Gadang Holdings Bhd (July 26, 76.5 sen)

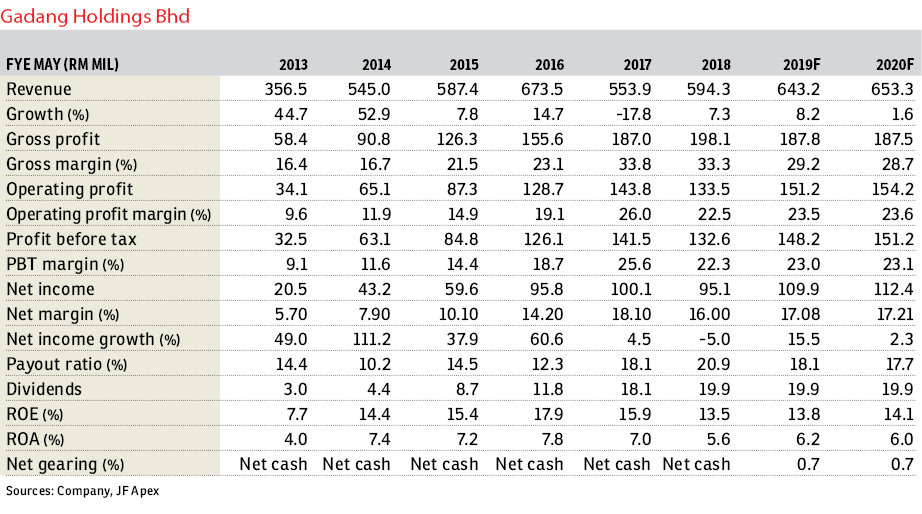

Maintain buy with an unchanged target price (TP) of RM1.21: Gadang Holdings Bhd reported RM23.3 million net profit and RM182 million revenue in the fourth quarter of financial year 2018 (4QFY18) with net profit down 7% quarter-on-quarter (q-o-q) and 22% year-on-year (y-o-y).

The unfavourable performance was a result of slides in the construction division and utility division (fazed by unrealised foreign exchange losses) amid better performance in the property division during 4QFY18.

As such, 12 months of FY18 (12FY18) net profit edged down 5% y-o-y to RM95.1 million, mainly bogged down by the utility division, amid higher revenue of RM594.3 million (+9% y-o-y).

12MFY18 net profit meets our and consensus forecast, accounting for 104% and 101% of full-year net earnings respectively.

Construction works are underpinned by a RM1.5 billion outstanding order book. The outstanding jobs will sustain the group’s revenue visibility close to 2.5 years or 2.5 times of FY18 revenue. Looking forward, we expect the group to replenish RM300 million worth of contracts in FY19 forecast (FY19F).

Unbilled sales for the property segment stand at RM100.8 million, which render revenue visibility over 0.52 times of FY18 property segmental revenue. Looking forward, we understand that there will be more aggressive marketing undertaken by the group. — JF Apex Securities, July 26

This article first appeared in The Edge Financial Daily, on July 27, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Baru Wangsa Maju (Seksyen 6)

Wangsa Maju, Kuala Lumpur

Pangsapuri Mawar Sari

Taman Setiawangsa, Kuala Lumpur

Kuala Terengganu Golf Resort

Kuala Terengganu, Terengganu

Happy Garden (Taman Gembira)

Kuchai Lama, Kuala Lumpur

Tropicana Golf & Country Resort

Tropicana, Selangor