Eco World Development Group Bhd (Dec 14, RM1)

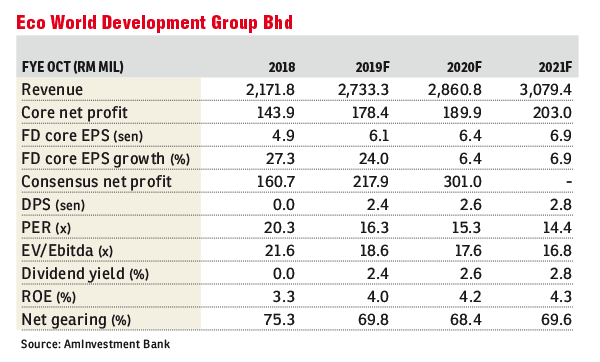

Maintain hold with an unchanged fair value of RM1.13: We maintain our “hold” recommendation on Eco World Development Bhd (EcoWorld) with an unchanged fair value of RM1.13 per share. We made no changes to our FY19-20 earnings forecasts and introduced FY21 earnings forecasts at RM203.0 million.

EcoWorld chalked up an FY18 net profit of RM165.6 million (+22.3% year-on-year). Excluding foreign exchange translation differences, its core net profit of RM143.9 million (+27.3% year-on-year) is within our expectations but missed consensus by 10%.

EcoWorld recorded new sales of RM3.1 billion, more than double the RM0.9 billion posted in the first 6 months ended 30 April 2018. This is mainly contributed by its projects in the Klang Valley (RM2.0 billion), followed by those in Iskandar Malaysia (RM939.5 million), and the remaining RM209.4 million in Penang.

We believe the outlook for FY19 remains stable supported by a record-high unbilled sales of RM6.4 billion (RM4.5 billion quarter on quarter) and an increasing number of maturing projects in Malaysia

EcoWorld’s 27%-associate Eco World International (EWI) registered its FY18 net profit at RM35.5 million compared to a loss of RMRM87.5 million in FY18. This is mainly due to the completion and delivery of London City Island and Embassy Gardens in the UK.

EcoWorld’s share of EWI’s profit in 4QFY18 amounted to RM18.9mil, compared to a share of loss of RM8.8 million in 4QFY17. We expect EWI to remain positive in FY19 with revenue recognitions from the aforementioned completed units and strong unbilled sales of RM6.6 billion (versus year-on-year’s RM5.8 billion).

We have a “hold” recommendation on EcoWorld because of: 1) limited upside on the share price; 2) a generally weak investor sentiment on the property sector, particularly larger developers; 3) demand for local properties remain sluggish; and 4) risk of worsening market conditions in the UK (until Brexit concerns are resolved).

We may upgrade the stock to buy if: 1) there’s a sharp retracement in share prices while fundamentals persist; 2) a general improvement in demand of local properties; and 3) major catalysts (for example, mergers and acquisitions, sales and/or earnings surprises among others.)

Presently, Ecoworld has numerous ongoing projects with remaining land bank of 4,827.2 acres bearing a total gross development value of RM70.5 billion. This provides long-term earnings visibility and will drive the company’s growth going forward. — AmInvestment Bank, Dec 14

This article first appeared in The Edge Financial Daily, on Dec 17, 2018.

TOP PICKS BY EDGEPROP

Kenny Hills (Bukit Tunku)

Kenny Hills (Bukit Tunku), Kuala Lumpur

Damansara Foresta

Bandar Sri Damansara, Selangor

Parkfield Residences, Tropicana Heights

Kajang, Selangor

Fairfield Residences, Tropicana Heights

Kajang, Selangor

D'Cerrum Apartment @ Setia EcoHill

Semenyih, Selangor

Springfield Residences @ Setia EcoHill 2

Semenyih, Selangor