Malaysian Resources Corp Bhd (Sept 20, RM1.16)

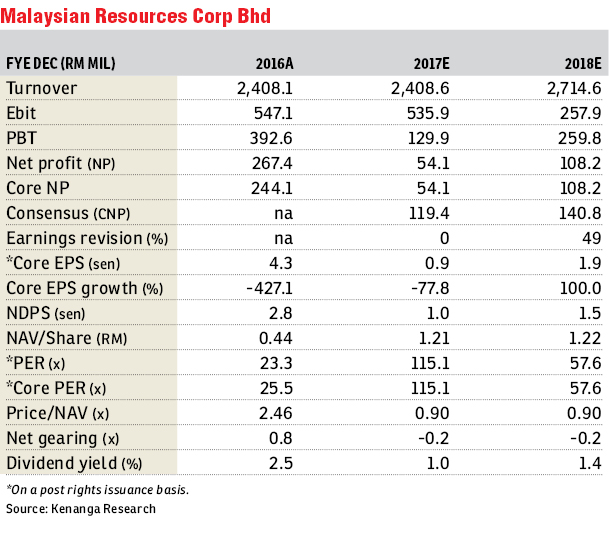

Maintain outperform with a lower target price (TP) of RM1.14: On Tuesday, Malaysian Resources Corp Bhd (MRCB) announced that the issue price for its rights shares has been fixed at 79 sen per rights share. The issue price of 79 sen represents a 20.2% discount to its theoretical ex-all price of 99 sen.

Based on the issue price of 79 sen, MRCB is looking to raise RM2.25 billion from the exercise instead of RM2.85 billion from its earlier proposed/illustrative issue price of RM1 due to weak market conditions. The exercise will bring down its existing net gearing of 0.99 times, as of the second quarter of 2017 (2Q17), to 0.24 times.

On a separate announcement, MRCB also announced that it has secured a stadium job in Larkin for a total consideration of RM58.9 million. The construction work for the stadium would take up to 18 months from the award date and we are neutral on the contract award as it is within our order book replenishment assumption of RM1 billion.

To date, MRCB has won RM467.9 million worth of jobs, making up 47% of our order book replenishment of RM1 billion.

Apart from the Larkin stadium job, MRCB also announced the contract win of the S210 package for mass rapid transit Line 2 (MRT2) station works totalling RM145.8 million which has no impact on our financial year 2017 estimated (FY17E) and FY18E earnings as we have already factored this in our estimates given that the work package S210 is part of package V210 worth RM648 million that it secured last year.

Moving into FY17, the management are maintaining their sales target at RM1.2 billion, banking on their planned launches of Sentral Suites (gross development value [GDV]: RM1.4 billion), 9 Seputeh Phase 2 (GDV: >RM900 million), Bukit Rahman Putra (GDV: RM100 million) and Bandar Sri Iskandar (GDV: RM16 million).

MRCB’s remaining external construction order book stands at around RM7 billion. Coupled with about RM1.5 billion of unbilled property sales, these numbers will provide the group with at least four years of earnings visibility.

Following the announcement of its price fixing, we raised our FY18E core earnings by 49% after factoring in the potential interest savings from the proceeds of the entire rights issuance exercise, while keeping our FY17E earnings unchanged.

Nonetheless, we are maintaining our outperform call on MRCB but with a lower sum-of-parts TP of RM1.14 from RM1.23 after factoring in a lower rights issue price of 79 sen as compared with our previous assumption of RM1.

We are positive on the rights issuance exercise as it brings MRCB back to a better financial footing coupled with the potential sale of Eastern Dispersal Link Expressway (EDL) which would be an upcoming catalyst for the stock.

The downside risks to our call include weaker-than-expected property sales, higher-than-expected administrative cost, negative real estate policies, and a tighter lending environment. — Kenanga Research, Sept 20

This article first appeared in The Edge Financial Daily, on Sept 21, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Centrio SoHo @ Pantai Hillpark

Pantai Dalam/Kerinchi, Kuala Lumpur

Desa Idaman, Taman Puchong Prima

Puchong, Selangor

Aurora Residence @ Lake Side City

Puchong, Selangor

The Establishment (Alila Bangsar )

Bangsar, Kuala Lumpur

Seksyen 25, Shah Alam (Taman Sri Muda)

Shah Alam, Selangor

Vogue Suites 1 @ KL Eco City

Bangsar, Kuala Lumpur