Malaysia Building Society Bhd (Aug 22, RM1.28)

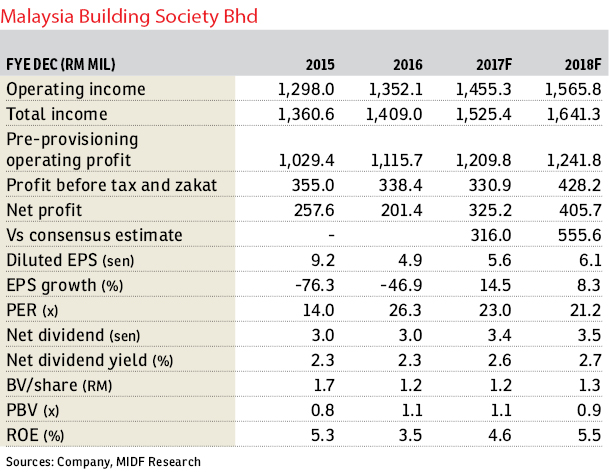

Maintain buy with an unchanged target price (TP) of RM1.50: Malaysia Building Society Bhd’s (MBSB) first half of financial year 2017 (1HFY17) net profit of RM192.4 million was above our and consensus expectations, accounting for 61.7% and 69.1% of respective full-year forecasts. For 1HFY17, the group recorded a net profit growth of 96.6% year-on-year (y-o-y) despite revenue being flattish.

The strong growth was attributable to higher income from net financing/loans, investment activities and lower cost of funds. The group’s gross loans and financing grew by 2.2% y-o-y in the second quarter of FY17 (2QFY17), attributable to higher corporate financing disbursement.

Overall, the group’s net impaired financing/loan ratio continued to strengthen, at 2.8% as at 2QFY17 (-0.5 percentage point [ppt] y-o-y). This was mainly driven by its recovery strategies and strengthened collection. Notably, the cost-to-income ratio showed further improvement of -2.1ppts y-o-y from 23.5% in 2QFY16, well below the industry’s average of 44.8%.

Despite the consistent improvement in cost, we foresee that the ratio will be impacted as a result of the merger with Asian Finance Bank Bhd (AFB). We view that the group will incur additional cost, mainly from integration, the various expenses associated with the rolling out of new products and customer acquisition. Management highlighted that it will ramp up efforts to improve its banking platform, building up its IT capacity to cater to retail customers. The implementation is expected to be completed by early 2018.

As earnings came above expectations, we revise upwards our FY17 earnings forecast by 4.3% to take into account higher income from net financing/loans. However, in order to be conservative and account for the integration cost from the merger with AFB, we revise downwards our FY18 net profit forecast by 19%.

Nevertheless, we are optimistic that its earnings will stabilise in FY19. On the back of Malaysian Financial Reporting Standard 9 (MFRS9) implementation, the group is currently doing a stimulation to prepare for any adjustment to its accounting treatment. The impact is yet to be clear, but we are comforted by the group’s financial standing as management has highlighted that no additional capital is required for MFRS9 adjustment.

As we remain optimistic about the group’s performance moving forward, supported by the current and future initiatives being planned and executed, we maintain our “buy” call on the stock with a TP of RM1.50, pegging its FY18 book value of equity per share to price-to-book ratio of 1.1 times. — MIDF Research, Aug 22

This article first appeared in The Edge Financial Daily, on Aug 23, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

KL Gateway Premium Residence

Bangsar South, Kuala Lumpur

Impian Bukit Tunku

Kenny Hills (Bukit Tunku), Kuala Lumpur

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor