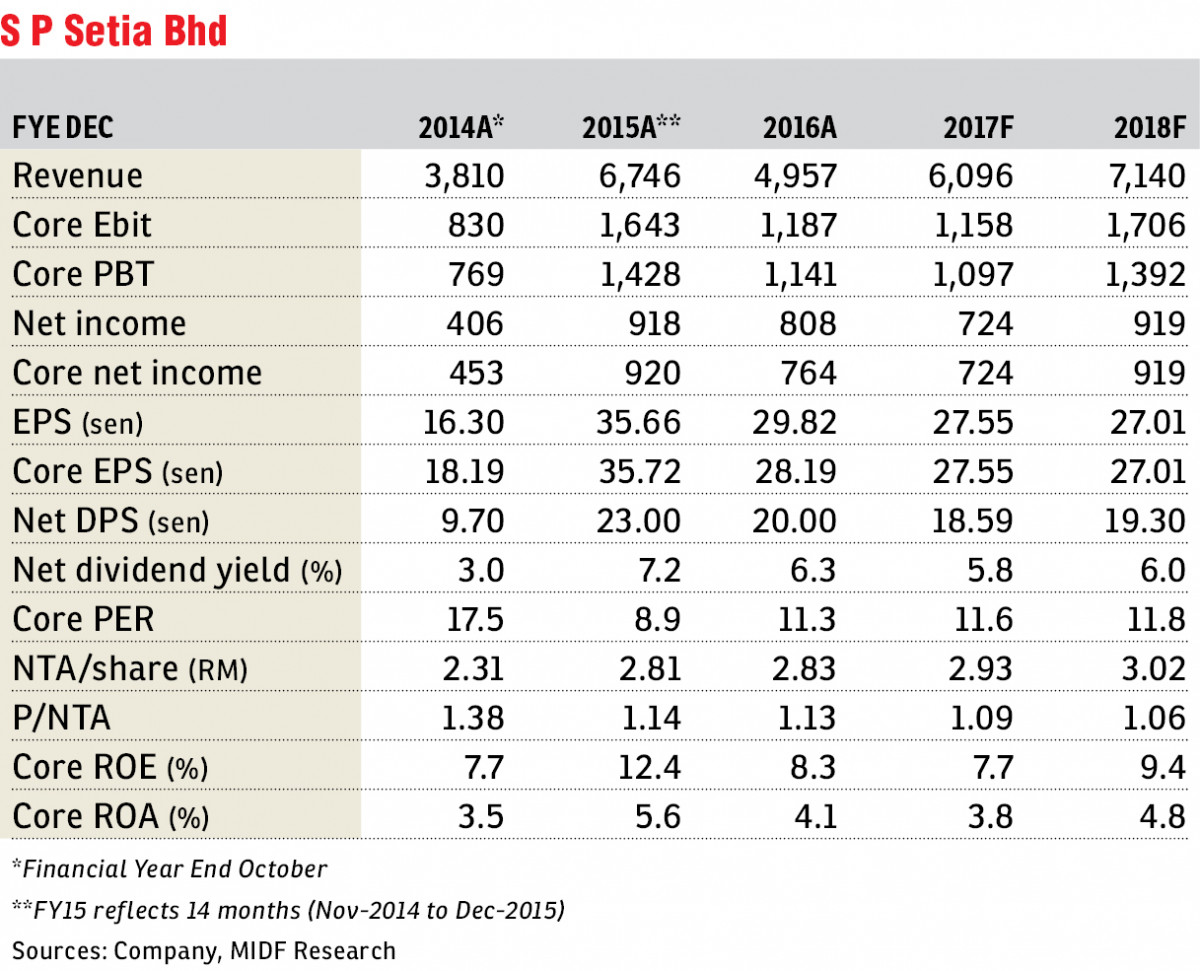

S P Setia Bhd (Jan 19, RM3.24)

Maintain buy at an unchanged TP of RM 4.13: S P Setia Bhd has announced that it had entered into a heads of terms with Permodalan Nasional Bhd (PNB) and Employees Provident Fund (EPF) to explore the terms of a potential sale, on completion, of the commercial assets of Phase 2 of the Battersea Power Station to a joint-venture company to be formed between PNB and EPF. The indicative sale price is estimated to be about £1.61 billion (RM8.8 billion). We gather that the commercial assets of Phase 2 of the Battersea Power Station are office and retail buildings, with completion expected to be in 2020.

We view the potential sale of commercial assets of Phase 2 of the Battersea Power Station to be neutral to positive. The potential sale of the commercial assets will enable S P Setia to unlock the value of the commercial assets while allowing S P Setia to focus on its role as property developer. With the potential sale of the commercial assets of Phase 2 of the Battersea Power Station, S P Setia will now focus on securing the development profit from the remaining development in Phase 3 to Phase 7 of the Battersea Power Station project.

We do not expect earnings impact from the potential sale of commercial assets of S P Setia in the near term as completion of the commercial buildings is expected to take place in 2020. Hence, we maintain our earnings forecasts for FY17/FY18.

We maintain our target price (TP) at RM4.13, based on 10% discount to revalued net asset valuation. We maintain our “buy” call on S P Setia for its plan to be included as one of the FBM KLCI component stocks. Besides, dividend yield of S P Setia is attractive at 5.8%. — MIDF Research, Jan 19

This article first appeared in The Edge Financial Daily, on Jan 22, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

KL Gateway Premium Residence

Bangsar South, Kuala Lumpur

Impian Bukit Tunku

Kenny Hills (Bukit Tunku), Kuala Lumpur

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor