KUALA LUMPUR (Feb 28): IJM Corp Bhd saw its net profit drop 26.7% to RM101.36 million in the third financial quarter ended Dec 31, 2017 (3QFY18) from RM138.36 million a year ago, mainly due to lower contributions from the property and manufacturing and quarrying divisions.

This was further compounded by a net foreign exchange (forex) loss of RM4.5 million compared to a net forex gain of RM3.9 million in 3QFY17.

This resulted in a lower earnings per share of 2.79 sen in 3QFY18 compared with 3.84 sen in 3QFY17.

Quarterly revenue also slipped 1.9% to RM1.57 billion in 3QFY18 from RM1.6 billion in 3QFY17 on lower contribution from its construction and manufacturing and quarrying divisions.

The weak quarterly results dragged down IJM Corp’s net profit for the cumulative nine months (9MFY18) by 18.9% to RM338.62 million from RM417.77 million a year ago. Revenue, however, rose 5.3% to RM4.63 billion in 9MFY18 from RM4.4 billion in 9MFY17.

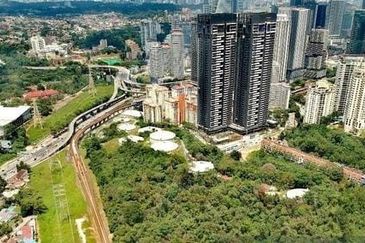

On prospects, IJM Corp chief executive officer and managing director Datuk Soam Heng Choon said it has secured RM2.7 billion worth of order book wins for 9MFY18, which included projects at the Tun Razak Exchange here.

“In India, we recently announced the award of the RM1.5 billion Solapur-Bijapur tollway concession. These new contracts, underpinned by local infrastructure projects, as well as a steady pipeline of large public infrastructure projects spurred by government initiatives, have helped expand our outstanding order book to a near-record high of RM9.3 billion,” he added.

Soam also said the group is on track to achieve its sales target of RM1.6 billion for FY18 on the back of the positive response to its townships in Bandar Rimbayu and Seremban 2, as well as recent launches.

This article first appeared in The Edge Financial Daily, on Feb 28, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Graham Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor

Laman Delfina @ Nilai Impian

Nilai, Negeri Sembilan

TAMAN SRI LEKIR (P/L 1534,1535,1540,1541)

Kinta, Perak

Taman Residensi Mesra @ Gurun East

Gurun, Kedah

Avenham Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor