Tiong Nam Logistics Holdings Bhd(July 25, RM1.63)

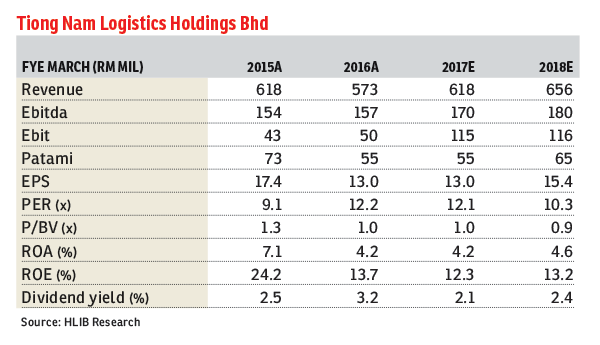

Maintain buy with an unchanged target price (TP) of RM2.07: We met up with Tiong Nam Logistics Holdings Bhd’s management last Friday to learn more about its recent business developments and updates on its upcoming real estate investment trust (REIT) listing. We have become reassured of the company’s long-term prospects after the meeting. Aside from the upcoming REIT listing of its warehousing assets, the management also has several business expansion plans on the cards to create more value for its shareholders.

The group is currently embarking on investment in efficiency-enhancing technologies in its logistics business, namely the Automated Storage Retrieval System (ASRS) (currently only 98,000 sq ft enabled with ASRS) to improve the cargo handling capability of its warehouses. While investment in ASRS system would cost about three times more than general warehousing systems, it would enable Tiong Nam to handle two to 2.5 times more goods utilising the same warehousing space. Significant labour costs could also be saved in the process.

Aside from technology, the group also plans to expand its logistics capacity through increasing warehousing spaces in several busy locations in Malaysia. Notable expansion by the group is a multistorey warehouse to be built in Shah Alam with an expected capacity of one million square feet targeted for completion in 2019. Total capital expenditure is RM158 million spanning three years but it is not expected to exert huge strain on the group’s balance sheet as the expansion would be jointly funded by other associate companies. The group is also taking delivery of a 17-axle-lines trailer to ready itself for the bidding of project cargo contracts related to the refinery and petrochemical integrated development project. Revenue contribution from this subsegment is expected to increase to about RM30 million per annum.

The group also recognises the trend of e-commerce in the logistics and warehousing industry. At this juncture, its e-commerce contribution is still minimal to the group but it is in the midst of tendering for contracts with several e-commerce online platform marketplaces like Lazada.

We reiterate our “buy” call on the stock with sum-of-parts-driven TP maintained at RM2.07. We opine that recent share price correction is a buying opportunity for the stock. — HLIB Research, July 25

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on July 26, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Jalan Setia Utama U13/38C

Setia Alam/Alam Nusantara, Selangor

Fortune Perdana Lakeside Residences

Kepong, Kuala Lumpur

Fortune Perdana Lakeside Residences

Kepong, Kuala Lumpur