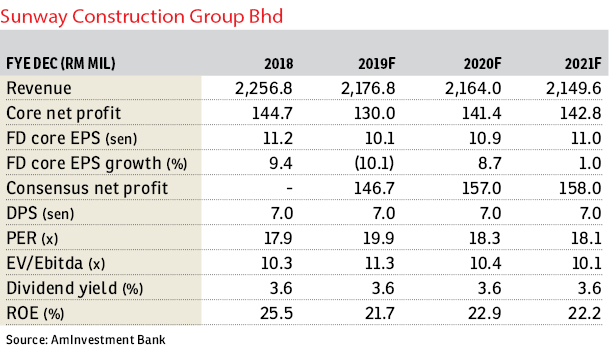

Sunway Construction Group Bhd (June 12, RM2)

Maintain underweight with a fair value (FV) of RM1.09: We maintain underweight with a FV of RM1.09 for Sunway Construction Group Bhd (SunCon) based on 10 times financial year 2020 (FY20) earnings per share (EPS), in line with our benchmark forward price-earnings ratio of 10 times for large- and mid-cap construction stocks.

The key message we gathered from SunCon during a recent visit is that the company is bracing itself for an extended lull period in the local construction sector, and is intensifying its pursuit of overseas construction jobs.

The company said that there is still hardly any sizeable new public infrastructure project up for bidding in the open market and did not appear to be too excited about the RM44 billion East Coast Rail Link (ECRL) project. SunCon will only be keen to participate if higher-value jobs such as piling, relocation of utilities and elevated structures are offered to the local contractors.

Having said that, subject to the final investment decisions by the project owners, locally, SunCon may bid for a high-rise commercial property project by parent Sunway Bhd, a public hospital project, and a superstructure job in Kuala Lumpur. These jobs could be worth about RM200 million each.

In India, SunCon has reopened an office and working on tenders for three toll-road projects worth about RM1 billion each. In Myanmar, SunCon via a joint venture (JV) with local conglomerate Capital Diamond Star Group, stands a good chance of winning a building job worth RM200 million to RM300 million for the maiden phase of a mixed project in Mandalay.

SunCon has mobilised three boring rigs to Singapore to better position itself in the piling sector. SunCon reiterated its guidance for order book replenishment in forecasted FY19 (FY19F) of RM1.5 billion. So far in FY19F, it has secured new construction jobs worth RM1 billion and new precast product orders worth RM31 million. No change to our forecasts that assume the respective construction and precast product job wins of RM1.3 billion and RM200 million annually in FY19F to FY21F.

At present, SunCon’s outstanding construction and precast product order books stand at RM5.4 billion and RM316 million respectively.

We acknowledge that the revival of the ECRL and Bandar Malaysia projects shall result in more jobs available in the market for local construction players. However, we believe the market has not priced in enough risk premium to reflect the fact that the latest megaprojects may leave local contractors with only low-value/low-margin supporting roles; and the fact that given the still elevated national debt, the government has no choice but to remain steadfastly committed to fiscal prudence which means the revival of the ECRL project could be a “zero-sum game”.

We believe SunCon can weather the sector downturn better given its proven ability to compete under an open bidding system, coupled with the availability of building jobs from its parent and sister companies under the Sunway Group.

However, valuations are unattractive at 18 times to 20 times forward earnings on muted sector prospects. — AmInvestment Bank, June 12

This article first appeared in The Edge Financial Daily, on June 13, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Telok Panglima Garang Industrial Zone

Telok Panglima Garang, Selangor

Sunsuria Forum @ 7th Avenue

Setia Alam/Alam Nusantara, Selangor

Sunsuria Forum @ 7th Avenue

Setia Alam/Alam Nusantara, Selangor