WORRY-free retirement is something many people look forward to. However, with the rising cost of living, is it possible for a senior citizen to be entirely financially independent during his or her twilight years?

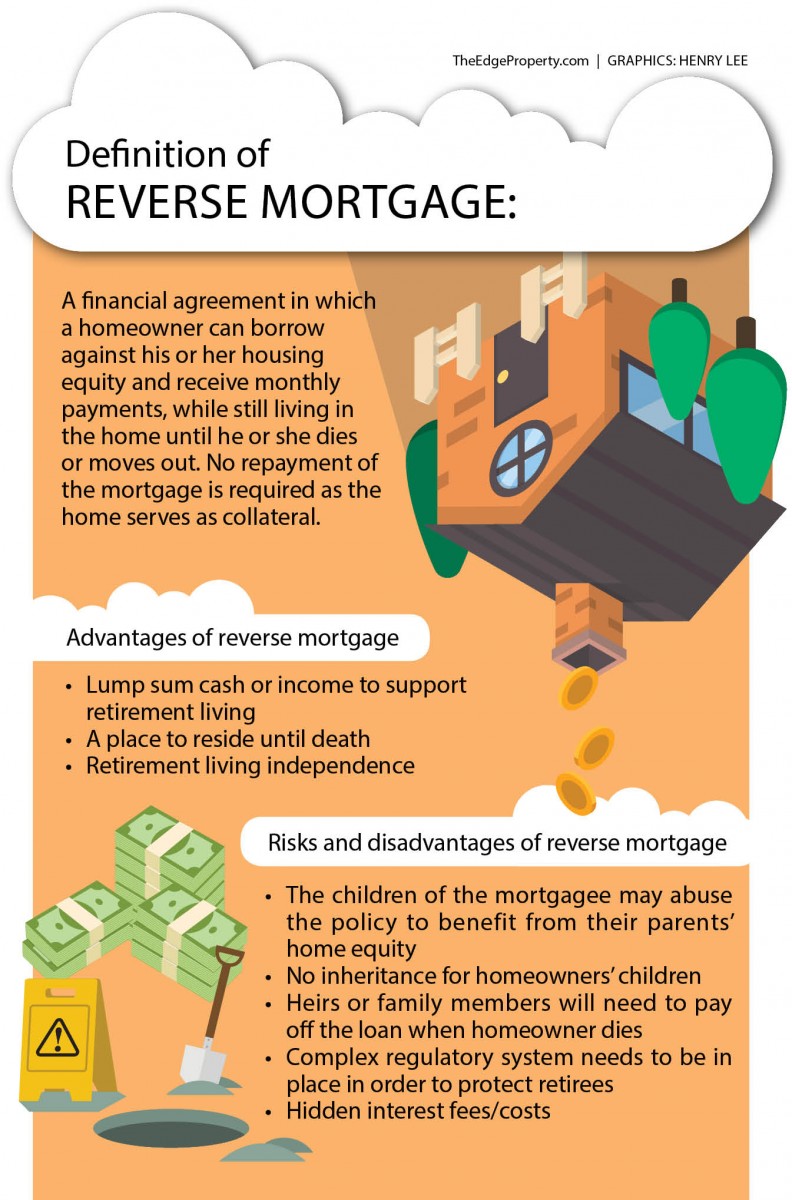

In some developed countries such as the US, UK and Canada, reverse mortgage has been introduced to help provide a source of income for retirees. Basically, it is a type of home loan which allows retirees to access the home equity on a monthly basis until they sell or move out of the home or pass away.

In Malaysia, the current minimum retirement age for both the private and public sectors is 60. According to the Department of Statistics Malaysia, by 2020, the proportion of Malaysians aged 65 and older is projected to be 7.2%. The country’s population is expected to be at 41.5 million by 2040 where 14.5% of the total population will be 65 years and above.

Funding your retirement via reverse mortgage

Not too long ago, property management, valuation and estate agency surveying vice-president of the Royal Institution of Surveyors Malaysia Choy Yue Kwong had suggested that it may be a better idea to help unlock the value of properties owned by senior citizens than to provide them with a senior citizen socioeconomic assistance of RM300 a month as announced in Budget 2017.

“The subsidy is hardly enough for them to have a worry-free retirement. They can have a better quality of life if the government introduces reverse mortgages,” he had said during a panel discussion at a property forum organised by Rahim & Co International on Nov 1, 2016. Choy is also Rahim & Co (Selangor) managing director.

But how does reverse mortgage work and is Malaysia ready for it? While that is debatable, there is no doubt that it could be something that Malaysia can explore and study for its viability to help improve the quality of lives of senior citizens upon retirement.

An innovative product

Professor of economics at Sunway University Business School and director of economic studies programme at Jeffrey Cheah Institute on Southeast Asia Professor Yeah Kim Leng says reverse mortgage is an innovative solution that allows homeowners to receive some cash while continuing to reside in the property till the end of their lives.

“It is one way to help existing homeowners cope with living costs, repay debts, pay for aged care and other expenses. However, it should be carefully regulated given its complexity, inter-generational issues and risks over the mortgage period. [Most] importantly, mortgagees will have to fully understand the contractual obligations, costs and benefits while bankers will need to fully disclose the fine print,” he stresses.

According to Yeah, there will certainly be demand for reverse mortgage but the question is “how big and how profitable” would it be for financial institutions to introduce the scheme, taking cognisance of the transaction costs involved, including legal and regulatory hurdles?

Laws and regulatory complexity

A senior researcher at the Malaysian Institute of Economic Research Dr Zulkiply Omar concurs, saying that there is a lot of uncertainties pertaining to the laws and regulations when it comes to reverse mortgages.

“In developed countries, the main objective of a reverse mortgage is to support retirees by converting their home equity into cash. If we are looking at the same concept, the relevant laws and regulations must be in place to protect retirees.

“Family members must be fully aware and understand the idea [behind reverse mortgage]. The retiree’s children must be obligated to the mortgage or else they will have to forgo the inheritance of the property. On the other hand, reverse mortgage may also be subject to abuse by children who seek to benefit from their parents’ home equity,” he points out.

As the concept of reverse mortgage is new to Malaysians, its introduction has to be well thought out especially in terms of regulations.

Not your regular home mortgage

Zulkiply adds that another salient feature of reverse mortgage is that the mortgagees are required to reside in the mortgaged property and the property must be well maintained.

“It may also come with hidden charges [such as unspecified processing fees]. Reverse mortgage is unlike a regular mortgage between a financial institution and a homeowner. It seems more of a mortgage between a financial institution and the family of the mortgagee/retiree. Therefore, it must be well planned,” he adds.

When asked about the feasibility of reverse mortgage in Malaysia, Yeah says as the demand and the economics of such products improve with the ageing population, rising home ownership and property prices, it is no longer a question of “should” but “when”.

“In terms of timing, I think it will be sooner rather than later as we inch nearer to becoming a high-income nation over the next several years,” he says.

Settle housing affordability issue first

Meanwhile, Zulkiply thinks now is not a good time to implement reverse mortgage unless “we get our property market in order”.

“The issue of housing affordability among the lower- to middle-income groups needs to be resolved [first]. For now, [reverse mortgage] might be feasible only under a well-regulated environment for a very limited target group.

“Reverse mortgage shouldn’t be a vehicle to stimulate the property and financial markets. A thorough study needs to be done to address potential ramifications especially on the property market besides studying its effectiveness on the elderly’s retirement plans,” he notes.

No more bequest of parents’ home

Zulkiply also cautions that policymakers will need to look at the social aspect and not just the economic aspect if they decide to draft a plan for reverse mortgage in Malaysia.

He explains that if the purpose of reverse mortgage is heavily skewed towards uplifting the country’s economic situation or to stimulate the property market, it may cause house price inflation as financial institutions begin to set their price expectation higher, further causing house prices to escalate.

“Meanwhile, the current generation has to bear the higher house prices besides having narrowed hopes for a bequest from their parents,” says Zulkiply.

Singapore case study

In 1997, Malaysia’s southern neighbour, Singapore, saw the introduction of a reverse mortgage scheme by insurance firm NTUC Income but it didn’t quite take off due to the lack of demand.

However, the Housing and Development Board (HDB) of Singapore then introduced another similar concept — a lease buyback scheme (LBS) in 2009 which enables elders to monetise their home equity.

Under LBS, a senior citizen sells a portion of his or her flat’s lease to HDB where the proceeds will then be used to top up their Central Provident Fund Retirement Account. Other options for elders to monetise their homes include subletting their flats or rooms as well as the Silver Housing Bonus where elders will receive a bonus of up to S$20,000 (RM62,593) cash per household when they sell their current flat and buy a smaller one.

This story first appeared in TheEdgeProperty.com pullout on Feb 24, 2017, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Nusa Cinta@Setia Fontaines

Kepala Batas, Penang

Nusa Cinta@Setia Fontaines

Kepala Batas, Penang

Nusa Cinta@Setia Fontaines

Kepala Batas, Penang