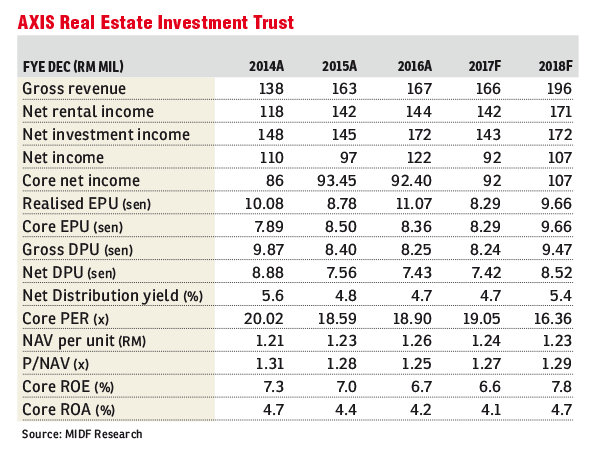

Axis REIT (Nov 02, RM1.58)

Upgrade buy call with an unchanged target price (TP) of RM1.73: Axis REIT has entered into an agreement to develop and lease a manufacturing facility-cum-office for Upeca Aerotech Sdn Bhd with a development cost of RM73.2 million.

The project is slated for completion by Dec 15, 2018. Upon completion, the plant will be leased to Upeca for RM5.6 million per annum in the first three years with rental step-up in later stages.

We are neutral on the greenfield project as Axis REIT agreement with Upeca for a long-term lease mitigates possible development risks.

We also take comfort that Upeca is already Axis REIT’s existing tenant. The single-storey plant will have a gross built-up area of about 179,000 sq ft.

The plant will be built on a 7.02-acre (2.84ha) parcel to be sub-leased from Malaysia Airport Holdings Bhd (MAHB) for RM19.9 million and for 30 years (with a renewal option of 19 years), which will be paid in full upon completion of the land lease agreement with MAHB.

The land is part of the 716-acre proposed Malaysia International Aerospace Centre Technology Park in Jalan Lapangan Terbang Subang.

The indicative rental rate of the asset is RM2.60 per sq ft (psf). Rental income from the asset is estimated at RM5.6 million per annum.

Upeca, a subsidiary of London-listed Senior plc, will be leasing the manufacturing plant-cum-office for 20 years. Upeca will bear the additional total project cost by paying an additional one sen psf for every RM300,000 exceeding the initial project budget of RM46.8 million.

We estimate that the new asset will contribute about RM2 million per year to Axis REIT’s net profit interest as we take into account the interest cost and annual rental income of the asset upon completion.

We expect financing cost of 990,000 to marginally impact our forecast financial year 2018 (FY18F) core net income by less than 1%.

We maintain our earnings forecast pending completion of the agreement. Meanwhile, we expect its net gearing to increase to 39.6% from 36.5% currently.

However, we note that Axis REIT is in the midst of a placement exercise, which is expected to reduce its gearing.

We upgrade to “buy” call with an unchanged TP of RM1.73, aligning the percentage upside to the change of our stock recommendation percentage threshold.

However, we make no changes to our assumptions as the earnings impact from this project will only start from FY19F. — MIDF Research, Nov 02

This article first appeared in The Edge Financial Daily, on Nov 3, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

KL Gateway Premium Residence

Bangsar South, Kuala Lumpur

Impian Bukit Tunku

Kenny Hills (Bukit Tunku), Kuala Lumpur

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor