Gamuda Bhd (Nov 16, RM2.43)

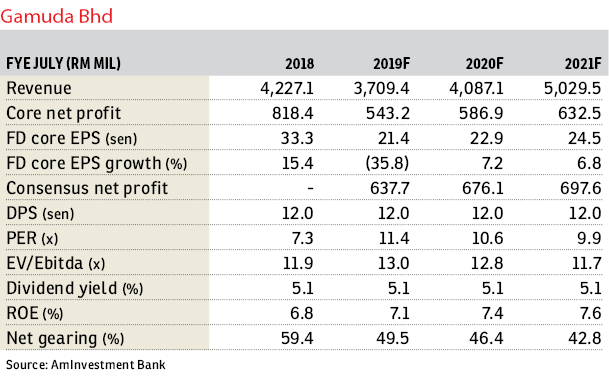

Downgrade to underweight with a lower fair value (FV) of RM2.20: We cut our net profit forecasts for Gamuda Bhd’s financial year 2019 (FY19), FY20, and FY21 by 4%, 9%, and 13% respectively, reduce our FV by 21% to RM2.20 (from RM2.80), and downgrade our call to “underweight” from “hold”. Our new FV is based on 10 times revised calendar year 2019 forecast earnings per share of 22 sen. The reduction in the forward price-earnings multiple from 12 times previously is to reflect the continuing derating of construction stocks. Meanwhile, the earnings downgrade is largely to factor in weaker property profits as we expect Gamuda to command weaker selling prices and hence margins for its local property launches over the short term.

We share Gamuda’s optimism about its new township projects in the Klang Valley, which are strategically located, well-planned, and effectively marketed. Gamuda projects’ combined sales from the three township projects are seen to almost quadruple to RM1.15 billion in FY19 from a mere RM300 million in FY18. However, we believe Gamuda will have to “go with the flow” by offering discounts to buyers in line with the commitment made by the Real Estate and Housing Developers’ Association Malaysia to the government in the recently announced Budget 2019 to cut prices of new launches and unsold stocks by 10%. We believe the reason is Gamuda will price itself out of the market if it holds the prices while its competitors reduce them.

Gamuda property division’s performance has been relatively “defensive” given its geographical diversification. For FY19 to FY20, Gamuda expects local projects to make a significant comeback, driven largely by the three new township projects as mentioned. It has set property sales targets of RM4 billion and RM4.5 billion for FY19 and FY20 respectively, with local projects contributing 54%-58% with overseas ventures making up the balance 42%-46%.

Following the slash in Gamuda’s construction profits on the revised contract terms for the mass rapid transit 2 project, our forecasts see property profits making up 28%-36% of group earnings in FY19-FY20 versus 24% in FY18. Given the significance of property profits to group earnings, we believe the latest development in the local property sector warrants a revision to Gamuda’s earnings forecasts. With the latest revisions, we now project property profits to make up only 26%-30% of group earnings in FY19-FY20.

We remain cautious about the outlook for the local construction sector as the government cuts back on public infrastructure projects on grounds of fiscal prudence. While the roll-out of public infrastructure projects will resume over the medium term, we believe the focus will shift to smaller scale or value-for-money basic infrastructure projects from mega projects.

The smaller projects are less economical to large contractors such as Gamuda, given their high fixed overheads. Not helping either is the uncertainty arising from the potential expropriation of Gamuda’s toll roads. — AmInvestment Bank, Nov 16

This article first appeared in The Edge Financial Daily, on Nov 19, 2018.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Kenny Hills (Bukit Tunku)

Kenny Hills (Bukit Tunku), Kuala Lumpur

Damansara Foresta

Bandar Sri Damansara, Selangor

Parkfield Residences, Tropicana Heights

Kajang, Selangor

Fairfield Residences, Tropicana Heights

Kajang, Selangor

D'Cerrum Apartment @ Setia EcoHill

Semenyih, Selangor

Springfield Residences @ Setia EcoHill 2

Semenyih, Selangor