S P Setia Bhd (June 17, RM3.10)

Maintain hold with an unchanged target price (TP) of RM3.05: We believe a vote to leave the European Union (EU) could affect S P Setia Bhd in two ways. Firstly, the British pound could weaken as the market turns jittery. This will reduce the earnings and value of S P Setia’s Battersea Power Station project in ringgit terms.

Secondly, the uncertainty about the UK’s economy created by Brexit could reduce demand for UK properties from both Britons and foreign investors. This could affect the sales performance of Battersea, which accounts for 22% of S P Setia’s remaining gross development value (GDV), 46% of its unbilled sales and 7% of total assets.

Based on an exchange rate of RM5.50 to £1, we estimate that Battersea accounts for 16% of S P Setia’s revised net asset value (RNAV). All else equal, every 10% depreciation in the pound against our assumption will reduce our RNAV and TP for S P Setia by 2%.

As for the longer-term impact of Brexit on Battersea’s sales performance, Article 50 of the Lisbon Treaty states that the UK will have two years to negotiate the terms of exit with the EU. Regardless of the outcome, the uncertainty created during the negotiations could deter foreign investment in the London property market. Foreign interest may recover afterwards, but the extent of the recovery will depend on the terms agreed.

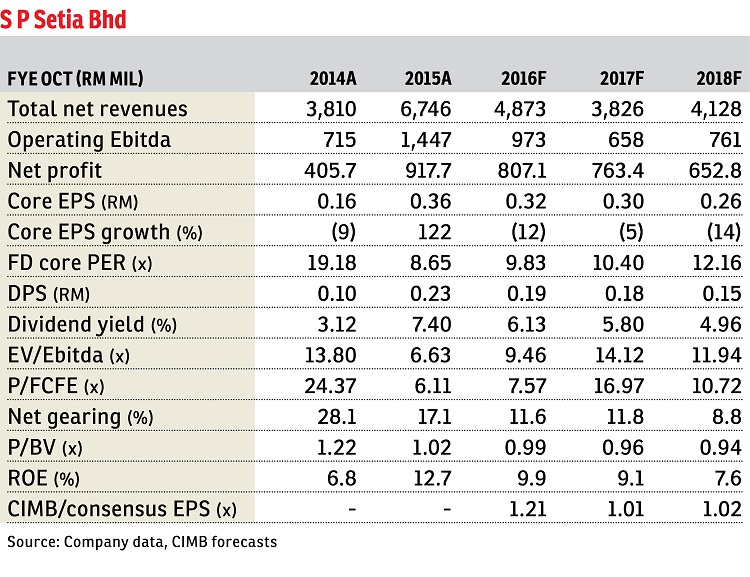

In financial year 2016 (FY16) to FY18, we believe the extent to which Brexit will affect S P Setia is mostly limited to the extent of the pound’s weakness. Battersea Phase 1 will be completed by the first quarter of 2017 and 99% of the units launched have been sold. Sale cancellation risk is small as deposit payments will be forfeited if the buyers cancel their purchases. S P Setia will recognise the earnings of this phase upon its completion. We have assumed RM5.50 to £1 in our earnings forecast and every 10% decline in the pound could cut our FY16 to FY17 earnings per share by 1% to 3%.

The subsequent phases will be completed by 2019 at the earliest. We think the completion risk for these phases is small as 70% of the units launched have already been sold. High take-up rates minimise the construction financing risk since proceeds from locked-in sales should cover most, if not all, of the construction costs of these phases.

While Brexit will cast into question whether the remaining £6 billion (RM35.22 billion) GDV of Battersea can be realised, the risk of weakening demand for London property is mitigated by undersupply of housing in the city. As for the risk to our TP in the event of a Brexit, we believe its downside is limited as our pound assumption is 5% lower. — CIMB Research, June 16

This article first appeared in The Edge Financial Daily, on June 20, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor