Mah Sing Group Bhd (May 18, RM1.52)

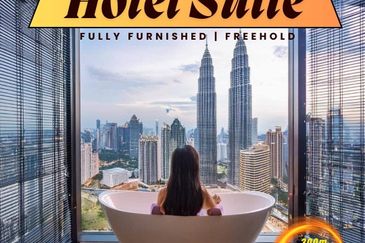

Maintain neutral with a higher target price of RM1.59: Mah Sing Group Bhd has entered into an agreement to acquire 3.56 acres (1.44ha) of freehold land in Titiwangsa, Kuala Lumpur. We gather that Mah Sing plans to develop condominiums with an indicative built-up from 850 sq ft (priced from RM485,000) with a total gross development value of up to RM650 million.

Valuation works out to be RM387 per sq ft (psf) which is fair in our view as it is within the surrounding area value of above RM400 psf.

We are positive on the news as we believe that the strategic location of the landbank with an affordable price (from RM485,000 onwards) should translate into a good take-up rate. The land purchase is estimated to be revalued net asset valuation-accretive and hence should result in enhancement of shareholder value.

As we expect the project launch only the financial year ending Dec 31, 2018 (FY18), we expect earnings to start to kick in only from FY19 onwards. Hence, we maintain our earnings forecasts for FY17 and FY18. — MIDF Research, May 18

This article first appeared in The Edge Financial Daily, on May 19, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

KL Gateway Premium Residence

Bangsar South, Kuala Lumpur

Impian Bukit Tunku

Kenny Hills (Bukit Tunku), Kuala Lumpur

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor