Property sector (July 14)

Maintain neutral: Bank Negara Malaysia (BNM) has cut its overnight policy rate by 25 basis points (bps) to 3%.

In our scenario analysis, we have assumed mortgage financing cost to reduce from an average of 4.6% to 4.35%.

Based on our calculations, a 25bps rate cut will reduce monthly instalments by about 3% or RM67 per month for a RM500,000 property with a loan tenure of 30 years.

For every RM3,000 of fixed monthly instalments, a 25bps rate cut will raise the amount of loan eligibility from RM585,000 to RM603,000, or a 3% increase.

We opine that a 25bps rate cut would not impact underlying demand significantly, given the muted impact on affordability. However, we view the rate cut positively for the near-term sentiment, given low expectations for the property sector.

BNM said previous property cooling measures, such as the removal of the Developer Interest Bearing Scheme and the Real Property Gains Tax hike, had successfully reined in property speculation activity. As such, we do not rule out any potential relaxation of property measures. High-beta stocks, such as Eco World Development Group Bhd (non-rated) and UEM Sunrise Bhd (hold) are main beneficiaries.

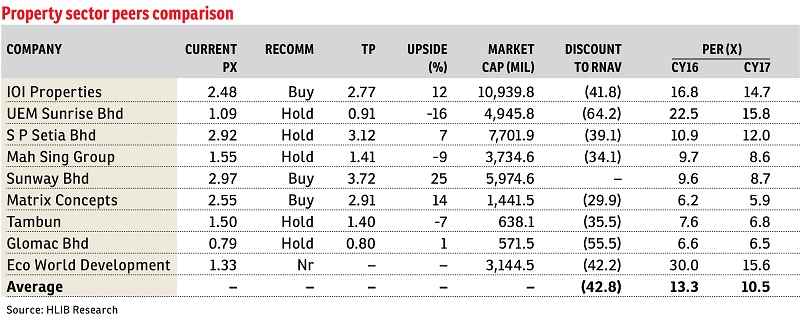

Sector valuation is trading at 0.75 times price-to-book value (P/B), slightly above the -1 standard valuation (SD) band (at 0.68 times), versus the crisis level of 0.47 times and the average of 0.81 times. For the revalued net asset valuation band, the sector (big-cap) is also trading at a 43% discount, slightly above -1 SD. Any potential relaxation of property measures will be a key rerating catalyst. We rate the property sector as “neutral”, with upside bias in anticipation of potential easing of property measures.

Positives include favourable demographics with a housing inflation hedge, while negatives include a prolonged weakening in consumer sentiment and tightening policy.

Our top picks for the sector are: i) IOI Properties Group Bhd (buy; target price [TP]: RM2.77), given that it is only trading at 0.7 times calender year 2016 P/B, compared with its peers at an average of one times (we believe the stock warrants a rerating, given its strong track record in township development and its attractive valuation); and ii) Matrix Concepts Holdings Bhd (buy; TP: RM2.91), as the dividend yield for Matrix is one of the highest in the sector at 6%. — HLIB Research, July 14

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on July 15, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor

Jalan Setia Utama U13/38C

Setia Alam/Alam Nusantara, Selangor