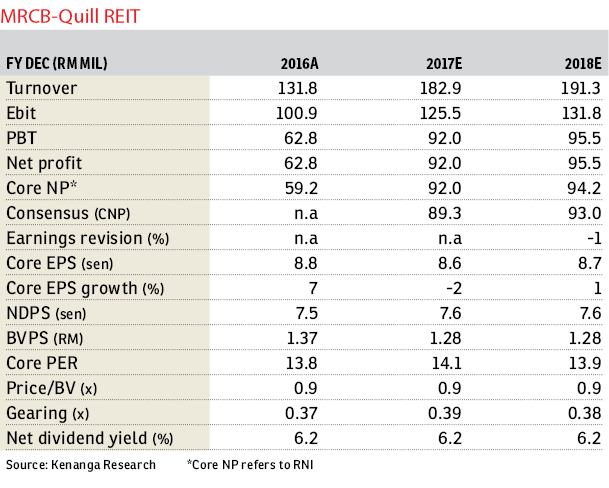

MRCB-Quill REIT (Jan 9, RM1.20)

Maintain outperform with an unchanged target price of RM1.38: MRCB-Quill REIT (MQREIT) has entered into a sale and purchase agreement to dispose of its industrial asset, Quill Building 8 (QB8) — DHL XPJ to Transmark Corp Sdn Bhd for a cash consideration of RM28 million, which is at a slight premium to its book value of RM25 million, while the group expects a net gain on disposal of RM1.28 million. QB8 is a single-storey detached warehouse with a three-storey office building located in Shah Alam. The disposal is expected to be completed by the second quarter of financial year 2018 (2QFY18).

We were surprised as we did not expect any disposals in the near term due to MQREIT’s stable portfolio. We believe the rationale is to unlock value to fund ongoing asset enhancement initiatives (AEIs) and lighten our balance sheet to possibly make way for future acquisitions. All in, we are “neutral” on impact from the disposal as the effect on earnings in FY18 is negligible. The net gain on disposal of RM1.28 million offset the loss in income from QB8 in FY18, as QB8 only makes up less than 2% of realised net income on an annualised basis.

FY17 to FY18 leases up for expiry are minimal at 14% to 26% of net lettable assets, which are preferable under current times, where the office market is facing an oversupply situation, given the risk of tenant attrition. As such, we are expecting low single-digit reversions. Additionally, we expect capital expenditure in FY17 to FY18 of RM10 million to RM12 million for maintenance. — Kenanga Research, Jan 9

This article first appeared in The Edge Financial Daily, on Jan 10, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

Suria Residence by Sunsuria

Bukit Jelutong, Selangor

Suria Residence by Sunsuria

Bukit Jelutong, Selangor