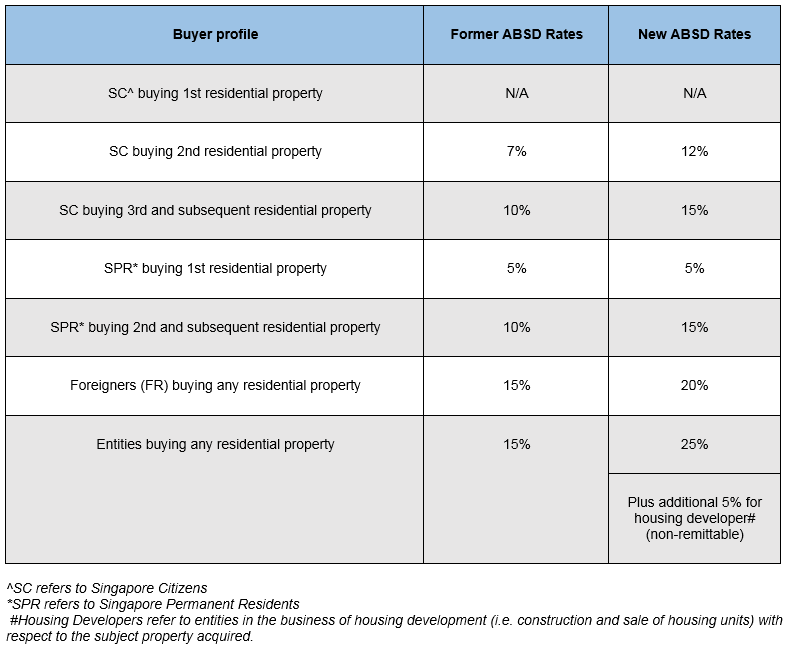

The government has acted to cool the red hot residential property market. Additional Buyer’s Stamp Duty (ABSD) rates have been raised for some categories of residential property purchases, and the Loan-to-Value (LTV) limits on residential property purchases have been lowered, all with effect from 6 July 2018.

Higher ABSD rates

Below is a table showing the latest ABSD rates in comparison with the previous rates:

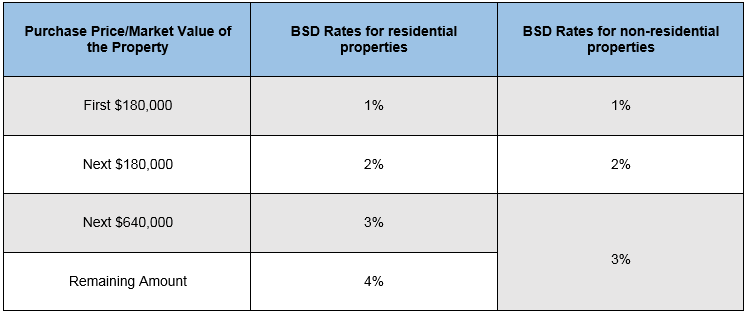

ABSD is an additional stamp duty on top of the prevailing Buyer’s Stamp Duty for residential properties. Below are the prevailing rates of Buyer’s Stamp Duty from 20 February 2018:

Source: IRAS

With the revised rates, here’s how much more homebuyers would be paying before and after the new cooling measures.

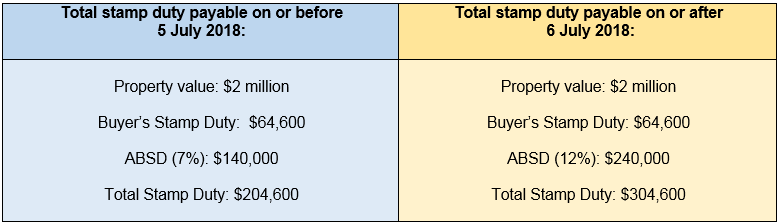

1) Singapore Citizens (SCs) buying a second residential property

If you’ve been eyeing a three-bedroom unit at Park Place Residences at PLQ, which is priced roughly at $2 million, here’s how much you would be paying before and after the new ABSD rates:

This translates to an increase of $100,000 in stamp duties payable if you were to purchase a unit priced at $2 million.

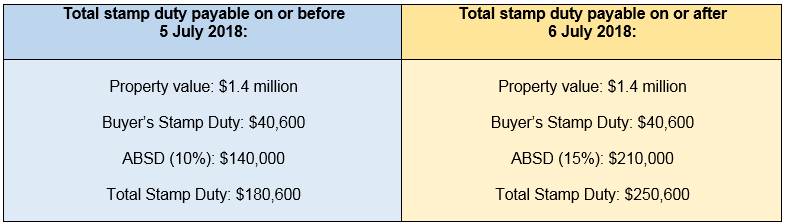

2) Singapore Permanent Residents (PRs) buying a second residential property

Looking to buy a property in the suburbs? A three-bedroom unit at The Garden Residences at Serangoon North View costs roughly $1.4 million. If you’re a Singapore PR seeking to purchase a second property, here’s how much more you would be paying before and after the new ABSD rates:

This translates to an increase of $70,000 in stamp duties payable for a $1.4 million property.

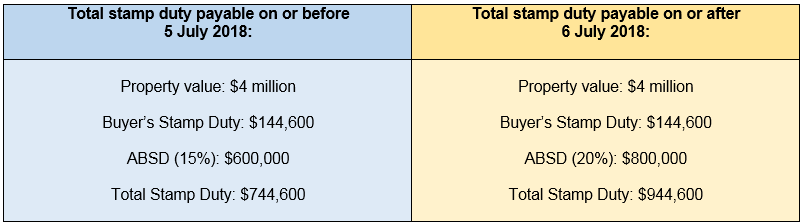

3) Foreigners buying any residential properties

Foreign property investors are known to favour locations in the prime districts or close to the Central Business District (CBD). A two-bedroom unit at the newly-launched New Futura comes with a price-tag of roughly $4 million. Here’s how much a foreign investor would have to pay before and after the new ABSD rates:

This translates to an increase of $200,000 in stamp duties payable if a foreign investors were to purchase a $4 million property.

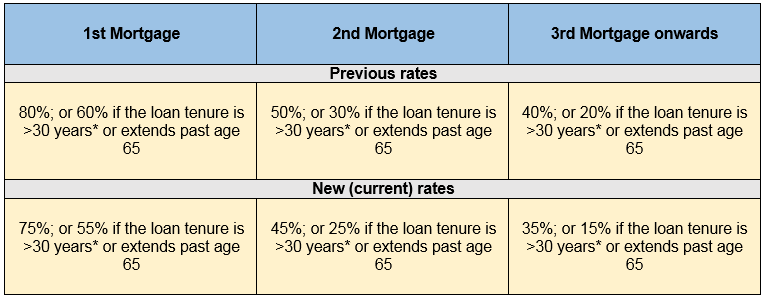

Lower Loan-to-Value (LTV) limit

Aside from higher ABSD rates, all housing loans granted by financial institutions (such as banks) will have a 5% lower LTV limit. What this basically means is, you lending margin has now been reduced by 5%. HDB loans are not affected by this revision.

The new LTV adjustments are presented in the table below:

So what happens now?

Sales volume are expected to slow with the new cooling measures in place, although home prices could still inch towards 10% for the year 2018, says JLL’s head of research & consultancy, Tay Huey Ying.

The en bloc market will also be dampened as developers become wary of end-demand, which will have an impact on their offer prices.

Meanwhile, strata-office and shophouse markets could emerge the biggest gainers from the higher ABSD rates, as investors looking for alternatives to park their money could divert their attention to the strata office and shophouse markets as they are not subjected to this round of purchase or sales restrictions/encumbrances.

Finally, the residential leasing market might also stand to benefit as some foreign owners of collective sale sites who might now look to rent instead of own their place of residence to avoid the higher ABSDs, JLL’s Tay concludes.

TOP PICKS BY EDGEPROP

Sri Samudera Seaview Residence Suites

Johor Bahru, Johor

Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

Seri Austin Luxury Apartment

Johor Bahru, Johor