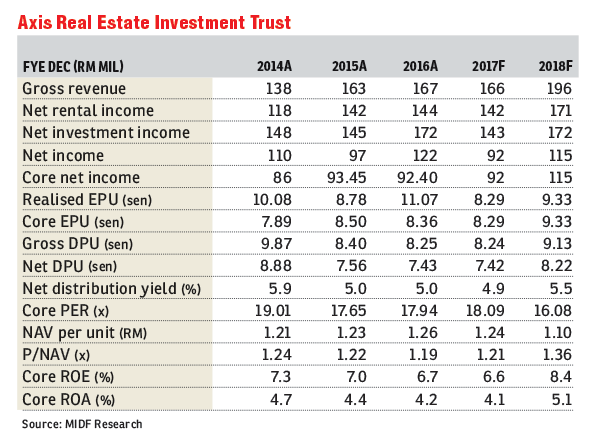

Axis Real Estate Investment Trust (Nov 13, RM1.50)

Maintain buy with a lower target price (TP) of RM1.66: Axis Real Estate Investment Trust (Axis REIT) has announced that it will be fixing the approved private placement of 125 million new units at RM1.43 per unit. This will sum up to RM178.8 million, which will come in handy for the company’s future expansion plans.

The issue price represents a 5.2% discount to the five-day volume weighted average market price of RM1.51. The number of new units represents 10% of the newly enlarged number of 1,230 million units. The new units make up 11.3% of existing 1.105 billion issued units.

With the new fund, Axis REIT’s gearing could be reduced to 29.4% from 37.3% currently if all the proceeds are used to pare down debts. However, we expect that a huge part of the proceeds would be used as capital for its mid- and near-term plans, such as the development of the aerospace manufacturing facility for Upeca Aerotech Sdn Bhd, which is estimated to cost RM73.2 million. It will also allow for Axis REIT to purchase more yield-accretive assets going forward.

We expect its core earnings per unit (EPU) to decline by 3.4% to 9.33 sen from 9.66 sen previously. Although we see Axis REIT’s financial year 2018 core earnings increase by 7.5% to RM114.7 million from RM106.7 million, mainly due to interest savings, it will be offset by an increase in share base of 11.3%.

We maintain our “buy” call, with a revised TP of RM1.66 (from RM1.73), as we take into consideration the lower EPU and distribution per unit forecasts going forward. Our valuation method is unchanged based on the dividend discount model (required rate of return: 7.3%; perpetual growth rate: 1.2%). Its dividend yield is estimated at 4.9%. — MIDF Research, Nov 13

This article first appeared in The Edge Financial Daily, on Nov 14, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

KL Gateway Premium Residence

Bangsar South, Kuala Lumpur

Impian Bukit Tunku

Kenny Hills (Bukit Tunku), Kuala Lumpur

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor