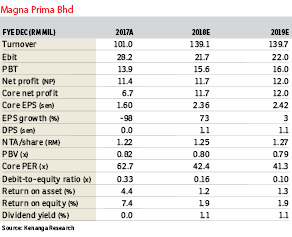

Magna Prima Bhd (Aug 15, RM1)

Upgrade to market perform with an unchanged target price of 95.5 sen: Magna Prima Bhd’s first half of financial year 2018 (1HFY18) core net profit (CNP) of RM6.9 million came in broadly within expectations, making up 59% of our full-year estimate. No dividend was declared as expected. We maintain our FY18 and FY19 earnings forecasts.

We expect either weaker sales of inventories or the possibility of more discounts to be given out in 2HFY18, which may result in a lower bottom line due to a challenging property market.

Year-on-year, its 1HFY18 CNP of RM6.9 million was down 15.6%, mainly due to: i) a lower property-segment revenue contribution (-5.6%) due to higher revenue recognition with the completion of the Jalan Kuching residential project in 1HFY17; and ii) higher operating cost that saw an earnings before interest and tax (Ebit) margin at 34.5% (-13 percentage points [ppts]).

Quarter-on-quarter, the property-segment revenue contribution doubled to RM25.3 million, likely due to more inventories being cleared. Despite the doubling of revenue, CNP only went up 13.7% because of higher operating expenses that saw an Ebit margin at 30.2% (-12.6ppts). We believe that there might be a possibility of higher discounts being dished out to encourage more sales of its inventory.

We believe that its longer-term earnings prospects should be supported by its Shah Alam and Kepong projects, coupled with its existing inventory of about RM200 million in the Boulevard Business Park, Jalan Kuching, and Desa Mentari, Jalan Klang Lama projects. That said, we also believe that earnings could be boosted should Magna successfully monetise its 2.6 acres (1.05ha) of land along Jalan Ampang valued at about RM400 million, which we have not yet imputed into our estimates.

We upgrade our call on Magna to “market perform” because we think that its share price has retraced in line with the overall weaker market sentiment. Risks to our call include: higher-than-expected margins/property sales, lower-than-expected administrative costs, positive real estate policies and a decent lending environment. — Kenanga Research, Aug 17

This article first appeared in The Edge Financial Daily, on Aug 20, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Kiara Court - Nilai Impian

Nilai, Negeri Sembilan

Perdana College Heights

Mantin, Negeri Sembilan

Residence 7, Bandar Springhill

Port Dickson, Negeri Sembilan

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur