Construction sector

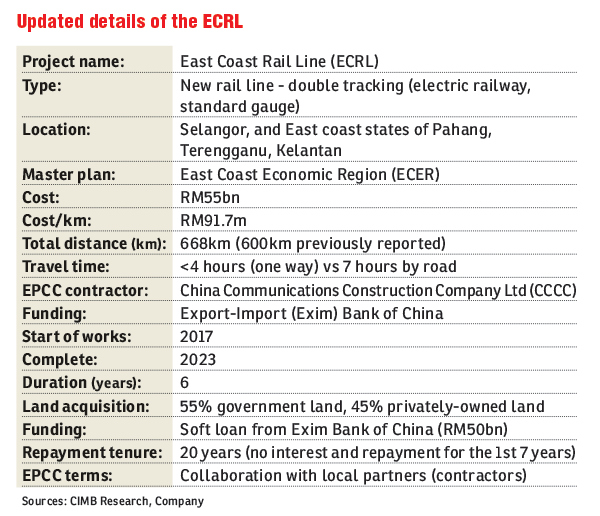

Maintain overweight sector rating: The East Coast Rail Link (ECRL) project took off with a groundbreaking ceremony yesterday. Prime Minister Datuk Seri Najib Razak has targeted for the RM55 billion project to be completed by 2024. The ECRL is an electric railway project measuring 668km in length connecting the East Coast states of Kelantan, Terengganu and Pahang to Greater Kuala Lumpur. News reports said the travel time from Gombak to Kota Bharu will be cut from seven to 12 hours by car to less than four hours.

Key takeaways from the event include the financing aspect of the project. Eighty-five per cent of ECRL would be financed via a soft loan from Exim Bank of China with a 3.25% interest and a seven-year moratorium. The balance 15% would be financed through a sukuk programme by local banks. The repayment tenure is 20 years, with interest and principal repayments waived for the first seven years. Under the agreement, China Communications Construction Co (CCCC) is the main contractor.

It was also reiterated that at least 30% of the contract value will be awarded to Malaysian contractors. This, according to the prime minister, should address concerns that the ECRL would only benefit Chinese companies/contractors. Seventy per cent of the total project value will be undertaken by CCCC. In terms of economic benefits, he said 80,000 jobs are expected to be created. Once completed, the economic multiplier effect from the rail system is expected to raise the East Coast states’ gross domestic product by 1.5%, he added.

The 30% portion earmarked for local contractors translates into a combined value of RM16 billion which is still sizeable, and comprises several main components including viaducts, bridges, stations, tunnels and depots. Among companies under our coverage, potential beneficiaries are Gamuda Bhd, IJM Corp Bhd, Malaysian Resources Corp Bhd, WCT Holdings Bhd, Muhibbah Engineering (M) Bhd and Lafarge Malaysia Bhd. Non-rated players that could benefit include Ann Joo Resources Bhd (steel), Econpile Holdings Bhd (piling), HSS Engineers Bhd (design) and Gadang Holdings Bhd (depot).

ECRL’s groundbreaking marks yet another big milestone for the construction sector’s rail theme in the second half of 2017 (2H17). We expect the tender phase to gain momentum over the coming months and reveal more colour on the tender structure. While other contractors stand to benefit as well, we believe Gamuda could emerge as the biggest player for ECRL. The group’s target of RM10 billion contract wins remain unchanged. We maintain our overweight sector rating. Downside risks include project delays and funding. — CIMB Research, Aug10

This article first appeared in The Edge Financial Daily, on Aug 11, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Aspira ParkHomes @ Gelang Patah

Gelang Patah, Johor

Aspira ParkHomes @ Gelang Patah

Gelang Patah, Johor

Iconia Garden Residence @ Taman Impian Emas

Johor Bahru, Johor

Nusa Perdana Serviced Apartment

Gelang Patah, Johor