S P Setia Bhd (Sept 11, RM3.15)

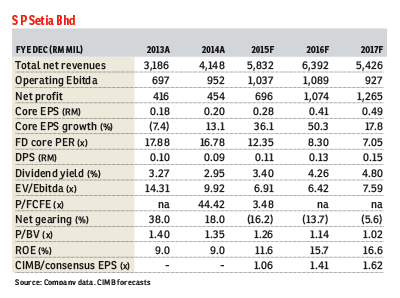

Maintain reduce with a higher target price (TP) of RM2.86: S P Setia’s nine months ended July 31, 2015 (9MFY15) results were broadly in line with expectations as core net profit made up 70% of our original FY15 full-year forecasts.

The fourth-quarter results are historically the strongest. Note that S P Setia has changed its financial year-end from October to December, and we have applied the same earnings forecasts for the 14 months ending Dec 31, 2015 period as we did for the 12 months ending Oct 31, 2015 period, in view of weak property market conditions and the group’s lowered sales target for this year.

Its 9MFY15 new sales were RM2.54 billion, 31% lower year-on-year (y-o-y) and made up 64% of its RM4 billion FY15 target. 37% came from Battersea, London, and 57% from Malaysia — RM1.13 billion from the Klang Valley, RM203 million from Johor, RM101 million from Penang and RM12 million from Sabah. Another 5% of group sales came from Singapore, Australia and Vietnam combined.

Third quarter of FY15 (3QFY15) sales fell 44% y-o-y and 31% quarter-on-quarter to RM750 million. The group’s unbilled sales fell from RM11.5 billion in 1QFY15 to RM10.8 billion in 2QFY15, and then further to RM9.9 billion in 3QFY15.

Third quarter of FY15 (3QFY15) sales fell 44% y-o-y and 31% quarter-on-quarter to RM750 million. The group’s unbilled sales fell from RM11.5 billion in 1QFY15 to RM10.8 billion in 2QFY15, and then further to RM9.9 billion in 3QFY15.

S P Setia’s share cap has risen to 2.595 billion shares due to new shares issued pursuant to its dividend reinvestment plan, vesting of an employee share grant plan and exercise of an employee share option scheme.

It did not propose any dividend for 3QFY15, in line with expectations and its historical practice. It proposed an interim single-tier dividend per share of four sen for the first half of FY15. We make no changes to our TP based on a 40% discount to revised net asset value (RNAV), but RNAV per share has been adjusted higher by 7% to RM4.74 after updating balance sheet items.

A key rerating catalyst for S P Setia is a long-awaited merger and acquisition. Earlier this year, there was a press report stating that its senior management had mooted to Permodalan Nasional Bhd’s top management a takeover by Sime Darby Bhd’s property arm. It was reported that “there was no resistance to the proposal” and that “they see a need for a strong leadership in S P Setia for the greater benefit of shareholders”.

However, weak sales suffered by developers year to date and poor appetite for property stocks make it difficult to execute property deals. S P Setia remains a “reduce” and we prefer Eco World Development Group Bhd for its exposure to the property sector. — CIMB Research, Sept 10

This article first appeared in the digitaledge DAILY on Sept 14, 2015. Subscribe here.

TOP PICKS BY EDGEPROP

SkyVille 8

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor

Biji Living (Seventeen Residences)

Petaling Jaya, Selangor

Taman Oug Square

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Pulau Indah Industrial Area

Pulau Indah (Pulau Lumut), Selangor