S P Setia Bhd (July 28, RM3.03)

Maintain hold with an unchanged target price (TP) of RM3.24: S P Setia Bhd will announce its second quarter ended June 30, 2016 (2QFY16) results on Aug 11. We estimate 2QFY16 net profit to come in relatively flat quarter-on-quarter at the range of RM120 million to RM130 million, driven by the steady progress of works from domestic projects. This will take its first half ended June 30, 2016 (1HFY16) net profit to RM243 million to RM265 million, representing a 23% to 26% year-on-year contraction in earnings.

The decline could largely be due to the lumpy revenue of Fulton Lane, Melbourne (Tower 1) recognised in 2QFY15. Having said that, 1HFY16 net profit will likely make up only 34% to 36% of our full-year earnings forecasts. However, we deem this as within expectations as we envisage S P Setia’s net profits to accelerate in 4QFY16 upon the stage handover of Battersea Power Station Phase 1 and Parque @ Melbourne.

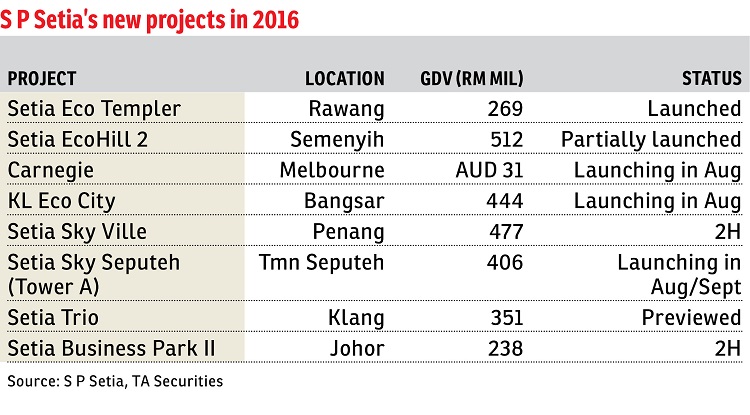

After a quiet start to the year, launch activities picked up greatly in 2QFY16. In 1QFY16, the group only launched Edulis, the three-storey terrace housing project (70 units, launched in March) in Setia Alam. S P Setia unveiled two new townships, namely Setia Eco Templer in Rawang and Setia EcoHill 2 in Semenyih, in 2QFY16. In May, the group launched the maiden phase of Setia Eco Templer, featuring 176 units of double-storey linked villas (2,394 sq ft to 2626 sq ft, RM850,000 per unit), 52 units of semi-detached houses (3,482 sq ft to 3,492 sq ft, RM1.7 million per unit) and six bungalows (4,214 sq ft, RM2.8 million per unit). The response was overwhelming, with all 176 units of double-storey linked villas and six units of bungalows booked within the first weekend of launch. We gather that all the launched units are now fully sold. Riding on the success of Setia EcoHill, the group also introduced Setia EcoHill 2 in June. The first phase of Setia EcoHill 2 — Springfield Residences — will comprise 258 units of double-storey terraced houses (1,859 sq ft to 2,148 sq ft) and 96 units of double-storey cluster semi-detached houses (2,028 sq ft). The units are priced from RM553,000 to RM668,000. This phase has a gross development value (GDV) of RM228 million. Sales performance is satisfactory, with 50% of the units booked to date.

The group will be launching the 40-storey ViiA Residences at KL Eco City in August, offering 326 units with built-up ranging between 650 sq ft and 1,300 sq ft. ViiA Residences is part of the 25-acre (10ha) KL Eco City mixed development, which is situated along Jalan Bangsar and will be connected to Mid Valley City and The Gardens via a pedestrian link bridge. Another project that is near Mid Valley City, namely Setia Sky Seputeh, will also be launched in August/September this year. Setia Sky Seputeh will consist of two blocks housing 290 luxury condo units with built-up ranging between 2,300 sq ft and 3,000 sq ft (total GDV: RM900 million). The group will launch Tower A (GDV: RM406 million), with an indicative selling price of RM1,300 per sq ft. As for S P Setia’s overseas projects, in August it will launch its third project in Melbourne, called Maison @ Carnegie, featuring 48 units of apartments with an average selling price about A$600,000 per unit (RM1.83 million) (project GDV: A$31 million).

Although S P Setia’s recent launches have garnered strong interest, we note that stringent lending practices by financial institutions remain the key hurdle in realising sales. As such, we are maintaining our 2016 sales forecasts of RM3.6 billion, below management’s target of RM4 billion. We made no change to our FY16 to FY18 earnings forecasts. Our FY16/17/18 sales assumptions are RM3.6 billion/RM4.8 billion/RM6.4 billion respectively.

We like the company’s strong near-term visibility backed up by sizeable unbilled sales of RM8.6 billion (as at March). Valuation-wise, the group is currently trading at 12 times and 1 times FY17 earnings per share (EPS) and book value per share respectively, compared with its five-year average price-earnings ratio and price-to-book-value ratio multiple of 17 times and 1.5 times respectively. While valuation appears decent, we believe the bumper earnings over FY16 to FY17 have already been reflected in its share price. As the domestic property market outlook remains challenging due to mounting concerns over the weak economic outlook, we maintain our “hold” recommendation on S P Setia with an unchanged TP of RM3.24 per share, based on 13 times calendar year 2017 EPS. — TA Securities, July 28

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on July 29, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Avira Garden Terraces @ Medini

Iskandar Puteri (Nusajaya), Johor

Villa Serene Kiara

Desa Sri Hartamas, Kuala Lumpur

Ara Vista, Ara Damansara

Ara Damansara, Selangor

Jalan Rimba Riang 9/8

Kota Damansara, Selangor

Rafflesia @ The Hill

Damansara Perdana, Selangor

D Villa Equestrian, Kota Damansara

Petaling Jaya, Selangor

Taman Seri Buloh, Sungai Buloh

Sungai Buloh, Selangor

Amberside Country Garden @ Danga Bay

Johor Bahru, Johor

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor