Pavilion Real Estate Investment Trust (April 27, RM1.44)

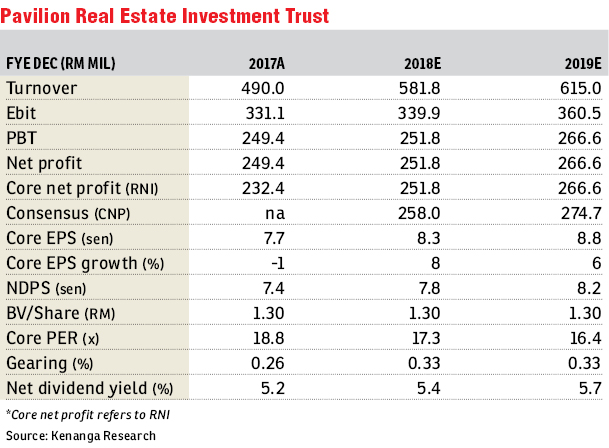

Maintain outperform with a target price (TP) of RM1.55: Pavilion Real Estate Investment Trust’s (REIT) first quarter of financial year 2018 (1QFY18) realised net income (RNI) of RM65.3 million came in well within our and consensus expectations (26% and 25% respectively). No dividends were declared as expected. We maintain our FY18 estimate (FY18E) and FY19E core net profit of RM252 million and RM267 million. FY18 and FY19 will see net lettable area (NLA) expiries of 24% and 52% on modest single-digit reversions, while FY18 growth is also driven by the Elite Pavilion acquisition. We maintain “outperform” and our TP of RM1.55 on a +1.6 percentage-point (ppts) spread and the 10-year Malaysian Government Securities (MGS) target of 4%.

Gross rental income (GRI) was up by a solid 11% due to higher rental income from Pavilion Kuala Lumpur. This resulted in RNI increasing by 15% on slight RNI margin improvements. Quarter-on-quarter, the top line was up by 2% mainly from higher rental income from Pavilion Kuala Lumpur. However, increased operating cost (+5%) due to similar reasons mentioned above and a slightly higher financing cost (+3%) caused RNI to be flat.

FY18 and FY19 will see 24% and 52% of portfolio NLA expiring on single-digit reversions. Although lease expiries in FY19 appear lumpy, we are not overly concerned as the bulk is from Pavilion Kuala Lumpur, which should have no issue maintaining full occupancy on decent reversions. The proposed acquisition of Elite Pavilion is expected to be completed in FY18 and will be funded by borrowings, and we are mildly positive on the acquisition. The Fahrenheit88 acquisition is still on the table, pending the sponsor’s intention to sell, while we believe Pavilion REIT is eyeing cap rates closer to 6.5%. We reckon that Pavilion REIT may acquire third-party assets from WCT Holdings Bhd. FY18 growth will be driven by the acquisition of Elite Pavilion and single-digit rental reversions from lease expiries, while FY19 will be driven by organic growth. Our FY18E and FY19E gross dividends per unit (GDPS) of 8.6 sen and 9.1 sen (net dividends per unit [NDPS] of 7.8 sen and 8.2 sen) suggest gross yields of 6% and 6.3% (net yields of 5.4% and 5.7%). Based on FY18E GDPS/NDPS of 8.6 sen/7.8 sen and an unchanged spread of +1.6ppts to our 10-year MGS target of 4%, our applied spread is +0.5 standard deviation above historical averages to encapsulate investors’ concerns about oversupply issues and overnight policy rate hikes, but we may look to remove this once confidence returns to Malaysian REITs’ (MREITs) valuations.

Our applied spread is on the thinner end among MREITs under our coverage (of +1.4ppts to +2.4ppts) which we believe is warranted given Pavilion REIT’s strong rerating potential from possible asset injections, aided by its healthy balance sheet and low gearing of 0.27 times. Pavilion REIT warrants an “outperform” call on inorganic growth potential and a decent gross yield of 6% versus retail peers’ average of 6.1%. Risks to our call include bond yield expansion versus our target 10-year MGS yield, and weakening rental income. — Kenanga Research, April 27

This article first appeared in The Edge Financial Daily, on April 30, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor

Kawasan Perindustrian Mount Austin

Johor Bahru, Johor

Palazio ( Pangsapuri Mayland Austin )

Johor Bahru, Johor

Smart Industrial Park @ SILC

Gelang Patah, Johor