Although some prefer to be optimistic and believe we are already seeing a glimmer of recovery for the current slowdown in the property market, what does the latest market data tell us?

The latest property market data for the first half of 2017 (1H17) released by the Valuation and Property Services Department (JPPH) of the Finance Ministry during the 2017 Preliminary Property Market Brief on Nov 13 revealed that overall, the property market has softened in 1H17, with more than 153,000 transactions recorded worth RM67.82 billion, a decline of 6% in volume compared with a decline of 12.3% in 1H16.

The dip in transactions was felt in all property sectors ranging between 0.9% and 12.7%.

However, transaction value has risen by 5% in 1H17 from a year ago compared to the 12% drop recorded in 1H16.

The increase in transaction value was seen across all property sectors, with growth ranging from 0.5% to 30% except for industrial properties, which saw a dip of 4.2%.

“The rate of contraction (in transaction volume) has reduced, indicating that the property market is adjusting to the changing market landscape,” said director of the National Property Information Centre (Napic) Khuzaimah Abdullah.

New residential property launches have also declined by 9.1% to about 28,000 units in 1H17 compared with about 31,000 units in 1H16.

Housing price moderates

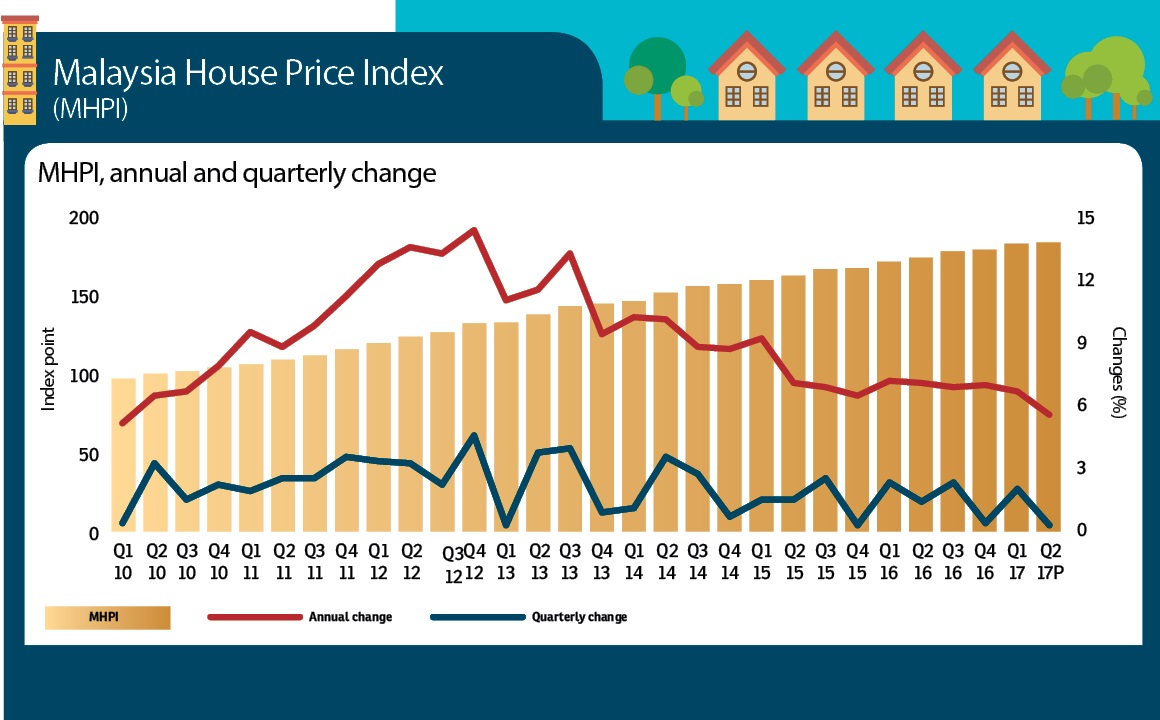

The Malaysian House Price Index (MHPI) showed that housing prices have moderated further by 5.6% in 2Q17 compared with 7.1% a year ago.

As at 2Q17, the MHPI was at 184.1 points, rising a mere 0.4% from 183.3 points from the previous quarter.

Overall, housing prices have been on a rising trend since 2010, but the growth has moderated from the double digit growths seen then. The annual change in the MHPI was in the double digits from 4Q11 to 2Q14.

Between 2010 to 2Q17, the highest y-o-y growth recorded was in 4Q12 at 14.3%.

“Previously, if you bought a property at RM100,000, two years down the road you might have been able to sell it for RM120,000. Today, if you buy a RM100,000 property, you can only sell it for RM110,000,” said Khuzaimah.

Will there be a possibility of a property bubble happening in Malaysia? Khuzaimah explained that a property bubble happens when there is an exorbitant increase in property prices to a point which is not sustainable.

“This means that the price keeps going up all the way and drops. And when it drops, it does not increase after that. What we have is overheating of prices, not a bubble. There are countries that have gone through a bubble burst situation and cannot rise up from there such as Japan. Thankfully, our property prices have moderated,” said Khuzaimah.

She also noted that the recent Budget 2018 did not have many “boost” factors for the housing sector while Bank Negara Malaysia is still adopting its responsible lending guidelines and the overnight policy rate has remained at 3%.

Overhang and price-location mismatch

The residential market represented 61.8% of transaction volume at almost 95,000 transactions worth RM33 billion — a 7% dip in volume with a mere 0.5% increase in value y-o-y.

Notably, the slow market absorption has led to an increase in residential overhang of 20,876 units worth RM12.26 billion, a 40% growth in overhang volume against 1H16.

Overhang is defined as completed units which have remained unsold nine months after being launched.

The bulk of the overhang units comprised condominiums and apartments priced between RM500,000 and RM1,000,000.

Kedah has the highest number of overhang residential properties at 4,363 units with most of them (3,401 units) located in the Kuala Muda District alone. Most of the units were priced from RM300,000 to RM400,000.

“There were a lot of completed units in Kedah this year. Once they have received the Certification of Completion and Compliance, the data will be automatically updated to JPPH. This reflects the mismatch in terms of price and location,” said Khuzaimah.

Timely data needed

Deputy Minister of Finance II Datuk Lee Chee Leong who officiated the market brief presentation event voiced his concerns on the residential overhang status and strongly urged the local authorities to study the data released by JPPH before considering approvals for new property developments.

“The same advice is also addressed to property developers. Timely and accurate data are very important. I strongly urge all data providers to continue supplying data as required by the Act. At the same time, JPPH should strengthen its role as the main property data source in the country,” said Lee.

On whether data collated by JPPH can be disseminated more rapidly to all stakeholders so that informed decisions can be made, JPPH (Operation) deputy director-general Dr Zailan Mohd Isa said the data collated by JPPH and Napic are derived from various sources including property developers, property agents, the government, hoteliers and property managers, and hence the question should be whether these data providers are submitting the data required on time for the full market report to be produced.

“We really have to educate our data providers. We have the property information unit at all our branch offices which provide training so that the data providers know how to submit the data required online,” Zailan explained.

Meanwhile, JPPH director-general Nordin Daharom added that property data differ from other data such as share transactions on the stock market because property transactions require some time to be completed.

“There is a lot involved in the process and it takes about one or two months before the data arrive at JPPH. It takes time to educate the public,” said Nordin.

While no one can predict when the property market will start booming again, it sure looks like it may not be anytime soon.

Commercial space occupancy stable

The first half of 2017 has so far recorded over 10,000 commercial property transactions in the country worth RM12 billion which is a dip of 11% in transaction volume. However, values went up 5.9% y-o-y.

According to the 1H17 Property Market Report, the increase in commercial property transaction value is due to a number of large transactions involving shopping complexes, purpose-built office buildings and hotels.

The office sector is seeing an occupancy rate of 83.5% as at 1H17, although unoccupied space in purpose-built office buildings stood at 3.4 million sq m.

Kuala Lumpur recorded the highest rate of unoccupied office space at more than 1.62 million sq m, followed by 0.87 million sq m in Selangor. Purpose-built offices saw a slight increase in occupancy of 0.48% from 83.1% in 1H16 to 83.5% in 1H17.

In the retail space segment, occupancy dipped slightly by 0.73% to 81.5% in 1H17 from 82.2% in 1H16. Both Kuala Lumpur and Selangor saw a dip of 2.3% (1H17: 84.9%, 1H16: 86.9%) and 1.3% (1H17: 85.4%, 1H16: 86.5%) respectively.

Meanwhile, the industrial sub-sector recorded 2,421 transactions worth RM5.39 billion, down by 12.8% in volume and 4.2% in value. Selangor continued to dominate the market, with 29.9% of the nation’s volume, followed by Johor and Perak, each with 15.2% and 9.6% market share respectively.

The industrial overhang increased 872 units worth RM1.2 billion, up by 3.6% and 7.9% in volume and value respectively. However, despite the increase, the report noted that the overhang situation remained manageable.

This story first appeared in EdgeProp.my pullout on Nov 17, 2017. Download EdgeProp.my pullout here for free.