IJM Corp Bhd (July 10, RM2.38)

Maintain buy with a higher target price (TP) of RM2.65: On Tuesday, IJM Corp Bhd received a notice of termination from MRCB George Kent Sdn Bhd for its RM1.115 billion tunnelling contract for light rail transit 3 (LRT3). The reason given is that the project delivery partnership-based (PDP) project has been remodelled into one with a fixed price contract as per the government’s cost restructuring. We understand there were ongoing negotiations to scale down the contract by excluding a tunnelling portion. Hence, this total termination came as a surprise.

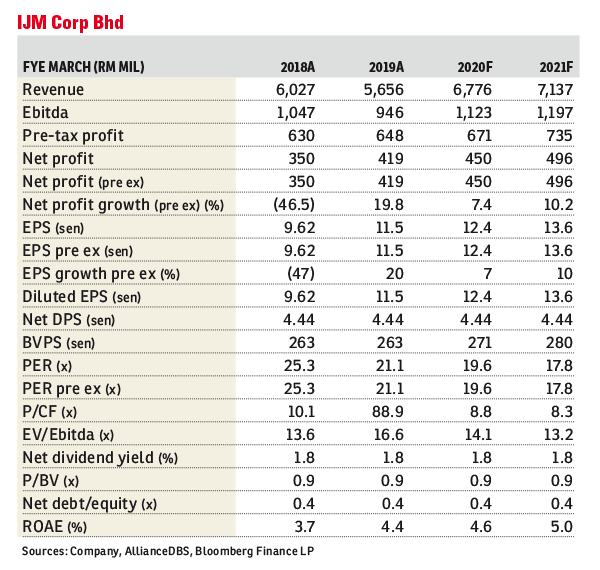

The contract forms 14% of IJM’s total outstanding order book of RM7.8 billion. The cancellation would reduce the company’s order book to RM6.7 billion.

In our earnings model, we had only assumed half of the contract value of RM1.115 billion or RM575 million. In terms of earnings impact, we cut our financial year 2020 to 2021 forecasts (FY20-21F) by 2.3-2.7%. However, we believe all costs incurred thus far will be reimbursed while IJM will also be seeking legal redress. Only preliminary stage works have been completed so far, covering less than 5% or RM56 million of the total contract value.

Despite this negative setback, we are maintaining our “buy” rating on IJM. We see any price weakness as an opportunity to buy the stock as we expect the government to accelerate its pump-priming efforts in 2020. IJM is also an excellent proxy to the East Coast Rail Link (ECRL) project revival (expected after July 25) which will benefit three of its business divisions — construction, Kuantan Port and manufacturing. New order guidance for FY20F is set at RM2 billion which may come from some internal jobs (phase 2 of The Light Waterfront Penang) and building jobs.

While we lower our sustainable order book assumption to RM7.8 billion (versus RM8.4 billion), we raise our target multiple for construction to 16 times (from 14 times previously). This will be still be slightly below -1 standard deviation of its five-year mean of 16.9 times. — AllianceDBS Research, July 10

This article first appeared in The Edge Financial Daily, on July 11, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Bangunan Duta Impian (The Embassy Suites)

Johor Bahru, Johor

Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor