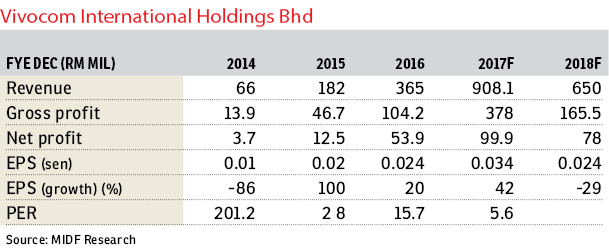

Vivocom International Holdings Bhd (Oct 16, 15 sen)

Maintain buy call with a target price (TP) of 39.5 sen: Vivocom International Holdings Bhd’s major shareholders Golden Oasis Sdn Bhd and Ang Li Hann have reportedly inked an indicative term sheet agreement to sell their stakes to CNQC International Holdings Ltd totalling 970.27 million shares amounting to 29.15% of its total shareholding.

We believe that CNQC will finance the purchase of the Vivocom shares via a share swap. The news comes as a pleasant surprise as CNQC is now roped in to support Vivocom’s growth in the construction segment.

CNQC was established in 1993 as a specialist substructure contractor in Hong Kong. The company is a part of the Qinjiang Group’s network in mainland China, established in 1952, and has strong project accomplishments such as the Qingdao Olympic Sailing Centre and Qingdao Liuting International Airport.

Currently, CNQC’s network is extensive, covering real estate development and construction across Singapore, Indonesia, Hong Kong, Macau, Indonesia and Vietnam.

The company’s project in Singapore covers almost 600,000 square metres of saleable floor area. Since last March, CNQC has delivered 32,000 residential units in Singapore. Among its notable completed projects in Singapore are The Minton in Hougang, HDB Punggol Spring in Punggol, Bellewoods in Woodlands and Ecopolitan in Punggol.

We view the news as a positive influence on Vivocom to expand its capacity and capabilities. CNQC is expected to complement Vivocom’s construction team in areas such as substructure, water infrastructure construction, real estate financing and residential development.

All in, with the cross-pollination of expertise, we estimate that its construction margin will improve by +1.2% in financial year 2018 (FY18) and FY19 due to the slated expansion of the project team to undertake a higher volume of construction activities.

Furthermore, CNQC’s track record will strengthen Vivocom’s expertise to bid for higher-scaled projects such as the East Coast Rail Link.

Altogether, we maintain our “buy” call with an adjusted TP of 39.5 sen per share based on a discounted cash flow with weighted average cost of capital of 7.4%. — MIDF Research, Oct 16

This article first appeared in The Edge Financial Daily, on Oct 17, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

KL Gateway Premium Residence

Bangsar South, Kuala Lumpur

Impian Bukit Tunku

Kenny Hills (Bukit Tunku), Kuala Lumpur

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor