Axis Real Estate Investment Trust (July 25, RM1.85)

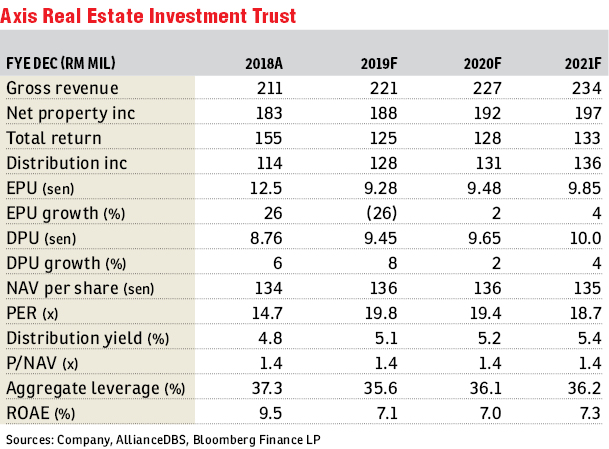

Maintain hold with an unchanged target price of RM1.73: Axis Real Estate Investment Trust’s (REIT) second quarter ended June 30, 2019 (2QFY19) realised earnings came in at RM28.9 million (+18.5% year-on-year [y-o-y]). This is in line with our and consensus expectations.

A dividend per unit of 2.36 sen was announced for 2QFY19, which implies a distribution payout of 99.8%.

The higher rental income of RM55.1 million (+13.5% y-o-y) was mainly due to the contribution from the newly acquired properties (Beyonics i-Park Campus Block E, Indahpura Facility, Senawang Industrial Facility), as well as the commencement of lease by Nestle at the Axis Mega Distribution Centre (DC) from June 2018 onwards and contribution from the lease by Upeca Aerotech that kicked in from Dec 16, 2018.

Property expenses came in slightly higher at RM7.3 million (+0.2% y-o-y), but net property income margin improved to 86.7% in 2QFY19 versus 85% in 2QFY18.

For Phase 2 of Axis Mega DC, Axis REIT is still in talks with a few parties to commit to the next build-to-suit development.

We believe this will contribute positively to Axis REIT’s future earnings as there is a demand for logistics and warehousing facilities.

Axis REIT has a number of ongoing asset acquisitions at a total estimated value of RM200 million. They include two industrial facilities in Shah Alam (RM55.8 million), two industrial facilities in Nusajaya (RM55.8 million) as well as an industrial facility in Kota Kinabalu (RM60 million).

We believe the positives for the steady assets has already been priced in at this juncture with share price gaining 17.8% year to date coupled with dividend yields of 5.1%.

Key catalyst for the stock would be securing a tenant for the Phase 2 of Axis Mega DC as well as sizeable acquisitions of industrial assets. — AllianceDBS Research, July 25

This article first appeared in The Edge Financial Daily, on July 26, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Jalan Bukit Bintang

Bukit Bintang, Kuala Lumpur

JALAN PJU 1A/3 TAIPAN DAMANSARA 2

Petaling Jaya, Selangor

Suasana Bukit Ceylon

Bukit Bintang, Kuala Lumpur

Ara Greens Residences

Ara Damansara, Selangor