KUALA LUMPUR (March 15): JAKS Resources Bhd has proposed a placement to raise RM68.88 million to fund its ongoing projects.

In a filing with Bursa Malaysia, JAKS said the proposed placement would involve an issuance of up to 50.67 new shares, to third-party investors to be identified and at an issue price to be determined later.

Of the RM68.88 million proceeds, RM45 million would be used to finance construction costs for the group’s ongoing projects, and RM20 million for working capital of its 51%-owned Evolve Concept Mall in Petaling Jaya. The rest would be utilised for working capital and estimated expenses relating to the proposed placement.

JAKS said the proposed exercise would enable it to raise additional funds expeditiously and cost-effectively compared with other fundraising exercises, involving a pro-rated issuance of securities such as a rights issue.

Based on an illustrative issue price of RM1.39 per share, representing a discount of not more than 10% to the five-day volume-weighted average market price, and assuming a minimum of 49.56 million placement shares issued, the proposed placement is expected to raise RM68.88 million.

The proposed exercise is expected to be completed by the third quarter.

This article first appeared in The Edge Financial Daily, on March 15, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Pearl Villa Townhouse

Bandar Saujana Putra, Selangor

Happy Garden (Taman Gembira)

Kuchai Lama, Kuala Lumpur

Bukit Jalil, 2.5 Storey house (end lot), Taman Jalil Sutera, Kuala Lumpur

Bukit Jalil, Kuala Lumpur

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

PJ Transit Oriented Office Building For Sale - Ideal For Corporate Office Headquarters

Petaling Jaya, Selangor

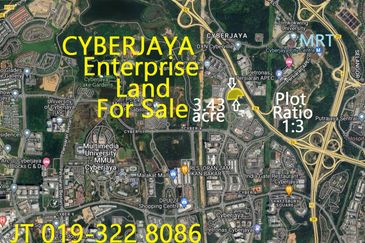

Cyberjaya Enterprise Land 3.43 Acre For Sale - Ideal For Commercial Mixed Property Development

Cyberjaya, Selangor