3 contract, which only advanced two percentage points (ppts) q-o-q to 5%. This was coupled with fewer orders secured for its precast segment. Other external projects such as its mass rapid transit 2 package worth close to RM1 billion progressed well, advancing by 18ppts to 52% completion — a welcome relief.

We cut our billing assumptions for SunCon’s LRT3 project further. We understand that the project delivery partner, along with the project owner, Prasarana Malaysia Bhd, would engage with work package contractors within the next couple of months (if not already) to implement cost-reduction measures to lessen the overall project cost to RM16.6 billion (from RM31.6 billion).

While the company will not see a reduction in the number of stations under its package, it would likely see a reduction in scale of some of its stations, in our view. Besides that, the target completion date for the project has been stretched to 2024 from 2021, slowing progress billings.

SunCon’s outstanding order book of RM5.8 billion as at June had been higher (+35% y-o-y) vis-à-vis RM4.3 billion as at June 2017. In terms of booking new jobs, it has not disappointed, raking in RM854 million worth of new orders so far in 2018 — second only to IJM Corp Bhd’s RM1.1 billion among Bursa Malaysia-listed companies. To be conservative, the firm has reduced its new contract replenishment target to RM1.5 billion (from between RM1.5 billion and RM2 billion), which we have matched in our forecast (reduced from RM2.2 billion). We lower our TP to RM2.30, based on an unchanged ex-cash FY18 forecast price-earnings ratio of 16 times. — RHB Research Institute, Aug 17

This article first appeared in The Edge Financial Daily, on Aug 20, 2018.

For more stories, download EdgeProp.my pullout here for free.