Gamuda Bhd (Feb 7, RM4.93)

Maintain add call with an unchanged target price (TP) of RM5.88: Our revised addressable market size for domestic rail and tunnelling contracts reinforces Gamuda Bhd’s position as among the likely biggest beneficiaries of this segment over the medium to longer term. Much improved job replenishment visibility is underpinned by our estimated RM41 billion total addressable tenders for rail tunnelling projects. A key driver of this is the MRT 3 Circle Line, which is still being studied.

Chances of Gamuda exceeding our RM2 billion assumed new wins this year remain good.

Its internal RM3 billion-to-RM4 billion job replenishment target comprises larger-value rail contracts (LRT 3 and the China-led Gemas-Johor Bahru double tracking) and a portion of the Pan Borneo Highway in Sabah, which is likely to be accelerated in conjunction with the impending general elections based on our market strategy and outlook, could occur in the second half of 2017 at the earliest. In our best case, there is 20% to 30% upside to its RM8.9 billion order book.

With a healthy order book revenue cover of 4.4 times, we expect the momentum of construction earnings in the first quarter of financial year 2017 (1QFY17) to be sustained in the coming quarters. Physical work progress for MRT 2 stood at some 2% as at end-2016 and we forecast the progress billings to hit a reasonable 20% mark by end-2017. We have assumed a blended construction pre-tax margin of 9%, which could rise to 10% to 11% within the next 2 years, similar to the peak of the previous MRT 1, as jobs go full swing.

The perceived overhang on the stock arising from the long-delayed sale of 40%-owned Splash (water asset) could slowly diminish in the coming months. The April target for a new deal and price tag for Splash now points to the possibility of a special dividend, in our view, as the company has no immediate major capital expenditure plans. Our sensitivity analysis based on a hypothetical RM1.1 billion share of proceeds shows that the combined dividend yield could be 7% if at least 50% of the cash is set aside as special dividends.

The potential revival of construction plays and investors’ preference for big-cap infrastructure laggards could trigger a recovery in Gamuda’s foreign shareholding, which stands at a low of 22%. This is unjustified, in our view, given the improved job outlook, greater conviction of the cash-enhancing Splash deal and new job opportunities from the RM55 billion East Coast Rail Line, RM50 billion High Speed Rail, RM40 billion MRT 3 and potential new overseas rail tunnelling jobs.

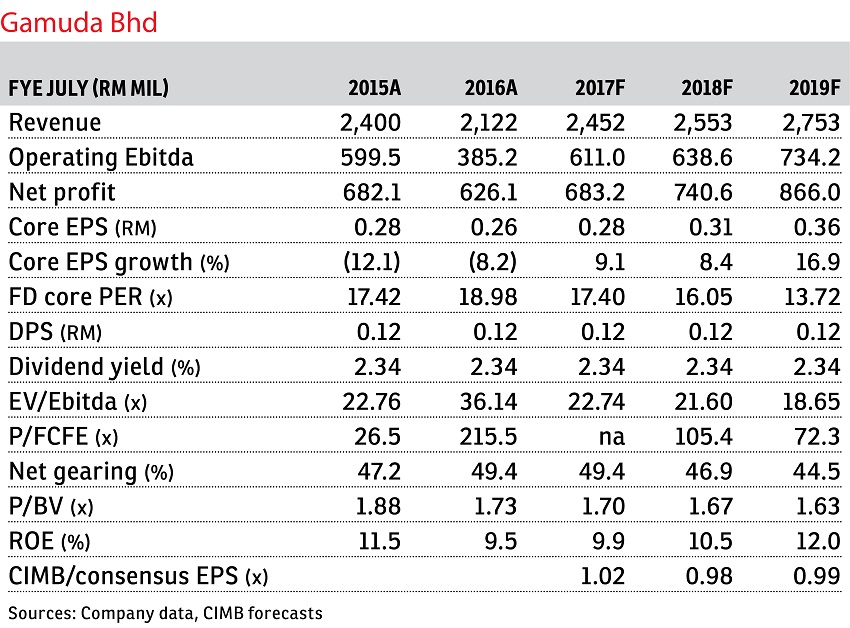

Gamuda remains our top pick among the big caps in view of the above potential medium-term catalysts. Our TP remains pegged at a 10% revalued net asset valuation discount and implies 19% upside. We maintain our earnings per share forecasts for FY17 to FY19. Key downside risks are delays in job roll-out and the Splash deal. — CIMB Research, Feb 6

This article first appeared in The Edge Financial Daily, on Feb 8, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.