IJM Corp Bhd (Nov 22, RM3.05)

Maintain hold with an unchanged target price (TP) of RM3.50: IJM Corp Bhd has entered into a share sale and purchase agreement with KLIFD Sdn Bhd to acquire 100% equity interest in Fairview Valley Sdn Bhd (FVSB) for RM1 million. KLIFD is a wholly-owned subsidiary of TRX City Sdn Bhd, which in turn is wholly owned by the finance ministry.

FVSB is the land owner-cum-developer of a 27-storey office building within the the Tun Razak Exchange (TRX) measuring 1.175 acres (0.47ha). The building is currently being constructed by IJM and works are expected to be completed by December 2018.

The total investment cost or gross development cost is about RM500 million, including the building’s land cost which will be paid over a two-year period. IJM’s incremental capital outlay will be less, given it has been funding the total construction cost of RM302 million on its own as we understand this agreement was already mooted at the beginning. The balance of RM200 million is likely to encompass land cost, interest cost capitalised and other professional fees.

The building comes with 84% secured tenants where the anchor tenant is Prudential Assurance Malaysia, which has agreed to lease for a term of 15 years. Assuming rental rates of RM10 per square foot (psf) and capital value of RM1,400 psf, indicative gross yield could be close to 9%.

While we acknowledge there is an oversupply of office space, we believe this acquisition: i) is an opportunity to gain a foothold in a Grade A office building with a secured tenancy from a good paymaster. In the past, IJM Land did not have the balance sheet to execute such an acquisition; ii) will also complement its recurring income from toll concessions. An indicative gross yield of 9% is relatively attractive considering that pre-tax margins for its property business have also fallen to the low-teens range; and iii) solidifies its reputation as a building contractor in TRX where it is also building HSBC’s headquarters there (contract value of RM392 million).

We believe IJM also realises there is intense competition for construction jobs in Malaysia, with the large-scale projects going to foreign contractors, and thinks this acquisition may turn out to be more positive in the longer term.

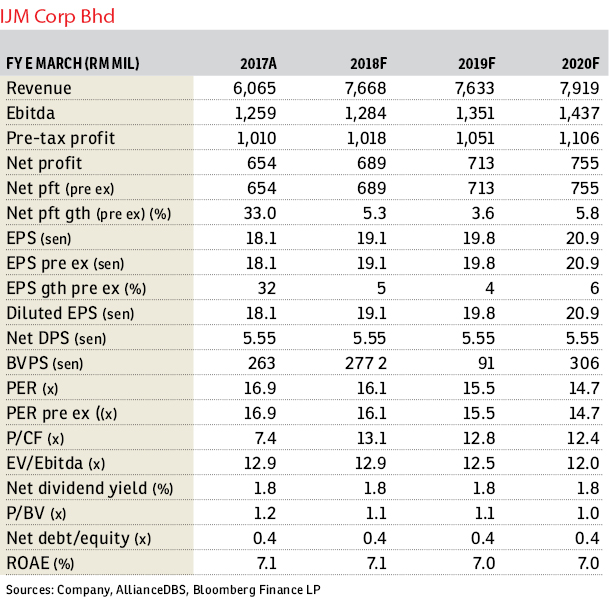

Given the completion of the building in December 2018, there will be some earnings contribution in forecasted financial year 2019 (FY19F) or FY20F. We leave our earnings forecast and TP unchanged for now. Our “hold” rating is maintained. — AllianceDBS Research, Nov 22

This article first appeared in The Edge Financial Daily, on Nov 23, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Dalia Residences @ Tropicana Aman

Telok Panglima Garang, Selangor

Seksyen 5 Wangsa Maju

Wangsa Maju, Kuala Lumpur