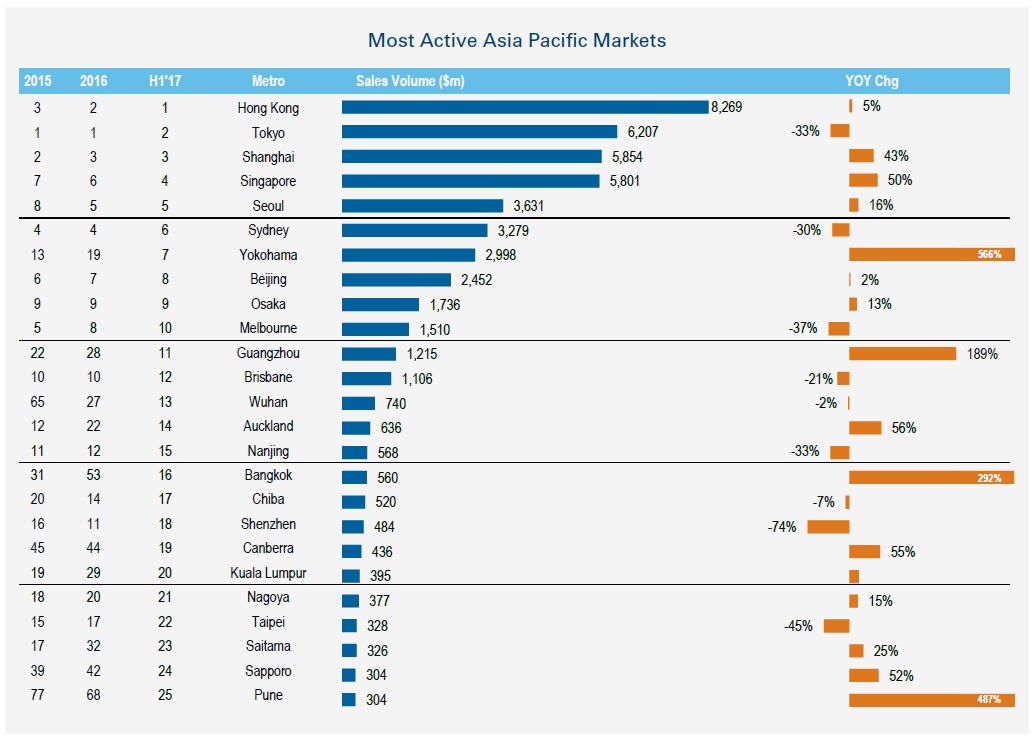

Singapore ranks 4th in 1H2017 real estate market activity among APAC countries

SINGAPORE (Aug 7): Singapore placed fourth in terms of 1H2017 real estate market activity among APAC countries, according to Real Capital Analytics’ Q2 2017 Asia-Pacific Capital Trends Report. This marks Singapore's highest position in five years. The report was released on Aug 7.

Real estate transactions in Singapore grew 50% y-o-y to S$8.1 billion (RM25.5 billion) in 1H2017. This was due to several large deals, such as NTUC social enterprise Mercatus Co-operative’s acquisition of Jurong Point shopping mall at S$2.2 billion, and plentiful sales in the residential en bloc market.

Three residential redevelopment sites at One Tree Hill Gardens, Rio Casa and Eunosville, were sold en bloc in 1H2017, for a total sale price of approximately S$1.4 billion. The only other en bloc transaction within the same time period was for mixed-use development Goh & Goh Building, which was sold at S$101.5 million.

Hong Kong took the top spot on the list, with completed sales of income-producing assets totalling US$8.3 billion (RM35.5 billion) in 1H2017. This represents the first time that Hong Kong has been top investment market, a position which had been consistently held by Tokyo. Tokyo ranked second on the list for 1H2017.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.