Titijaya Land Bhd (Aug 14, RM1.54)

Initiate coverage with a buy call and fair value of RM2.01: We initiate our coverage of Titijaya Land Bhd with a “buy” recommendation and a fair value of RM2.01, based on a 30% discount to its revalued net asset value (RNAV).

Titijaya was founded in 1997 by Tan Sri Lim Soon Peng. Its early projects included double-storey terraced houses and three-storey shop offices in Taman Bukit Cheras, Kuala Lumpur, and double-storey terraced houses, residential lots and low-cost apartments in Klang.

The group launched its first high-rise development project, E-Tiara serviced apartments in Subang Jaya, in 2004. Subsequently, in 2007, Titijaya embarked on its first mixed commercial development of office suites and retail lots in First Subang, in SS15 Subang Jaya. This was followed by Subang Parkhomes (Phase 1), its first low-rise and low-density condominiums in Subang Jaya in 2009. In 2013, Titijaya was listed on the Main Market of Bursa Malaysia.

Currently, its ongoing projects include H2O @ Ara Damansara (mixed development), Emery @ Kemensah (high-end, landed, residential) in Ampang, Mutiara Residences in Klang (landed, residential) and Seri Alam Residence in Klang (landed, residential).

Titijaya is launching new developments with a RM1.82 billion gross development value (GDV) in the financial year ending June 30, 2018 (FY18). These comprise five new projects, namely The Shore @ Kota Kinabalu (mixed development), 3rdNvenue @ Jalan Ampang (mixed development), Riveria KL Sentral (mixed development), Damansara West, Bukit Subang (township), and Park Residensi @ Cheras (landed, residential).

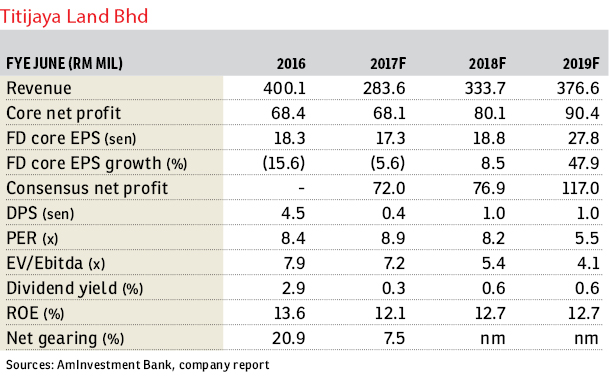

Titijaya’s revenue growth has been strong, with a three-year compound annual growth rate (CAGR) of 29% from FY13 to FY16. Although we expect revenue growth to be negative in FY17, consistent with the challenging conditions of the industry, we expect a rebound from FY18 onwards, supported by a slew of new launches in FY18 and beyond.

Its earnings growth has also been commendable, with its FY13 to FY16 three-year net profit CAGR standing at 7.1%, despite its net profit margin dropping to 17.1% in FY16, compared with 23.8% the year before, which we believe was due to the challenging environment of the industry.

Moving forward, we expect Titijaya’s earnings to return to positive growth from FY18 onwards, supported by the upcoming launches of new projects and improving market conditions, which should result in the normalisation of its profitability level to its historical level. — AmInvestment Bank, Aug 14