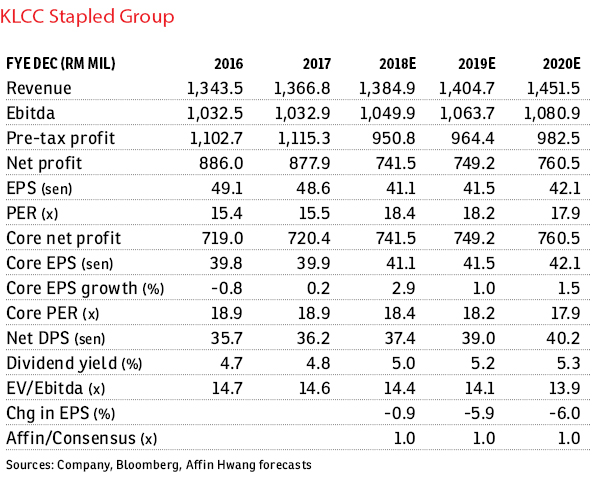

KLCC Stapled Group (June 26, RM7.50)

Maintain hold with a lower target price (TP) of RM7.55: KLCC Stapled Group’s parent company, KLCC (Holdings) Sdn Bhd (KLCCH), is developing three new integrated commercial projects around the KLCC Park, partnering with local and foreign companies. These projects (office tower, hotel, retail podium) are located next to KLCC Stapled Group’s existing assets, and are under various development stages with target completion in 2020 to 2022.

KLCC Stapled Group has first right of refusal for any project developed by KLCCH. The new developments are, in our view, likely candidates for asset injection. While there are various considerations/hurdles to overcome such as pricing, ownership structure, tenancy portfolio, a successful asset injection if materialised should lift KLCC Stapled Group’s earnings and fair value. We estimate that injection of RM1 billion of assets should lift KLCC Stapled Group’s fair value by 11 sen-25 sen, assuming 6%-7% asset yield, 4.8% finance cost, and 2.5% long-term growth.

We lower our 2018-2020 earnings per share (EPS) forecasts by 1%-6% after revising our forecafor its triple net leases using the straight-line method, as per KLCC Stapled Group’s accounting practice. We make minimal changes to our dividend per share forecasts, which we base on cash flow projections rather than reported EPS. Despite the EPS forecast cuts, KLCC Stapled Group’s earnings outlook remains stable.

We revise our sum-of-the-parts-derived TP to RM7.55 (from RM7.78) after incorporating our new earnings forecasts, higher long-term-growth rate of 2.5% (from 2%) and higher cost of equity of 7.9% (from 7.6%) to account for the earnings growth potential from asset injections and higher associated risks. — Affin Hwang Capital Research, June 26

This article first appeared in The Edge Financial Daily, on June 27, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Seksyen 5, Petaling Jaya

Petaling Jaya, Selangor

Seksyen 5, Petaling Jaya

Petaling Jaya, Selangor

Seksyen 12, Petaling Jaya

Petaling Jaya, Selangor

Seksyen 5, Petaling Jaya

Petaling Jaya, Selangor

Core Residence @ TRX

Bandar Tun Razak, Kuala Lumpur

Core Residence @ TRX

Bandar Tun Razak, Kuala Lumpur

Core Residence @ TRX

Bandar Tun Razak, Kuala Lumpur