I-Bhd (July 18, 61.5 sen)

Affirm outperform call with an unchanged target price of 91 sen: I-Bhd recorded a net profit of RM19.6 million (up 33.7% year-on-year [y-o-y]; up 5.6% quarter-on-quarter) for the second quarter of financial year 2017 (2QFY17), bringing cumulative first-half (1HFY17) net profit to RM38.2 million (up 27.3% y-o-y).

Making up 44.2% of our full-year estimate, we continue to deem the results in line as we see stronger earnings recognition in subsequent quarters on the back of RM334.7 million in unbilled sales.

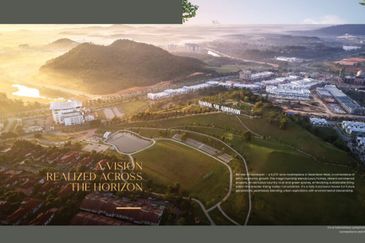

We like I-Bhd’s value proposition and attractive location in benefiting from the urbanisation of the outer Klang Valley region (Klang and Shah Alam). We reckon that I-Bhd is underappreciated, owing to its predominant single-location focus, which we believe is very much unwarranted given its steadily growing earnings and encouraging sales numbers.

In the absence of meaningful property investment and leisure-related contributions, property development continued to drive earnings growth in the interim. Divisional pre-tax profit of RM49.2 million for 1HFY17 was 20.9% higher than the previous corresponding period’s RM40.7 million, underpinned by steady construction progress of its ongoing developments.

The i-SoHo project was completed and handed over to purchasers in early second quarter of 2017 (2Q17), allowing the group to realise a portion of its unbilled sales, which in turn has ballooned its current cash holdings to RM243.3 million (about 18.5 sen per share on a fully diluted basis).

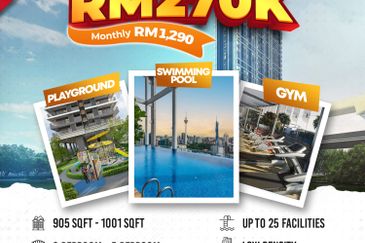

The i-Suite development will be handed over to purchasers by 4Q17, while the Liberty, Parisien and Hyde Towers are on track for delivery in late 2018/early 2019. The four towers have achieved combined average sales of 86%.

While unbilled sales had fallen to RM334.7 million as at mid-2017, from RM447.9 million in the previous quarter, this does not include the recently launched Hill10 Residence (RM120 million gross development value [GDV]) which saw a healthy 70% take-up rate.

Marketed as one of the most luxurious properties of its kind in Shah Alam, we are encouraged by the successful sales numbers — a watershed moment for property development in the area given its benchmark pricing amid reportedly lacklustre operating conditions — and this strongly reinforces our belief in the eventual realisation of the group’s remaining GDV of about RM7 billion.

Structural works on the mall have reached about 70% completion and remain very much on track for a 2018 opening, providing a boost to property investment-related earnings.

Works on the DoubleTree by Hilton hotel is also under way, with completion in 2019. Slated for launch this year end or early next year, depending on certain regulatory approvals, are another two residential towers with an estimated combined GDV of RM520 million. — PublicInvest Research, July 18

This article first appeared in The Edge Financial Daily, on July 19, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Mah Sing Integrated Industrial Park

Subang Bestari, Selangor

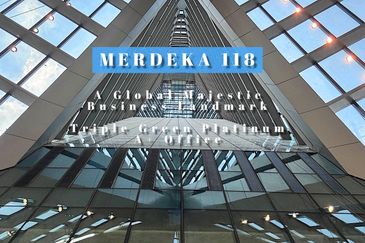

Merdeka 118 @ Warisan Merdeka 118

KLCC, Kuala Lumpur

Horizon Residence (Dwi Mutiara)

Bukit Indah, Johor