MRCB-Quill Real Estatement Investment Trust (May 18, RM1.10)

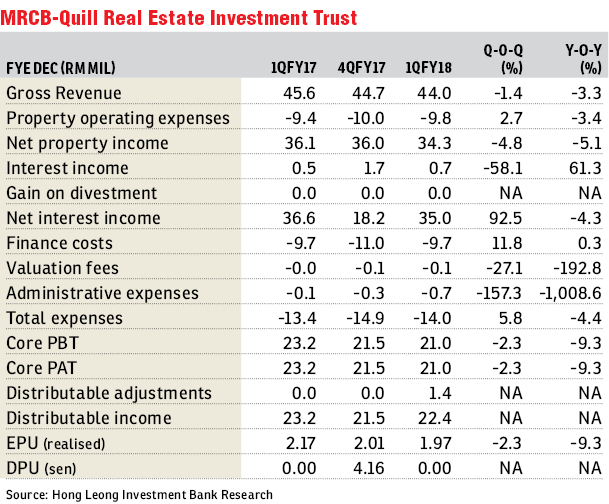

Maintain buy with a lower target price (TP) of RM1.40: MRCB-Quill Real Estatement Investment Trust’s (MQREIT) first quarter of financial year 2018 (1QFY18) core net profit RM21 million (-2.3% quarter-on-quarter [q-o-q]; -9.3% year-on-year [y-o-y]) was broadly in line with our and consensus expectations. The reduction was driven by a decline in revenue, higher operating expenses and administrative expenses but slightly mitigated by lower finance costs. We lower our FY18 to FY20 earnings forecasts by 2% following a decrease in FY18 to FY20 distribution per unit by 5% as we take into account the completion of the disposal of QB8-DHL (XPJ). Our lower TP of RM1.40 (from RM1.44) is based on an unchanged target yield of 6.4%.

Its 1QFY18 gross revenue of RM44 million (-1.4% q-o-q; -3.3% y-o-y) translated into core net profit of RM21 million (-2.3% q-o-q; -9.3% y-o-y). The results were broadly in line with our and consensus expectations, accounting for 22.8% and 23.2% of full-year forecasts respectively.

We deem it to be in line as we feel the administrative expenses would normalise in the coming quarters. There’s no dividend as it is usually paid semi-annually.

Total gross revenue declined by 1.4% to RM44 million (from RM44.7 million in 4QFY17), following a decrease in core net profit to RM21 million. The reduction was caused by a lower revenue contribution and higher administrative expenses pertaining to the disposal of QB8-DHL (XPJ). However, this was slightly offset by a decrease in finance costs for the quarter.

Core net profit declined by 9.3% to RM21 million. This was driven by lower revenue contribution, mainly from Platinum Sentral and Menara Shell, increase in routine property operating expenses, and higher administrative expenses related to the proposed disposal of QB8-DHL (XPJ). This was slightly cushioned by lower finance costs due to lower amortisation of transaction costs incurred.

The overall occupancy rate remained healthy at 96.2% (4QFY17: 96.3%). Average debt to maturity decreased slightly from 2.79 years to 2.55 years, while average cost of debt was maintained at 4.4%. The gearing level increased slightly to 38% (4QFY17: 37%), which was still comfortably below the 50% limit.

Despite the lacklustre overall office market, MQREIT’s office space will remain relatively stable and well-guarded. To date, management has successfully completed 81% of renewals due in 1QFY18. We continue to like MQREIT given its attractive dividend yield of 8.2% (highest among REITs in our universe), stable assets in Kuala Lumpur Sentral with high occupancy rates and a healthy weighted average lease expiry profile.

Although the results were broadly in line, we take this opportunity to adjust our FY18 to FY20 earnings forecasts marginally lower by 2% to account for the completion of the disposal of the QB8-DHL (XPJ) building. As a result, our FY18 to FY20 dividend per share forecast is also reduced by 5%. — Hong Leong Investment Bank Research, May 18

This article first appeared in The Edge Financial Daily, on May 21, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

The Hills, Horizon Hills

Iskandar Puteri (Nusajaya), Johor

JP Perdana (Jaya Putra Perdana)

Johor Bahru, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Lagoon View Resort Condominium

Bandar Sunway, Selangor

Lagoon View Resort Condominium

Bandar Sunway, Selangor