UEM Sunrise Bhd (Aug 1, 92.5 sen)

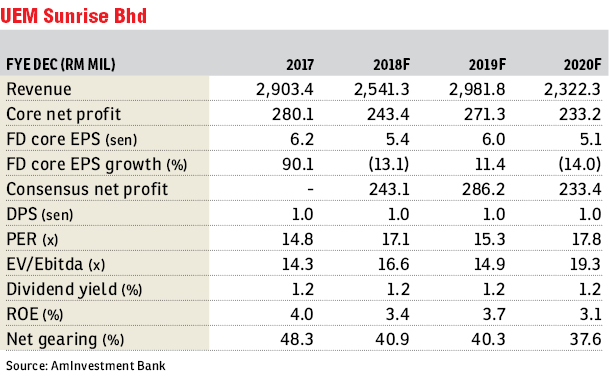

Maintain hold with a fair value of RM1.00: We cut our earnings estimate for UEM Sunrise Bhd’s financial year 2018 (FY18) by 1.1% while increasing that of FY19 by 7.7% after imputing new information and assumptions into our model. We expect UEM Sunrise to register net earnings of RM243.4 million, RM271.3 million and RM233.2 million for FY18, FY19 and FY20 respectively.

UEM Sunrise has numerous ongoing key projects, namely Serene Heights @ Bangi (landed residential, gross development value [GDV] RM3.1 billion), Solaris Parq @ Dutamas, Kuala Lumpur (high-rise residential, GDV RM2.9 billion), Estuari, Puteri Harbour (mixed development, GDV RM6.5 billion), East Ledang @ Iskandar Puteri (landed residential, GDV RM4.1 billion) and Almas, Puteri Harbour @ Iskandar Puteri (mixed development, GDV RM1.9 billion).

In April, UEM Sunrise acquired 72.7 acres (29.42ha) of land in Kepong from the Kuala Lumpur City Hall at RM416.4 million via a 50:50 joint venture (JV) with Mega Legacy Equity Sdn Bhd. The land is adjacent to the Kepong Metropolitan Park. The JV plans to develop a mixed residential and commercial development with an estimated GDV of RM15 billion over a 15-year period.

In first half of FY18, UEM Sunrise lined up RM356.8 million of new launches (high-rise and landed residential), with key selling points being affordability, of Kondominium Kiara Kasih units in Segambut at RM300,000 — GDV RM218 million and “nature themed” units in Serimbum, Iskandar Puteri at between RM630,000 and RM1.4 million — GDV RM139 million.

Meanwhile, the unbilled sales of RM4.8 billion together with a slew of new launches in FY18-FY19 will boost its revenue in the near term.

UEM Sunrise has a total land bank of 12,926 acres, with a remaining GDV of RM109.1 billion whereby RM78.1 billion of it is new projects while the balance RM31 billion is yet-to-be-launched ongoing projects. These are mainly located in the southern and central regions, providing earnings visibility and driving the company’s growth well into the next decade.

Nonetheless, we remain cautious about the property sector due to the generally still elevated home prices; the low loan-to-value offered by banks; and house buyers’ inability to qualify for a home mortgage due to their already-high debt service ratio. In addition, the still-subdued consumer sentiment against a backdrop of rising cost of living and elevated household debts are holding consumers back from committing themselves to purchasing big-ticket items like a house. However, we do see a bright spot in the affordable segment. — Am Investment Bank, Aug 1

This article first appeared in The Edge Financial Daily, on Aug 2, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

8th & Stellar

Bandar Baru Sri Petaling, Kuala Lumpur

8th & Stellar

Bandar Baru Sri Petaling, Kuala Lumpur

8th & Stellar

Bandar Baru Sri Petaling, Kuala Lumpur

Millerz Square

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Millerz Square

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Millerz Square

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Millerz Square

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Millerz Square

Jalan Klang Lama (Old Klang Road), Kuala Lumpur